Newsroom

Berger gets CUs noticed on Hill, talks reg relief, RBC

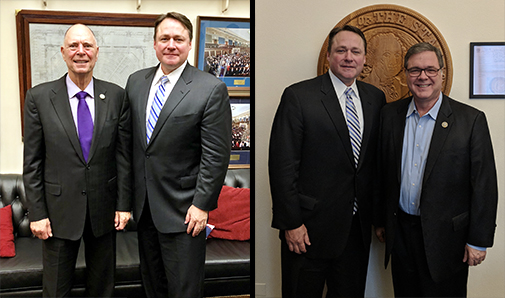

Talking with Reps. Bill Posey, R-Fla., and Denny Heck, D-Wash., in their Capitol Hill offices this week, NAFCU President and CEO Dan Berger thanked them for their support of credit unions, especially their efforts to protect the industry from the adverse effects of the NCUA's risk-based capital (RBC) rule.

Posey and Heck introduced the NAFCU-backed Common Sense Capital Relief Act (H.R. 5288), which would allow the NCUA to revisit and reconsider its approach to RBC by delaying the rule's effective date for two years to Jan. 1, 2021.

"NAFCU has been seeking relief for credit unions from the RBC rule since the NCUA finalized the rule," Berger said. "We appreciate the work of Reps. Posey and Heck and their understanding of the harmful effects this rule – as it stands – will have on the credit union industry."

NAFCU supports an appropriate RBC system for credit unions. The association has been opposed to NCUA's RBC rulemaking since its passage and has urged the rule be modified or effective date delayed because of the adverse effects it would have on the credit union industry – particularly as a result of regulatory burdens and costs.

Most recently, the language in H.R. 5288 was included in legislation introduced Wednesday dealing with the Committee on Foreign Investment in the United States (CFIUS). The Foreign Investment Risk Review Modernization Act of 2018 (H.R. 5841) was introduced by Rep. Robert Pittenger, R-N.C. The RBC delay provision will be reviewed during a House Financial Services Committee mark-up Tuesday. Committee Chairman Jeb Hensarling, R-Texas, was instrumental in getting the language added to the foreign investment bill. Berger also met with Hensarling Wednesday and thanked him for his efforts to provide regulatory relief to the credit union industry.

Berger was on the Hill this week meeting with key House members to secure support of the NAFCU-backed Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155) when it comes to a vote in the House next week. The House Rule Committee on Monday is slated to take up S. 2155 at 5 p.m. Eastern. A vote on the bill is expected Tuesday.

He also recently noted a number of top legislative items still pending before Congress – risk-based capital reform, data and cybersecurity standards, field of membership reforms, and lawsuit abuse under the Americans with Disabilities Act – and asked leaders in the House and Senate to work with the association to address these issues to bring the credit union industry even more relief.

Share This

Related Resources

A Furnisher's Guide to the FCRA

Articles

Defining Abusive Acts and Practices

Articles

Explaining Unfair Acts or Practices

Articles

Get daily updates.

Subscribe to NAFCU today.