Newsroom

NAFCU's RBC-delay provision advances in House Approps

NAFCU continues to make progress on protecting credit unions from the harmful effects of NCUA's risk-based capital (RBC) rule as the House Appropriations Subcommittee on Financial Services and General Government yesterday advanced to the full committee legislation that includes NAFCU-sought language to delay the implementation of the rule by two years.

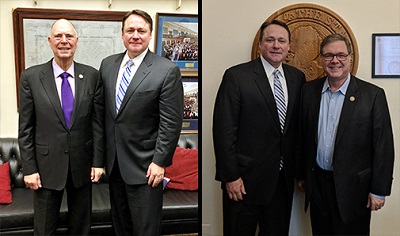

The RBC language included comes from the Common Sense Capital Relief Act (H.R. 5288), which was introduced by Reps. Bill Posey, R-Fla., and Denny Heck, D-Wash., in March. NAFCU President and CEO Dan Berger met with Posey and Heck last week to thank them for their ongoing efforts to protect the industry from the adverse effects of this rule.

Ahead of the subcommittee's markup on the appropriations bill, NAFCU Vice President of Legislative Affairs Brad Thaler sent a letter urging members to support the provision. Thaler also requested that the subcommittee continue to fund the NCUA's Community Development Revolving Loan Fund at $2 million in FY2019, as was included in the bill. In the letter, Thaler expressed the association's appreciation for the $191 million funding level of the Treasury Department's Community Development Financial Institutions (CDFI), but asked the subcommittee to work to restore the FY2018 funding level of $250 million.

The RBC-delay provision is also included in the House Financial Services Committee-passed Foreign Investment Risk Review Modernization Act of 2018 (H.R. 5841). H.R. 5841, introduced by Rep. Robert Pittenger, R-N.C., deals with the Committee on Foreign Investment in the United States (CFIUS). U.S. Defense Secretary Jim Mattis has urged that CFIUS legislation be included in the National Defense Authorization Act (NDAA), which is currently under consideration in the House. NAFCU will continue to advocate for House members to include a delay of the RBC rule in the legislation.

While NAFCU supports an appropriate RBC system for credit unions, the NCUA's rule as written will have a negative impact on the credit union industry. The association has been opposed to NCUA's RBC rulemaking since its passage and has urged the rule be modified or effective date delayed, particularly because of increased regulatory burdens and costs.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.