Newsroom

NAFCU urges House panel to support RBC rule delay

NAFCU, in a letter yesterday, urged leaders of the House Financial Services Committee to support a provision in the Foreign Investment Risk Review Modernization Act of 2018 (H.R. 5841) that would delay the implementation of NCUA's risk based capital (RBC) rule by two years.

H.R. 5841 is slated to be marked up by the committee today.

The legislation, introduced by Rep. Robert Pittenger, R-N.C., has language in Title VII that would delay the effective date of the RBC rule to Jan. 1, 2021. "NAFCU is very supportive of Title VII and believes it is imperative that it remains in H.R. 5841 due to the short time period for this provision to be enacted before this harmful rule takes effect," wrote NAFCU Vice President of Legislative Affairs Brad Thaler.

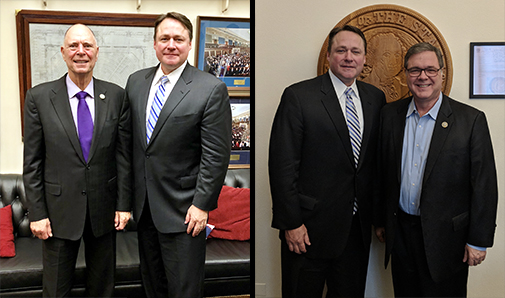

The language included in H.R. 5841 comes from the Common Sense Capital Relief Act (H.R. 5288), which was introduced by Reps. Bill Posey, R-Fla., and Denny Heck, D-Wash., in March. NAFCU President and CEO Dan Berger met with Reps. Posey and Heck last week to thank them for their support of credit unions and their efforts to protect the industry from the adverse effects of this rule.

While NAFCU supports an appropriate RBC system for credit unions, the NCUA's rule as written will have a negative impact on the credit union industry. "Dozens of credit unions stand to see a downgrade in their capital levels and more than 400 credit unions will see a decline in their capital cushions," Thaler wrote. "A two-year delay in the rule would give credit unions more time to prepare and comply, and more importantly, it would give the NCUA time to fix the rule, which they have expressed interest in doing."

Thaler thanked Pittenger and leaders of the House Financial Services Committee for their efforts to provide regulatory relief to the credit union industry.

Read the full letter here.

Share This

Related Resources

Get daily updates.

Subscribe to NAFCU today.