Newsroom

Weekly wins: Reg relief adopted, RBC-delay advances, NCUA heeds NAFCU on PALs reforms

NAFCU and credit unions achieved wins on many priorities last week that will improve the regulatory environment in which the industry operates. Most notably, after years of NAFCU advocacy and credit union grassroots efforts, the industry secured meaningful regulatory relief as President Donald Trump signed into law the NAFCU-backed Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155).

Here is an overview of progress made last week on key issues; many of these will be talked about in detail during NAFCU's upcoming member call on June 13:

Regulatory Relief

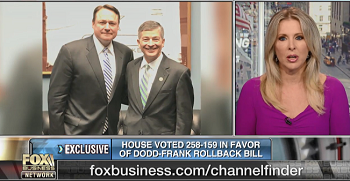

President Trump signed the NAFCU-backed regulatory relief package (S. 2155) into law Thursday following months of NAFCU advocacy in support of the bill. Prior to its passage, NAFCU President and CEO Dan Berger along with NAFCU's advocacy team held numerous meetings on Capitol Hill to gather support for S. 2155. In February, Berger, along with numerous credit union CEOs, met with Trump to discuss industry issues – including regulatory relief.

Berger joined Fox Business Wednesday to discuss the positive impact the law will have on credit unions and American consumers. Berger noted the provisions will allow credit unions to provide more loans to support small business and American consumers. It will also provide relief under the Home Mortgage Disclosure Act's reporting requirements; more details on the NAFCU-supported provisions of the bill can be found here.

NCUA's Risk-Based Capital (RBC) Rule

In recent weeks, NAFCU efforts have led to the inclusion of language to delay the implementation of the NCUA's RBC rule by two years in two major pieces of legislation: the House Appropriations Financial Services and General Government's appropriations bill, and the Foreign Investment Risk Review Modernization Act of 2018 (H.R. 5841).

The language included in both bills comes from the Common Sense Capital Relief Act (H.R. 5288), which was introduced by Reps. Bill Posey, R-Fla., and Denny Heck, D-Wash., in March. Berger recently met with Posey and Heck to thank them for their ongoing efforts to protect the industry from the adverse effects of this rule. NAFCU will continue to advocate for House members to support a delay of the RBC rule in the legislation.

Payday Alternative Loans (PALs)

After 10 years of offering a PALs program, the NCUA Board last week issued a proposed rulemaking to enhance credit unions' short-term, small-dollar loan offerings. The proposed PALs changes would not replace the current PALs rule, but would be an alternative option.

NAFCU has long advocated for additional mechanisms to allow credit unions to provide more small-dollar loans to members in need and last year hosted a small-dollar lending working group to explore additional small dollar lending options for credit unions.

Americans with Disabilities Act (ADA) Website Accessibility

NAFCU continues to support credit unions facing litigation over unclear website accessibility requirements under the ADA. Last week, the association filed its 10th amicus brief in the effort; five of the lawsuits in which NAFCU has filed an amicus brief have been dismissed.

In addition to providing legal support to credit unions, NAFCU is active on Capitol Hill seeking clarification of regulatory standards for websites. Language was recently added to a House Appropriation's measure that would require the Justice Department (DOJ) to clarify website accessibility standards under the ADA, and Reps. Ted Budd, R-N.C., and Lou Correa, D-Calif., are currently circulating a letter among House members to urge the DOJ to resolve the issue as soon as possible. NAFCU encourages credit unions to contact their representatives about the issue through the association's Grassroots Action Center.

Credit Union Tax Exemption

Thirteen pro-business groups, including the Competitive Enterprise Institute and Americans for Tax Reform, sent a letter last week to Senate Finance Committee Chairman Orrin Hatch, R-Utah, to defend credit unions' federal income tax exemption. NAFCU was successful in maintaining the industry's tax-exempt status throughout tax reform efforts last year.

Cybersecurity

During a hearing last week, Senate Banking Committee Chairman Mike Crapo, R-Idaho, and Ranking Member Sherrod Brown, D-Ohio, made clear they intend to focus the committee's efforts on cybersecurity now that the regulatory relief package has been signed into law.

NAFCU has been active with lawmakers since the massive 2013 Target data breach stressing the need for a legislative solution to reform the nation's data security system, and has been a leader in advocating for national data security standards – akin to those followed by credit unions – in an effort to curb future breaches.

Housing Finance

Berger met with Federal Housing Finance Agency (FHFA) Director Mel Watt last week to discuss the FHFA's efforts to strengthen the housing market and advocated for the creation of a pilot program to ensure a secondary market for affordable mortgage options.

During a Senate Banking Committee hearing later in the week, Watt discussed a number of issues that concern credit unions, including maintaining 30-year fix mortgages and addressing the lack of affordable housing.

NAFCU remains engaged with lawmakers and agency officials to advance the association's core principles for housing finance reform.

CFPB's Indirect Auto Lending Bulletin

Trump last week signed the repeal of the CFPB's 2013 bulletin regarding indirect auto lending. In response, CFPB Acting Director Mick Mulvaney said the bureau would reexamine the requirements of the Equal Credit Opportunity Act.

While NAFCU and credit unions strongly support fair lending, the association worried that the bulletin could potentially set the stage for making indirect lenders, including credit unions, liable for fair lending violations by auto dealers.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 2024 Mid-Year Fraud Review Listen On: Key Takeaways: [01:16] Check fraud continues to be rampant across the country. Card fraud is affecting everyone. [04:31] Counterfeit US passport cards are just another new toolbox in the bad actors’ toolbox. [07:21] Blocking the fallback is the only way to defeat counterfeit cards. [11:17] The best way is constant education to your members in as many channels as you can. [13:02] We are still seeing overdraft lawsuits. Make sure the programming you have at your credit union matches what you have displayed for the members. Web NAFCU digital@nafcu.org America/New_York public

2024 Mid-Year Fraud Review

Strategy & Growth, Consumer Lending

preferred partner

Allied Solutions

Podcast

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

Get daily updates.

Subscribe to NAFCU today.