Pentegra is NAFCU Services' Preferred Partner for qualified retirement plans for credit unions and their employees. With more than 80 years of retirement plan and fiduciary expertise, Pentegra offers deep industry knowledge and insights in developing credit union-focused retirement plan solutions designed to drive improved plan and participant outcomes.

Pentegra’s retirement plan and fiduciary outsourcing solutions are designed to help credit unions improve retirement plan effectiveness, attract and retain quality employees and build a competitive advantage.

As one of America’s oldest independent fiduciaries, our clients enjoy the confidence that comes from uncompromised and objective oversight. Plan sponsors and participants, as well as their trusted advisors and professional partners enjoy a higher level of protection—and the peace of mind that having a professional fiduciary partner on board.

Read our PDFs:

Products and Services

-

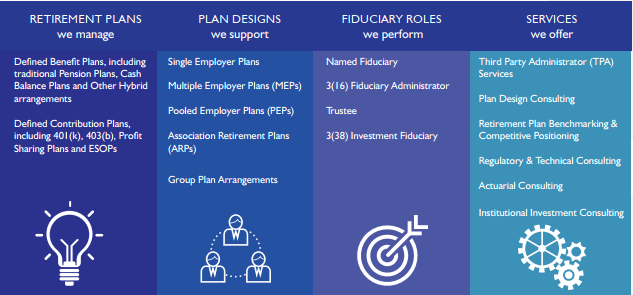

Pentegra offers a comprehensive array of qualified retirement plan and fiduciary outsourcing solutions.

Pentegra also offers the ability for credit unions to ‘private label’ retirement plans for their members.

With every retirement solution, we bring the same focus—relieving credit unions of the fiduciary and administrative burdens that come with sponsoring a retirement plan. Pentegra’s multiple employer plans, the Pentegra Defined Benefit Plan for Financial Institutions, and its companion program, the Pentegra Defined Contribution Plan for Financial Institutions, with approximately $6.2 billion in assets, are among the largest retirement plans in the nation. These plans are unique in the industry, offering credit unions the ability to outsource primary fiduciary responsibility for the management of their retirement programs.

With more than 80 years of industry knowledge and insights gained working with credit unions nationwide, Pentegra’s retirement plan solutions are designed to help you deliver successful retirement plan outcomes for your organization and your employees.

-

As an institutional fiduciary, Pentegra assumes key retirement plan responsibilities for you, transferring these responsibilities from your organization to ours. This helps you by not only eliminating work, but also minimizing your risk and responsibility for doing the work.

You’ll have the comfort of knowing that your plan is being administered so that it’s compliant and managed with your participants’ best interests in mind. Your long list of retirement plan responsibilities become only a few. With 3(16) fiduciary outsourcing, you’ll have more time to focus on what you do best. When you can trust someone to do their best work, you can focus on doing yours.

What 3(16) Fiduciary Outsourcing Does for Credit Unions:

- Saves me time

- Takes work off my desk

- Reduces compliance burdens

- Minimizes risk & liability

- Eliminates complex responsibilities

- Saves money by saving time

- Helps ensure my business is competitive

- Improves plan outcomes

-

- Over 80 years of experience in designing retirement plans for financial institutions

- One of the nation’s most experienced fiduciary service providers

- The ability to fulfill all three of the principal roles in a retirement plan—as an ERISA 402(a) Named Fiduciary, as a 3(16)(A) Plan Administrator, and as Trustee, whether as a fully discretionary trustee with sole authority over plan assets or as a directed trustee

- User Board of Directors delivers an unparalleled level of governance and oversight

- Independent, unbiased approach

- Customized Multiple Employer Plan (MEP) solutions, with a wide range of plan design provisions, investments, and service provider arrangements (bundled or unbundled)