2017 Adjusted Threshold Levels for Regulations Z and C; Updated HMDA Resources

Written by Stephanie Lyon, Regulatory Compliance Counsel

The Consumer Financial Protection Bureau (CFPB) has been updating and adjusting threshold dollar amounts for transactions covered under Regulation Z (which implements the Truth in Lending Act) and Regulation C (which implements the Home Mortgage Disclosure Act) since the middle of last year. As most threshold adjustments became effective as of January 1st, 2017, we thought it would be helpful to gather this information in a one-stop shop.

Regulation Z

The Dodd-Frank Act and the CARD Act require the Bureau to adjust a variety of thresholds annually for inflation. Below are a few of the most notable adjusted amounts:

Credit Cards

Regulation Z prohibits a card issuer from imposing a fee for violating the terms or other requirements of a credit card account under an open-end (not home-secured) plan unless the fee represents a reasonable proportion of the total costs incurred for the violation, or is within the safe harbor provision of 12 C.F.R. section 1026.52(b). If a credit card issuer charges anything up to the safe harbor amount for certain violations, it is considered to be in compliance with Regulation Z.

The safe harbor amounts will remain the same as in 2016:

- $27 for a first late payment; and

- $38 for each subsequent late payment over six months.

Ability-to-Repay/Qualified Mortgage

For dollar amounts related to determining a borrower's ability to repay a transaction secured by a dwelling, the threshold for what is a qualified mortgage in 2017 will require that total points and fees not to exceed:

- 3 percent of the total loan amount for a loan greater or equal to $102,894;

- $3,087 for a loan amount greater or equal to $61,737 and less than $102,894;

- 5 percent of the total loan amount for a loan greater or equal to $20,579 but less than $61,737;

- $1,029 for a loan amount greater or equal to $12,862 and less than $20,579; and

- 8 percent of the total loan amount for a loan less than $12,862.

Home Ownership and Equity Protection Act (HOEPA) Loans

Regulation Z sets additional requirements for high-cost mortgages. To be considered a high-cost mortgage, the transaction must be secured by the consumer's principal dwelling and the APR and loan amount have to be over a certain threshold. For 2017, the total loan amount will be increased to $20,579 and the loan's points and fees must exceed 5% of the total loan amount. See, 12 C.F.R. § 1026.32(a)(ii). Loans below $20,579 will also be high-cost if the points and fees exceed the lesser of 8% of the loan amount or $1,029.

Escrow Requirement

Creditors making higher priced mortgage loans must escrow the borrower's property taxes and insurance unless the credit union meets certain exceptions. Credit unions with an asset size of less than $2.069 billion (increased from $2.052 billion in 2016) that extend a covered loan for a property that is located in rural or underserved areas and meet other requirements are exempt from establishing escrow accounts. See, 12 C.F.R. § 1026.35(b).

Special Appraisal Requirements

Higher-priced mortgage loans are considered to be higher risk and hence require that the credit union obtain a written appraisal based on a physical visit to the home's interior.12 C.F.R. § 1026.35(c)(3)(i). The rule contains a few exceptions for the appraisal requirement including for transactions of less than an amount adjusted annually, which will remain the same as last year, $25,500.

For more information on Regulation Z's 2017 adjusted thresholds, see the CFPB's rule in the Federal Register or their press release.

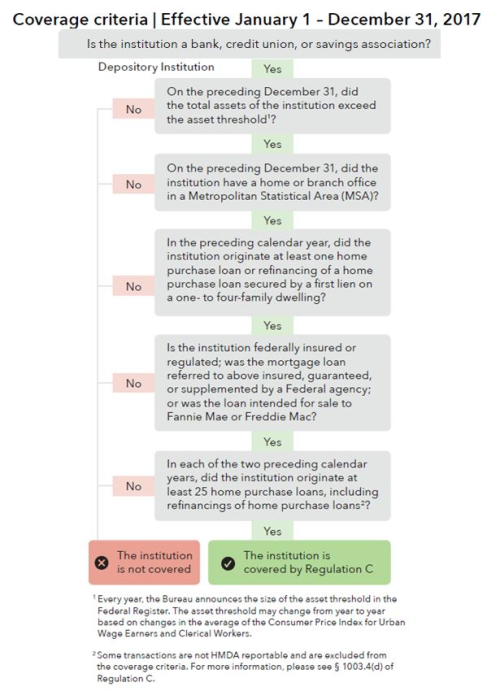

Regulation C

HMDA Asset Size Reporting Exemption

HMDA exempts small credit unions from reporting HMDA data for the following year, using a multi-prong test that includes an asset threshold. There is no change from last year's asset size exemption. So in 2017, credit unions with assets at or below $44 million as of December 31, 2016 will continue to be exempt from collecting and reporting HMDA data in 2017. See, 12 C.F.R. § 1003.2 (Financial Institution)(2).

Updated Resources

Also, I wanted to highlight that additional Resources for HMDA Filers were posted by the CFPB to their webpage and the FFIEC's page. Among the additions are:

- The release of the 2017 Loan/Application Register (LAR) Formatting Tool

- Modifications to the Technology Preview, Filing Instructions Guide for data collected in or after 2018, and Frequently Asked Questions (FAQs).

The CFPB has an additional HMDA implementation page full of easy to digest coverage charts like the 2017 HMDA institutional coverage chart , which looks something like this: