Written by Brandy Bruyere, Vice President of Regulatory Compliance, NAFCU

NAFCU members are increasingly asking about potential requirements for their credit union websites in terms of accessibility for individuals with disabilities. While formal federal regulations setting uniform standards have not been adopted in this area, there are broader statutory concerns and potential litigation and reputational risks to consider, specifically stemming from the Americans with Disabilities Act (ADA or Act).

The ADA is a complex, fact-specific area of law, and some states have their own statutes addressing similar issues, so consulting with counsel may be necessary to fully assess ADA legal issues and risks. However, an overview of the statutory framework, rulemaking and enforcement activity, and potential for litigation is helpful for determining a credit union's course of action in this area.

Statutory Background – How the ADA Applies to Credit Unions

The ADA was signed into law on July 26, 1990, and amended in 2008. Its purpose is, in part, "to provide a clear and comprehensive national mandate for the elimination of discrimination against individuals with disabilities" and "to provide clear, strong, consistent enforceable standards" addressing such discrimination. See, 42 U.S.C. § 12101(b). One way the ADA applies to credit unions is through Title III of the Act, which sets standards for certain "public accommodations." Public accommodations include banks and other "service establishments," so these provisions have been interpreted to apply to credit unions. As a result, the ADA requires credit unions to meet standards for "newly constructed or altered places" and has wide-ranging implications that impact how to communicate with persons with disabilities. This in turn impacts the issue of website accessibility.

Specifically, the ADA prohibits discrimination, which is broadly defined into five categories. The one most applicable to the issue of websites is a provision that prohibits excluding, denying services or treating members with disabilities differently because of a lack of "auxiliary aids and services." This generally involves accommodations for persons with vision and hearing related disabilities – providing aids and services like closed-captions, interpreters, Braille materials and similar tools.

There are exceptions such as if the credit union can show that offering services with auxiliary aids and services would fundamentally change the nature of the services, or providing an auxiliary aid would cause an "undue burden." However, these exceptions are generally interpreted narrowly. Overall, the definition of discrimination is highly technical and includes several legal terms of art that are somewhat clarified in the Department of Justice (DOJ) ADA regulations, specifically 28 C.F.R. § 36.303. Between the statute, regulation and positioning by the DOJ, private litigation is increasing in this area.

Potential for Litigation Risk

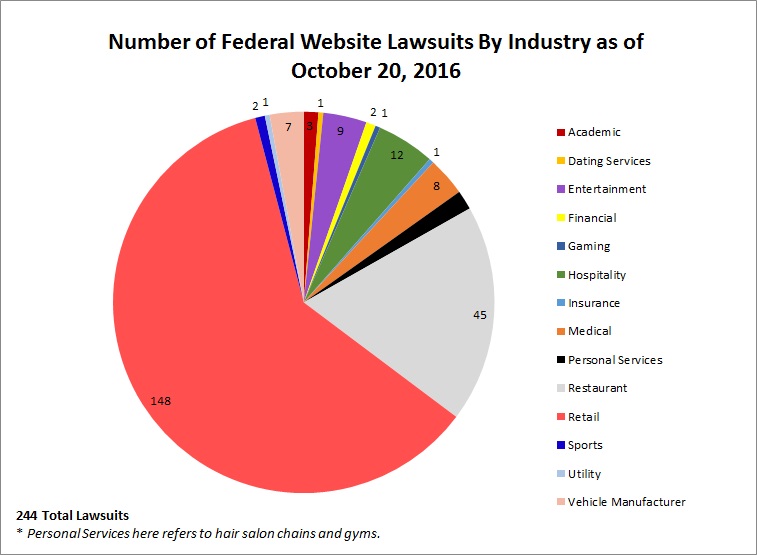

ADA website accessibility can present some litigation risk for businesses that are public accommodations, including credit unions. According to one law firm that handles ADA issues, plaintiffs' firms are sending demand letters to businesses that are public accommodations, and between January 2015 and October 2016, nearly 250 private lawsuits were filed on website accessibility issues. These suits were filed against a variety of types of businesses that are classified as public accommodations, although the vast majority of these suits targeted retailers and restaurants.

Here is a chart summarizing the suits by industry:

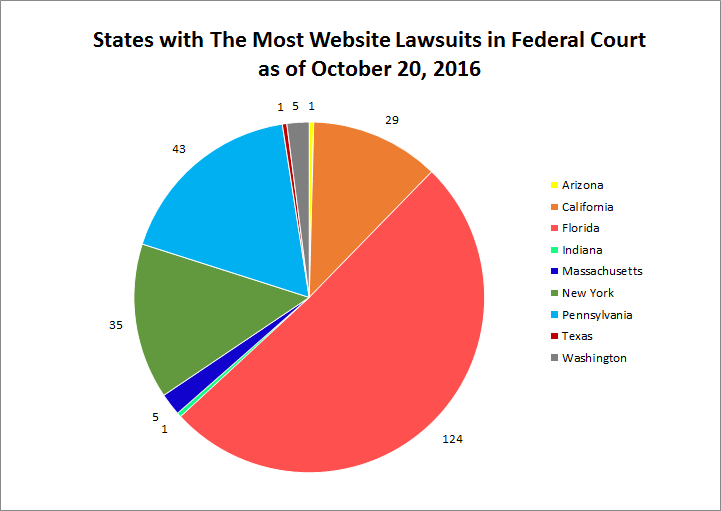

The same firm categorized these suits by state as well:

Although plaintiffs' firms are also sending demand letters seeking payment for alleged ADA violations stemming from website accessibility issues, so far, few lawsuits involving financial services public accommodations have been filed. A large portion of the suits were filed in Florida, followed by Pennsylvania, New York and California. Even with few lawsuits involving the financial services industry in general, some credit unions are assessing risk in this area.

An important question in assessing the risk involved in these issues is the possible penalties or damages for ADA violations stemming from litigation. The ADA permits the DOJ to assess civil penalties, which are currently up to $75,000 for the first ADA violation, and up to $150,000 for additional violations. The ADA and its regulations do not authorize statutory penalties for plaintiffs. But a court can force a business to meet accessibility standards as part of a private lawsuit and award plaintiffs their attorney's fees, costs and expenses in a suit. Additionally, risk can stem from state statutes. Overall, the rise in litigation is a continuing trend that is in part influenced by the DOJ's rulemaking and enforcement activity.

Regulatory Provisions, Rulemaking Efforts and Enforcement

As discussed, one way a credit union can run afoul of the ADA is by not taking the steps in regulations that address when "auxiliary aids and services" may be necessary to meet objectives like effective communication with individuals with disabilities." Under the current rule, website accessibility is not specifically addressed, but even the existing regulatory language is quite broad. In 2010, the DOJ issued an advanced notice of proposed rulemaking aimed at starting the process for adopting formal standards for website accessibility. While acknowledging that neither the Act nor existing regulations "specifically address access to websites," the DOJ indicated its position that the ADA is broad enough to apply to websites.

After collecting information in 2010, the DOJ did not take further rulemaking action that would impose a clear standard for credit unions to follow with regard to website accessibility for persons with disabilities. While this initiative remained on the DOJ's radar for several years, the agency did not publish a rule – but it did pursue enforcement actions against public accommodations whose websites were not accessible to persons with disabilities.

DOJ Enforcement Efforts.

Throughout the past several years, the DOJ has intervened in private lawsuits on the issue of website accessibility, taking the same position set forth in the 2010 ANPR – the ADA is broad enough to apply to the websites of public accommodations like credit unions. For example, on May 31, 2011, the DOJ entered into a settlement agreement with Wells Fargo, indicating that discrimination includes the failure to "provid[e] a website that is accessible to individuals with disabilities, including blind individuals who use screen readers to access web content that is visual and providing captions for deaf individuals…" While Wells Fargo committed to making its website more accessible as part of the settlement, the DOJ did not require specific standards to be followed.

In later cases, such as a consent decree with H&R Block in 2014, the DOJ went a bit further than in the Wells Fargo case and actually required H&R Block to commit to following a specific standard in making its website accessible that is known as the Web Content Accessibility Guidelines 2.0 Level A and AA. These are voluntary standards with a dozen separate components. Interestingly, the DOJ required H&R Block to make not only its website accessible, but its mobile applications as well. Despite not adopting a formal website accessibility standard, the DOJ continued requiring this standard in its enforcement actions. The DOJ also continued to involve itself in private lawsuits. Other more recent examples include:

- In 2015, filing statements of interest in cases involving Harvard University and the Massachusetts Institute of Technology;

- In October 2016, a consent decree with Miami University (where the university agreed to follow the same standards, as H&R Block did in 2014); and

- In December 2016, the DOJ filed a statement of interest in a case involving the grocery chain Winn-Dixie.

However, the DOJ is now operating with a new Attorney General, so it is unclear whether this kind of ADA enforcement activity will remain a priority under the current administration.

DOJ Rulemaking and Enforcement – Looking Forward.

After several years with little activity on the 2010 ANPR on website accessibility, the DOJ indicated in its fall 2015 statement of regulatory priorities that formal rulemaking that would impact credit unions would be delayed until at least 2018. This timeframe was then further delayed when the DOJ withdrew a related rule on April 29, 2016. However, it is not clear what the DOJ's priorities will be under a new administration – previous efforts made under the Obama administration may stall under the Trump administration. This is in part due to an executive order which calls, in part, for the elimination of two regulations for every new regulation issued. Given the uncertainty of the rulemaking process and future DOJ enforcement action, parties seeking widespread website accessibility may increasingly pursue private litigation as a course of action.

So far, the DOJ has only telegraphed its position on website accessibility for public accommodations in enforcement actions and proposals. The ADA does not directly address websites and no implementing regulations specifically addressing websites are in place. At this point in time, a credit union must make its own risk-based decisions with regard to website accessibility. Overall, a credit union may need to consult with its local counsel to discuss the trends in jurisdictions where it operates relating to potential demand letters and lawsuit activities. Some credit unions may also consider adopting accessibility measures based on the potential risk – which, in addition to litigation risk, can include reputation risk. There are consultants that work to make websites accessible for persons with disabilities and perform ongoing work for changes in content over time which comes with various upfront and continuing expenses.

Article originally appeared in NAFCU's March 2017 Compliance Monitor.