Recap: UDAP Supervisory Highlights from the Federal Reserve

Written by, André B. Cotten, Regulatory Compliance Counsel, NAFCU

In late July 2018, the Federal Reserve published its Consumer Compliance Supervision Bulletin. This new Federal Reserve publication provides highlights of current issues in consumer compliance supervision. This publication is meant to enhance transparency regarding the Federal Reserve’s consumer compliance supervisory activities. Today’s blog will discuss the unfair or deceptive practices (UDAP) found in this issue. The Bulletin also contains more highlights concerning fair lending and regulatory and policy developments.

According to the Federal Reserve, Fair Lending and UDAP are two of the most significant areas of risk for financial institutions. A violation in either of these may cause significant consumer harm as well as legal, financial, and reputational risk to the financial institution. In the UDAP section of the Bulletin, the Federal Reserve highlighted three topics: Overdrafts; Loan Officer Misrepresentations; and Student Financial Products and Services.

Overdraft

The Federal Reserve has observed certain practices related to charging overdraft fees to consumers have been identified as unfair or deceptive acts or practices in violation of section 5 of the FTC Act. UDAP violations and risks have occurred when misleading omissions or representations are made concerning an overdraft program. There have also been unfair or deceptive practices found in connection with the use of third-party vendor software to process overdraft transactions and assess overdraft fees.

As an example, the Federal Reserve noted that a UDAP violation could occur when a financial institution imposes an overdraft fee on some point of sale (POS) transactions based on insufficient funds in the account’s available balance at the time of posting. Specifically, some financial institutions still assessed overdraft fees even if the transaction was previously authorized at the time based on the amount available in the account when the consumer entered into the transaction. This is despite the fact that there can be a delay of one to a few days between the authorizing and posting of a POS transaction, during which the available balance can decrease and the POS transaction could exceed the available balance at the time of posting. The Federal Reserve stated that charging an overdraft fee on the POS transaction in this circumstance would be a UDAP violation.

The Federal Reserve identified steps to manage UDAP risk associated with overdraft practices. First, exercise appropriate vendor management. Next, understand the financial institution’s processing methodology and ensure no incorrect information is provided to consumers. Lastly, the Federal Reserve also suggests refraining from assessing overdraft fees on POS transactions when they post to consumer’s accounts with insufficient available funds after having authorized those transactions based on sufficient available funds. For further guidance, NCUA Letter to Credit Unions 2005-03 and the Interagency Guidance on Overdraft Protection Programs sets forth “best practices” for overdraft programs, although this predates disclosure requirements in Regulation E.

Loan Officer Misrepresentations

The Federal Reserve also observed UDAP issues in lending. It is not uncommon for financial institutions to assist consumers in the loan origination process. However, in some instances, loan officers have made misrepresentations concerning a consumer’s eligibility for a particular product or loan program. These misrepresentations may violate section 5 of the FTC Act.

To clarify, the Bulletin provides an example. A loan officer misrepresented to co-applicants that they would qualify for a mortgage loan if they reduced their debt-to-income ratio by paying off certain credit card debts. However, after paying off the debts as instructed by the loan officer, the co-applicants still did not qualify for a mortgage loan. The Federal Reserve notes other instances where consumers have relied on loan officer misrepresentations to their detriment, and banks have been required to pay restitution as a result.

The Federal Reserve gives suggestions on how financial institutions can continue to actively assist consumers and mitigate UDAP risks. One step is to monitor consumer complaints for potential loan officer misrepresentations. Next, financial institutions may want to instruct loan officers from representing consumers do, or will, qualify for a loan if the determination remains uncertain. It is also important to clearly and accurately disclose the loan qualification requirements, including documentation, to an applicant. Lastly, a financial institution may also want to train its employees about who is authorized to underwrite loans and communicate underwriting decisions to applicants.

Student Financial Products and Services.

The Bulletin warns that financial institutions may face an increased UDAP risk when working with a third party to provide bank-related products or services, such as student deposit accounts. While these arrangements can be beneficial to financial institutions and consumers, it is critical for financial institutions to manage these risks and establish effective processes to oversee third-party service providers.

The Federal Reserve noted some examples of practices it found concerning. For example, the marketing and enrollment process for student deposit accounts included several practices that the Federal Reserve found to be deceptive, such as failing to inform students about how to get their financial aid refunds without having to open a deposit account. Some financial institutions also failed to inform students about unusual fees, features, and limitations associated with the deposit account before they selected the account as the method to receive their financial aid refunds.

The Federal Reserve provided several suggestions to mitigate potential risks related to unfair or deceptive acts or practices involving third-party service providers by adopting the following practices. First, prior to entering an agreement with a third-party vendor, evaluate their financial condition and experience, which is consistent with previous NCUA guidance we’ve received. Next, a financial institution may consider monitoring consumer complaint activity. Consumer complaints are sometimes the early warning signs of a more significant issue. Lastly, the Federal Reserve advises that financial institutions have personnel with continuing oversight and management responsibilities to monitor vendor products and services.

Conclusion

The Consumer Compliance Supervision Bulletin also covers several other topics that may be of interest. Credit unions may want to review the risk mitigation recommendations from the Federal Reserve in full. These highlights might help credit unions and other financial institutions develop and maintain more compliant products and services.

***

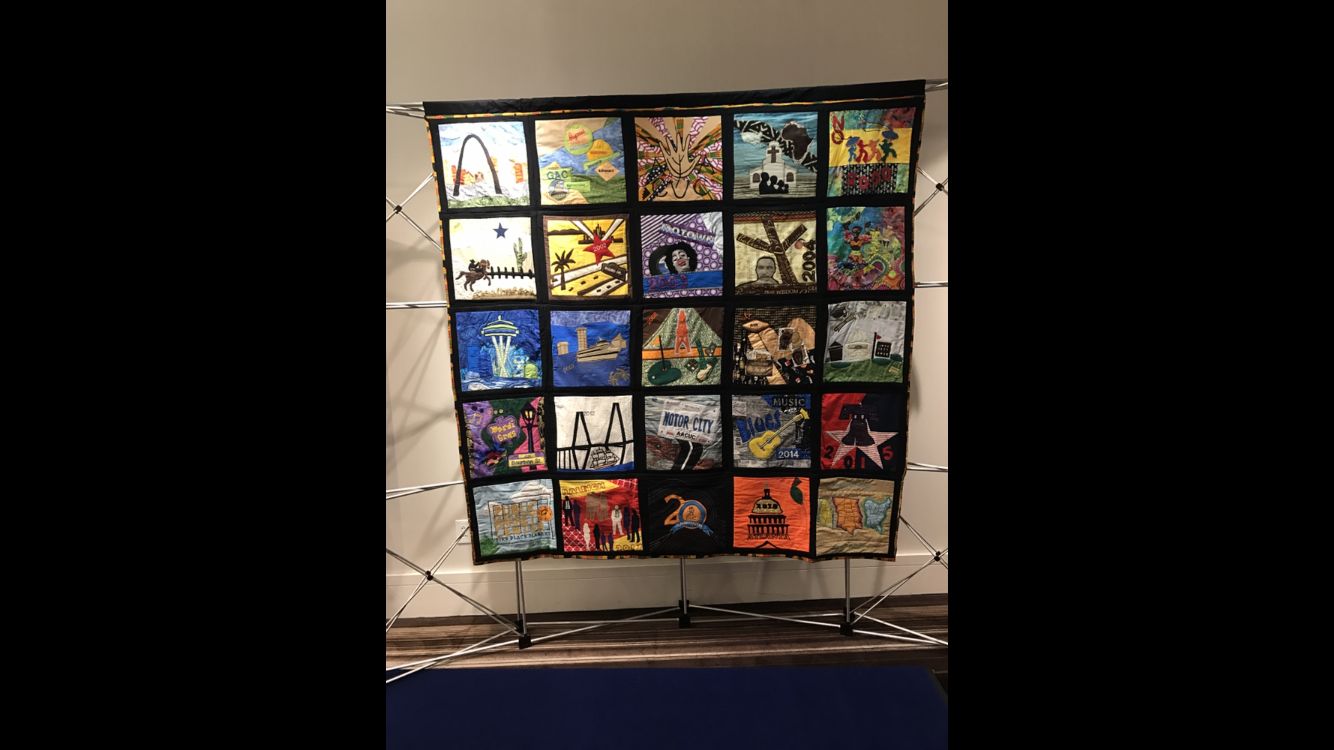

Last week, I had the awesome opportunity to attend the 20th African-American Credit Union Coalition Conference in Atlanta, GA. I met so many amazing credit union professionals and attended some really interesting sessions about how we can continue to grow as an industry. Below is a picture of a quilt that details the locations of AACUC's conferences over the past 20 years: