Newsroom

Overall consumer credit decelerates; CUs' market share up

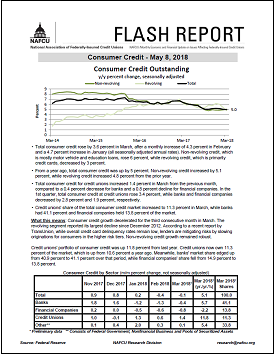

Decelerating for the third consecutive month, total consumer credit rose 3.6 percent in March, after a monthly increase of 4.3 percent in February and 4.7 percent in January (all seasonally adjusted annual rates). NAFCU Chief Economist and Vice President of Research Curt Long points out that revolving credit, which is primarily credit cards, reported its largest decline – 3 percent – since December 2012.

Decelerating for the third consecutive month, total consumer credit rose 3.6 percent in March, after a monthly increase of 4.3 percent in February and 4.7 percent in January (all seasonally adjusted annual rates). NAFCU Chief Economist and Vice President of Research Curt Long points out that revolving credit, which is primarily credit cards, reported its largest decline – 3 percent – since December 2012.

"According to a recent report by TransUnion, while overall credit card delinquency rates remain low, lenders are mitigating risks by slowing originations for consumers in the higher-risk tiers," Long said in a NAFCU Macro Data Flash report Tuesday. "Non-revolving credit growth remained robust."

Non-revolving credit, which is mostly motor vehicle and education loans, rose 6 percent.

From a year ago, total consumer credit was up 5 percent; non-revolving credit increased 5.1 percent and revolving credit increased 4.8 percent.

Total consumer credit for credit unions increased 1.4 percent in March from the previous month, compared to a 0.4 percent decrease for banks and a 0.8 percent decline for financial companies. In the first quarter, total consumer credit at credit unions rose 3.4 percent, while banks and financial companies decreased 2.8 percent and 1.9 percent, respectively.

"Credit unions' portfolio of consumer credit was up 11.8 percent from last year," Long said. "Credit unions now own 11.3 percent of the market, which is up from 10.6 percent a year ago."

From last year, banks' market share edged up from 40.9 percent to 41.1 percent and financial companies' share fell from 14.9 percent to 13.8 percent.

Share This

Related Resources

Compliance Monitor - September 2018

Newsletter

Get daily updates.

Subscribe to NAFCU today.