Newsroom

Berger meets again with key House members ahead of reg relief vote

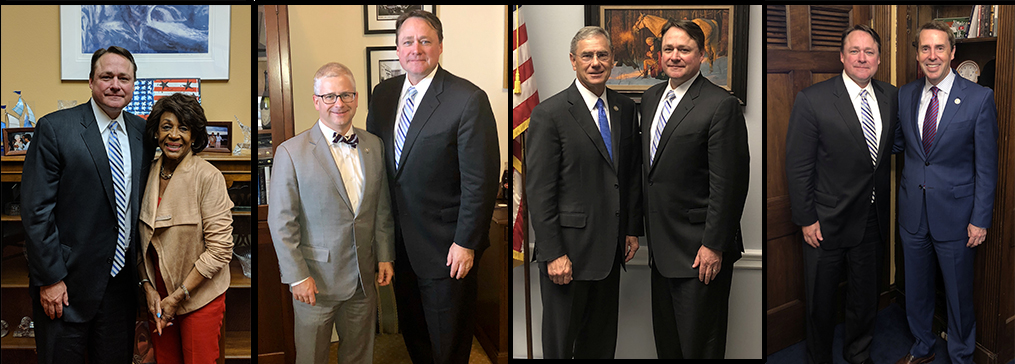

NAFCU President and CEO Dan Berger, in a number of meetings on Capitol Hill yesterday, shared credit unions' regulatory relief priorities and urged members to vote in favor of the NAFCU-backed Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155) when it comes to a vote in the House next week.

Berger spent Wednesday visiting members' offices to discuss the bill and met with House Financial Services Committee Chairman Jeb Hensarling, R-Texas, House Financial Services Committee Ranking Member Maxine Waters, D-Calif., House Chief Deputy Whip Patrick McHenry, R-N.C., House Financial Services subcommittee Chairman Blaine Luetkemeyer, R-Mo., and Republican Study Committee Chairman Mark Walker, R-N.C.

House sources have confirmed to NAFCU that the chamber will vote on S. 2155 on Tuesday. Following the announcement, Berger said the association stands ready to work with the House to see this bill passed into law.

Once S. 2155 passes, NAFCU will focus on advocating for Congress to address a series of challenges that credit unions still face. Berger has noted a number of top legislative items still pending before Congress – risk-based capital (RBC) reform, data and cybersecurity standards, field of membership reforms, and lawsuit abuse under the Americans with Disabilities Act – and asked leaders in the House and Senate to work with the association to address these issues to bring the credit union industry even more relief.

Language to delay the NCUA's RBC rule by two years has been included in legislation introduced yesterday dealing with the Committee on Foreign Investment in the United States (CFIUS). Hensarling was instrumental in getting the language added to the bill. (Read more here)

NAFCU encourages credit unions to continue reaching out to their lawmakers and urge them to support S.2155 through the association's active grassroots campaign. For several months, NAFCU lobbyists have been on Capitol Hill holding non-stop bipartisan meetings, advocating for the bill's passage and for other credit union regulatory relief measures.

S. 2155 includes various credit union regulatory relief measures related to member business lending and the Home Mortgage Disclosure Act. More details on the NAFCU-supported provisions of the bill can be found here.

NAFCU has been working towards regulatory relief for credit unions since the implementation of the Dodd-Frank Act. Most recently, NAFCU has advocated for S. 2155's passage since it was introduced by Sen. Mike Crapo, R-Idaho, and several Democratic members of the Senate Banking Committee last November.

Share This

Related Resources

CFPB Reform Issue Brief

Whitepapers

Interchange One-Pager

Whitepapers

Credit Union-Bank Mergers Fact Sheet

Whitepapers

Data Privacy Issue Brief

Whitepapers

Get daily updates.

Subscribe to NAFCU today.