Newsroom

NAFCU economist: Consumers key in fragile economy

NAFCU's Curt Long attributed the 2 percent economic growth during the second quarter to "a standout performance from U.S. consumers." However, he acknowledged that "there is an undeniable fragility in the economy, and any slippage from the consumer would almost certainly mean a recession is nigh."

NAFCU's Curt Long attributed the 2 percent economic growth during the second quarter to "a standout performance from U.S. consumers." However, he acknowledged that "there is an undeniable fragility in the economy, and any slippage from the consumer would almost certainly mean a recession is nigh."

"The strong labor market has given rise to some modest wage growth," said Long, NAFCU's chief economist and vice president of research. "That along with still-sturdy balance sheets are allowing for solid spending rates by households. However, that should not mask the numerous drags on the economy at the moment."

Long identified business investment, housing, and trade – and the potential for higher trade tensions as another round of tariffs are set to take effect later this year – as the components that are negatively impacting growth.

"The recovery now hinges entirely upon households and the labor market. As long as people are working, they should keep spending at high enough rates to keep the expansion going," Long concluded.

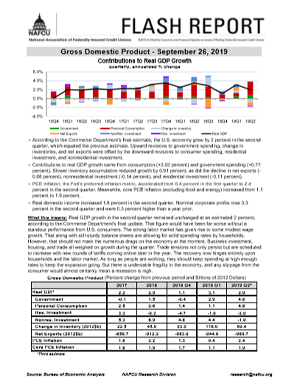

According to the Commerce Department's final second quarter estimate, overall contributions to real GDP growth came from consumption (+3.03 percent) and government spending (+0.77 percent). Inventory accumulation (-0.91 percent), net exports (-0.68 percent), nonresidential investment (-0.14 percent), and residential investment (-0.11 percent) reduced growth.

The Federal Reserve’s preferred inflation metric, PCE inflation, accelerated from 0.4 percent in the first quarter to 2.4 percent in the second quarter. Core PCE inflation (excluding food and energy) increased from 1.1 percent to 1.9 percent in the second quarter.

Share This

Related Resources

Add to Calendar 2024-04-15 09:00:00 2024-04-15 09:00:00 Mergers and Acquisitions: Unifying Two Different Executive Total Compensation and Benefits Programs Listen On: Key Takeaways: [03:50] With the merger of a smaller credit union into a larger one you are really only dealing with integrating staff into the larger credit union. [05:53] When working with a merger of equals we start with a deep dive into the executive compensation and benefits of each organization. [09:09] If your current executive benefits provider doesn’t conduct regular plan evaluations, consider having a plan audit anyway. [13:46] Don’t overpay for these things if you don’t have to. When you have more options available that means the cost is more appropriate. [17:11] It is in a unified organization’s best interest to do tier timelines where we look at your top executives who are critical to the unified organization’s success today and then slowly add in the next levels. Web NAFCU digital@nafcu.org America/New_York public

Mergers and Acquisitions: Unifying Two Different Executive Total Compensation and Benefits Programs

preferred partner

Gallagher

Podcast

Add to Calendar 2024-04-11 14:00:00 2024-04-11 14:00:00 Regulation E: Impacts Across Your Institution Dive into regulatory excellence with, Regulation E: Impacts Across Your Institution. This webinar is tailored to empower you with the knowledge and strategies necessary to effectively implement the Electronic Funds Transfer Act (EFTA) and Regulation E within your operations. You’ll explore how to apply Regulation E across various business areas to ensure compliance obligations are met with precision. Key Takeaways Learn the basics of EFTA and Regulation E Understand how to apply Regulation E at your organization to detect processes and transactions that require Regulation E compliance Discover how Regulation E may apply to a large breath of areas in your institutions and functions for which you may rely on third-party vendors Review recent enforcement activity for non-compliance with EFTA and Regulation E Register Now $295 Members | $395 Nonmembers(Additional $50 for USB)One registration gives your entire team access to the live webinar and on-demand recording until April 11, 2025Go to the Online Training Center to access the webinar after purchase » Who Should Attend NCCOs NCRMs Compliance and risk titles Education Credits NCCOs will receive 1.0 CEUs for participating in this webinar NCRMs will recieve 1.0 CEUs for participating in this webinar Web NAFCU digital@nafcu.org America/New_York public

Regulation E: Impacts Across Your Institution

Credits: NCCO, NCRM

Webinar

Refining the Consumer Loan Experience

Credit Unions, Education, Consumer Lending, Growth & Retention, Current Affairs, Marketing

preferred partner

Securian Financial

Blog Post

Knowledge breeds empathy: New research puts credit union lenders in the minds of today’s borrower

Planning, Auto Loans, Research

preferred partner

TruStage

Blog Post

Get daily updates.

Subscribe to NAFCU today.