The Bottom Line on Insurance Tracking and Collateral Protection

By: Mike Batchelor, 2nd VP, Risk Management Operations at Allied Solutions

An insurance tracking program's core function is to monitor and verify insurance on outstanding collateral, minimizing potential losses on collateralized loans. Yet, its value surpasses this. When utilized efficiently, it becomes a pivotal tool for enhancing enterprise-level risk management, nurturing member relationships, and simplifying operational processes.

Compounding Market Pressures

Car insurance rates are up almost 21% for the 12 months ended in February, according to new Consumer Price Index data. Such increases have not been observed in decades. Experts attribute the spike to increased driving costs, more accidents due to increased traffic, rising auto theft, and an increase in damaged cars from catastrophic weather events. But those are not the only contributing factors. Riskier driving habits, parts and repairs as well as labor costs, all play a role in these market conditions. The cost to repair a car is up 6.7% for the year, according to CPI data.

In 2023, AAA reported that the annual cost of owning a new car rose to $12,182, with monthly expenses at $1,015, a 13.6% increase from 2022, attributed mainly to higher new car prices and financing costs, while the average sales price for new cars was $47,331 and for used cars was $29,586, with prices increasing by 30% for new cars and 40.3% for used cars from 2019 to 2023.

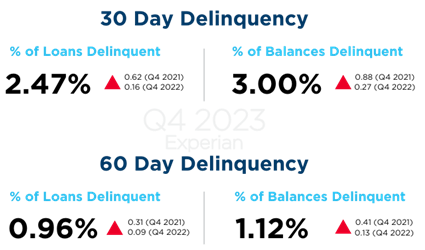

All of this and more has led to increased delinquencies, more repossessions and ultimately a risky and unpredictable market. Let's delve into how a comprehensive insurance tracking program extends beyond mitigating collateral risk.

Enterprise Risk Management

Traditionally, insurance tracking programs have been perceived as tools for safeguarding collateral against uninsured losses. However, the role has evolved significantly in recent years.

Today, insurance tracking programs stand as indispensable pillars of enterprise risk management strategies for Collateral Protection Insurance (CPI) and repossession programs for credit unions. By leveraging real-time data and enhanced verification technologies, these holistic program approaches empower you to proactively assess and address risks, not just in the present but also in the foreseeable future. This proactive approach enables you to stay ahead of potential threats, thereby safeguarding your financial health and ensuring long-term sustainability.

Bottom line – insurance tracking programs serve as the vanguard of risk mitigation efforts, enabling you to make informed decisions and allocate resources strategically. By embracing the full potential of these programs, you can navigate the complexities of the financial landscape with confidence, resilience, and foresight.

Enhanced Member Relationships

As member expectations soar to unprecedented heights, credit unions are tasked with nurturing robust relationships to meet these demands. Members, often burdened with multiple insurance obligations amidst their daily responsibilities, may inadvertently overlook crucial insurance needs. The intricate nature of insurance compounds this challenge, compelling reliance on lenders and insurers for updates. Effective insurance tracking is essential, fostering a proactive and attentive approach to member service. Accurate insurance tracking is increasingly vital for risk management and recovery initiatives. Credit unions must leverage all available resources to ensure that coverage is extended only to borrowers with lapses in their insurance policies.

Implementing coverage without prior notification risks damaging member relationships, especially with financially responsible clients. Adequate, accurate, timely, and friendly notifications empower members to seek affordable coverage independently, thereby preserving trust and ensuring satisfaction. Especially in catastrophic events, member notifications serve as a channel for offering assistance and support.

Bottom line – insurance tracking programs offer credit unions a unique opportunity to differentiate themselves in a crowded market by delivering exceptional member experiences. By prioritizing member satisfaction and building strong relationships, you can position yourselves as trusted financial partners, driving long-term growth and success.

Streamlining Compliance Processes

Regulatory scrutiny is an ongoing challenge for credit unions, demanding meticulous compliance efforts. Insurance tracking programs serve as essential allies, offering streamlined solutions to navigate complex compliance requirements including but not limited to

- Types of notices used

- Language in the notifications

- Accurate selection of borrowers who receive notices

- Data, time, and manner in which notices are provided

Automated processes and proactive notifications enable credit unions to stay ahead of regulatory changes and ensure adherence to standards. By centralizing compliance efforts and providing expert guidance, these programs alleviate the burden of manual compliance management, allowing you to focus on strategic initiatives and core business objectives, even in the face of temporary requirements imposed by governing bodies in areas affected by catastrophic events.

Bottom line – insurance tracking programs empower credit unions to operate with confidence in a regulatory environment that is constantly in flux. By streamlining compliance processes and mitigating compliance-related risks, these programs enable you to uphold the highest standards of integrity and governance, thereby safeguarding your reputation and enhancing your credibility in the eyes of stakeholders.

Beyond mere risk mitigation, these programs serve as a catalyst for organizational resilience, member satisfaction, and regulatory compliance. In embracing your full potential, credit unions chart a course towards a future defined by stability, trust, and sustained growth.