Newsroom

New NAFCU S. 2155 analysis explains impact on CUs

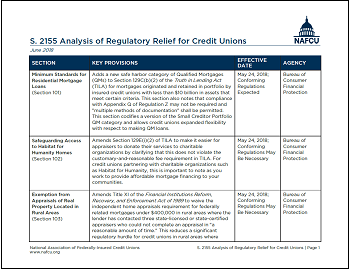

In an effort to further explain the credit union-related relief provisions within the recently enacted Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155), the NAFCU Regulatory Affairs team has put together a detailed summary guide of the bill, featuring these provisions, their effective dates and other details.

In an effort to further explain the credit union-related relief provisions within the recently enacted Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155), the NAFCU Regulatory Affairs team has put together a detailed summary guide of the bill, featuring these provisions, their effective dates and other details.

The eight-page table – available for download now – details the Home Mortgage Disclosure Act relief components, the member business lending changes and the qualified mortgage safe harbor categories, among others.

In a message to credit unions about the summary guide on Friday, NAFCU Director of Regulatory Affairs Alexander Monterrubio wrote that this "detailed table not only provides you with a summary of the changes and how this may apply to your credit union but also helps you navigate important effective dates and the agency charged with implementing the new law."

NAFCU also recently wrote a new post on the Compliance Blog detailing the implications S. 2155 will have on credit unions. The post provides some clarifications of various provisions.

NAFCU continues to work with lawmakers and regulators to secure even more regulatory relief for credit unions, guided by the association's 2018 advocacy priorities.

Share This

Related Resources

NAFCU S. 2155 Analysis

Charts

Compliance Monitor - December 2018

Newsletter

Compliance Monitor - June 2018

Newsletter

Get daily updates.

Subscribe to NAFCU today.