Inheriting Debt: The Impact of Debt on Loved Ones Should the Borrower Unexpectedly Die

By Nikki Griggs, Marketing Manager, NAFCU Services.

What do Thomas Jefferson, Judy Garland, and Michael Jackson have in common? They each left a tremendous amount of debt behind when they died. With their wealth and assets, itâs easy to imagine the red tape and the burden this put on their loved ones.

But perhaps youâre thinking that a founding father and a couple of wealthy, out-of-touch celebrities may not be the most relatable trio. Fair enough. Then what about debt that is left behind by the average American today? Is it forgiven when someone unexpectedly dies?

Itâs widely known that consumer debt has touched all generations culminating with 2009âs Great Recession. From Baby Boomers affected by the mortgage crisis to the Millenialsâ huge student loan debt to the staggering credit card debt across the boards, many Americans find themselves in precarious financial straits. But what may be equally alarming and less known is the significant impact that a loved oneâs debt can have on his or her survivors if arrangements had not been made for post mortem coverage.

According to a recent Securian survey, nearly one-third of respondents said they have not thought about what would happen to their debt if theyâor their cosignersâunexpectedly passed away.

Debt does not, in fact, die with the borrower, and surviving family members and cosigners will find themselves in the hole even after liquidating assets unless advance arrangements have been made.

So how big of a problem could this be? Among the 1,004 survey respondents who hold debt as primary borrowers or cosigners, 44 percent owed $25,000 or more and 20 percent owed $100,000 or more. More than half said their debts exceed their assets, with 41 percent of those indicating their debt was âmuch higherâ than their assets.

Nearly one-quarter of the respondents have cosigned loans for others. Credit card debt, consumer loans, and mortgages were most frequently cited as the types of loans cosigned, and 22 percent cosigned student loans.

These cosigners are liable for the debt. But if there is no cosigner, the lender will seek to collect the debt from the estate, which could result in the sale of assets (homes, cars, and other property). And a spouse is responsible in community property states even if he or she did not cosign the loan.

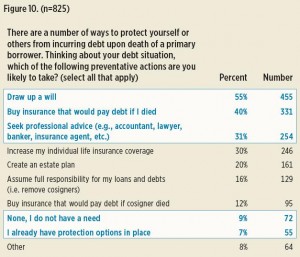

Only 18 percent of respondents indicated they had no need or already had financial protections in place. However, upon taking the survey more than half said they would now take preventative action, including drawing up a will and buying insurance to cover debt.

So how can individuals protect loved ones from an unwanted inheritance, or legacy, of debt? Options include:

- Cosigner can purchase inexpensive insurance coverage for death and disability of the primary borrower

- Simple term life insurance, another inexpensive option, especially for younger healthy individuals

- Power of attorney or other legal precautions offer protection from responsibility from debt for those helping elderly or disabled loved ones

Read the Securian article, Debt: The Inheritance No One Wants, to learn more, including what respondents thought happened to debt, and their feelings about being saddled with loved onesâ debt and with leaving their debt behind.

Securian Financial Group, Inc. is the NAFCU Services Preferred Partner for Credit Insurance and Debt Protection. More educational resources and contact information are available at www.nafcu.org/securian.

Also available, Credit Union Industry Experts: Whatâs in Store for 2014 (Blog Post) »