3 strategies for redesigning your credit union checking accounts

If you are an executive at a credit union, the odds are overwhelming that you’ve been debating whether to continue free checking accounts in the wake of recent legislative and regulatory developments. And if you do decide to charge for checking, what fee(s) make sense, who to charge it to (and who not to), whether to tier it based on total profitability of a member, what the competition is going to do, and so on.

Whew – that’s a lot to think about, but let’s not forget the popular saying – with every challenge comes opportunity. And with these challenges, credit unions are faced with a choice: Stay with the status quo or innovate. Let me help you with that decision – INNOVATE. :-)

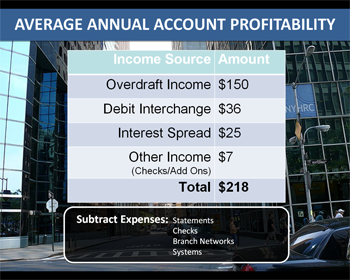

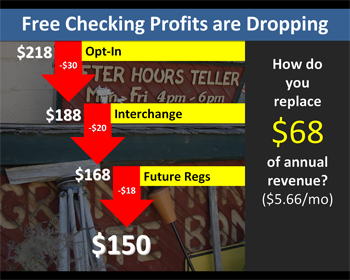

In a recent webcast Todd Werner, GVP, Sales and Marketing for Affinion Group, shared this compelling chart illustrating average checking account profitability per member in early 2009 versus today.

So what to do? Your choice is not just ‘To Charge or Not To Charge’ – look for the bigger opportunity, based on marketing 101 – what your members want. Members are demanding more and are shopping around for the products that have less fees and more perks. Credit unions are faced with this pressure from members to lower fees and offer more while the expenses from changing regulations and operations are going up.

But it has become increasingly difficult for credit unions to balance the design of products to both satisfy growing member expectations as well as continue to generate revenue for the credit union. To help us understand how to approach this challenge (a.k.a. opportunity!), Todd outlines three key strategies that credit unions can use to address these challenges and satisfy their member wants and expectations while also increasing profitability. (Thanks for the silver lining, Todd!)

1.) Embedded accounts that marry financial and non-financial products and services to provide added value for fees. In the case study Todd shared, Affinion helped a large financial institution move from free checking to fee checking with an identity theft solution which could be embedded into the core checking account for a nominal fee. The results?

- No change in number of account holders

- Over 210,000 active customers in the identity theft program

- Over 38% of new account holders opting into the id theft program

- $10 million expected in net new revenue this year

2.) Fee checking accounts that are behavior based with the ability to “buy down” the monthly fee. This is my favorite. This means that you can mold your members into your ideal member. Offer incentives to members that will lower their monthly fee (as well as lower expenses or increase the revenues for the credit union). Some examples may be stopping paper statements, banking online, using the debit card a certain amount, maintaining a minimum balance or signing up for direct deposit. Trust me, members are willing to change their behaviors to save a little doe or gain perks – it’s what I, I mean they, want! Not to mention, most of things I mentioned are far more convenient than the manual, costly alternatives.

3.) Development of overlay strategies to compliment core account. Credit unions can create “packages” that create a competitive advantage – offer things that other financial institutions don’t! I think that credit unions in particular have an opportunity to thrive here with valuable offerings from the community. Those community ties are what make credit unions different and preferred – larger institutions just don’t have the ability to know or focus on perks at that community level.

These packaged bundles with your checking accounts can also drive non-interest income, and attract new members and/or accounts with the differentiation and value. Think of packages ranging from credit and identity theft services to travel and shopping discounts and services. There’s something for everyone and by letting your members add packages a la carte and design their own account, you’re undoubtedly giving them exactly what they want.

According to Todd, “Members are 1/3 more likely to open an account if money saving and fraud protection were offered with their account.”

Todd shares a case study of one credit union that used this strategy and has seen results such as 20% cross-sale ratio in the first two months, 20% of checking accounts with the value-added package(s), and trends of 100 brand new checking accounts per week!

All in all, the lesson here is clear to me – change is essential. And it can be done for the good of your credit union and your members. That doesn’t mean it’s not tricky, but the good news is that there are some proven models out there that you can use as benchmarks. You must seek out the opportunities that exist to deepen your member relationships, improve member satisfaction, heighten frequency of member interaction while also reducing operating expenses, generating incremental fee income and increasing member acquisition. Sound impossible? It’s not, but it is a lot to consider – so take these tips from Todd and embrace the inevitable change (a.k.a. opportunity!). In the end your credit union will come out stronger.

Watch the whole webcast from Todd to get more tips, facts and trends to help enhance your checking account offerings.

Related Posts: It’s time to give your credit products a face lift