The Home Mortgage Disclosure Act (HMDA) requires credit unions to disclose certain information regarding loans originated or purchased by the credit union. HMDA is implemented by the CFPB's Regulation C which was recently amended to include home equity lines of credit, establish transactional thresholds for coverage, and expand the number of HMDA data points collected from credit unions. Most of the new HMDA requirements became effective January 1, 2018.

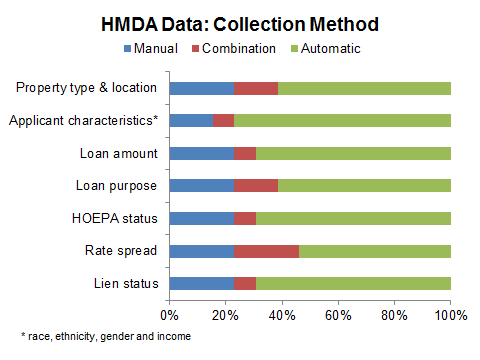

Expansion of the HMDA data set to roughly 38 data points will likely necessitate major changes in the data collection processes, policies and procedures for many credit unions. More than 20% of NAFCU survey respondents manually collect data for most HMDA data points (May 2016 NAFCU Economic & CU Monitor data). Credit unions that are subject to the final regulation will need to have plans and processes in place well before the effective date.

Although confident in their credit union or third-party vendor being able to successfully implement all the changes necessitated by the new requirements by the effective date, only 10 percent of respondents have already received final updates from their vendors to implement the new data points, indicating that implementation work is still continuing despite the deferred effective date (November 2017 Economic & CU Monitor data).

Credit unions estimate an average of about 19 hours of training will be necessary to bring staff up to speed on the new HMDA data points, with initial training costs expected to average around $39,000 per credit union (November 2017 Economic & CU Monitor data).

Below you'll find credit union resources for HMDA/Regulation C compliance, including final rule summary, scope and applicability chart, insightful blog posts, articles and webcasts, to help you get up-to-speed.

Resources marked by * are member-only. If you are not a NAFCU member, learn more about membership.

Regulator Compliance Resources

- CFPB Home Mortgage Disclosure Act rule implementation page - Includes small entity compliance guide, executive summary and institutional coverage charts.

- FFIEC Home Mortgage Disclosure Act resource page - Includes rule background, glossary, reporting guides, and more.

Charts & Guides

- HMDA Consolidated Regulatory Text*

See what exactly changed in the rule text and when it is effective. - HMDA Scope & Applicability Chart*

A handy resource detailing the background, scope and exemptions for the new HMDA requirements under CFPB's Regulation C. - HMDA Data Points Chart*

Compare the difference between current and upcoming data points. - HMDA Action Taken and Date Chart*

A handy resource to help report an accurate date of action.

Articles

- CFPB Sets HMDA Corrections, Higher HELOC Floor (For Now)

- Preparing for HMDA - Do You Have a Legal Entity Identifier?

- HMDA Final Rule Series: Reporting Data Under the Revised HMDA Rule*

- HMDA Final Rule Series: Changes to the Institutional and Transactional Coverage Tests*

- HMDA Final Rule Series: Understanding HMDA's New Transactional Scope*

- The HMDA Final Rule Is Knocking on Your Credit Union's Door

Webinars

- Understanding the New HMDA Submission Tool (Available on-demand until August 3, 2018)

NAFCU Compliance Blog Posts

- HMDA: The 2020 Edition (December 09, 2019)

- ICYMI: NCUA’s Recent HMDA Observations (October 30, 2019)

- CFPB Fair Lending Report (July 17, 2019)

- HMDA Deadline Approaches (February 22, 2019)

- Some Pre-Holiday HMDA Fun (December 28, 2018)

- 2019 HMDA LARs – LEIs Will Replace Respondent IDs (November 26, 2018)

- CFPB Issues Supervisory Guidance for HMDA (November 15, 2017)

- CFPB Releases Beta HMDA Platform (November 6, 2017)

- Time for S'More Learning: Collecting Disaggregated HMDA Data (October 18, 2017)

- CFPB Updates HMDA Guide (October 16, 2017)

- CFPB Finalizes HMDA Corrections, Temporary Increase to HELOC Thresholds; Filing 2017 HMDA Data (August 28, 2017)

- HMDA – Lessons from the CFPB's Recent Webcast (August 9, 2017)

- CFPB Proposes Change to HMDA HELOC Threshold, Releases HMDA Loan Scenarios (July 24, 2017)

- The CFPB's HMDA Submission Tool…Coming Soon? Yes! (July 7, 2017)

- Changes in HMDA Notices (June 23, 2017)

- CFPB Proposes HMDA Clarifications Part II: Temporary Financing; LEI Resources (May 15, 2017)

- Just When You Thought You Knew HMDA…CFPB Proposes HMDA Clarifications – Part I: New Geocoding Tool (April 21, 2017)

- CFPB Proposes Reg B Amendments Given Interplay with HMDA (April 10, 2017)

- Preparing for HMDA - More on "Final Actions" and Acquiring LEI (June 3, 2016)

- NAFCU's HMDA Rule Key Dates Timeline (April 20, 2016)

- HMDA.... Hum... Data? (February 26, 2016)

- CFPB Issues HMDA Resources (December 7, 2015)

- HMDA—Institutional Coverage Test in 2017 and Beyond (October 19, 2015)

- Final RBC and HMDA Rules Unveiled (October 16, 2015)

Find more HMDA blog posts on The NAFCU Compliance Blog.