In Addition to CUGMA, Omnibus Spending Package Includes “Adjustable Interest Rate (LIBOR) Act”

Last week, we blogged about the Credit Union Governance Modernization Act (CUGMA), which was included in the Consolidated Appropriations Act, 2022. The passage of CUGMA was a much-anticipated piece of legislation, which will help Federal credit unions deal with problematic members more efficiently. However, the omnibus spending package also includes an important update via the Adjustable Interest Rate (LIBOR) Act, which addresses the replacement of the London Interbank Offered Rate (LIBOR) in existing contracts.

The Adjustable Interest Rate (LIBOR) Act is found in Division U of the appropriations act, immediately after the CUGMA. It’s main purpose is to “establish a clear and uniform process, on a nationwide basis, for replacing LIBOR in existing contracts the terms of which do not provide for the use of a clearly defined or practicable replacement benchmark rate, without affecting the ability of parties to use any appropriate benchmark rate in new contracts.” It also purports to preclude litigation around contracts that do not provide for a LIBOR replacement, to allow existing contracts that reference LIBOR and do provide for the use of a LIBOR replacement, and to address LIBOR references in Federal law. Section 110 provides the Federal Reserve Board with 180 days to issue regulations to carry out the Act.

Let’s get into some details of the act which could be relevant to credit unions.

Section 104 of the law addresses LIBOR contracts, and outlines that the Board selected benchmark replacement (based on the Secured Overnight Financing Rate (SOFR)) shall be the benchmark replacement for contracts containing no LIBOR fallback provisions, or containing fallback provisions that do not identify a specific LIBOR replacement or a “determining person.” Pursuant to the Act, a determining person is “with respect to any LIBOR contract, any person with the authority, right, or obligation, including on a temporary basis (as identified by the LIBOR contract or the governing law of the LIBOR contract, as appropriate) to determine a benchmark replacement.” Fallback provisions means “terms in a LIBOR contract for determining a benchmark replacement, including any terms relating to the date on which the benchmark replacement becomes effective.”

Basically, that means that if there is a LIBOR contract that does not specify a LIBOR replacement, or does not specify a person to choose a LIBOR replacement, then the “Board selected benchmark replacement” (i.e., the SOFR) will become the replacement for the LIBOR. Additionally, if the determining person does not choose a LIBOR replacement by the LIBOR replacement date or the last date for choosing a benchmark replacement specified in the LIBOR contract, then the Board selected benchmark replacement will also become the LIBOR replacement. The LIBOR replacement date is the “first London banking day after June 30, 2023, unless the FRB determines that any LIBOR tenor will cease to be published or cease to be representative on a different date.”

In addition to the automatic replacement of the LIBOR if no fallback provisions or determining persons are identified in the contract, the Act specifies that certain references made in contracts that do include fallback provisions will be nullified. These references include:

- a benchmark replacement that is based in any way on any LIBOR value, except to account for the difference between LIBOR and the benchmark replacement; or

- a requirement that a person (other than a benchmark administrator) conduct a poll, survey, or inquiries for quotes or information concerning interbank lending or deposit rates.

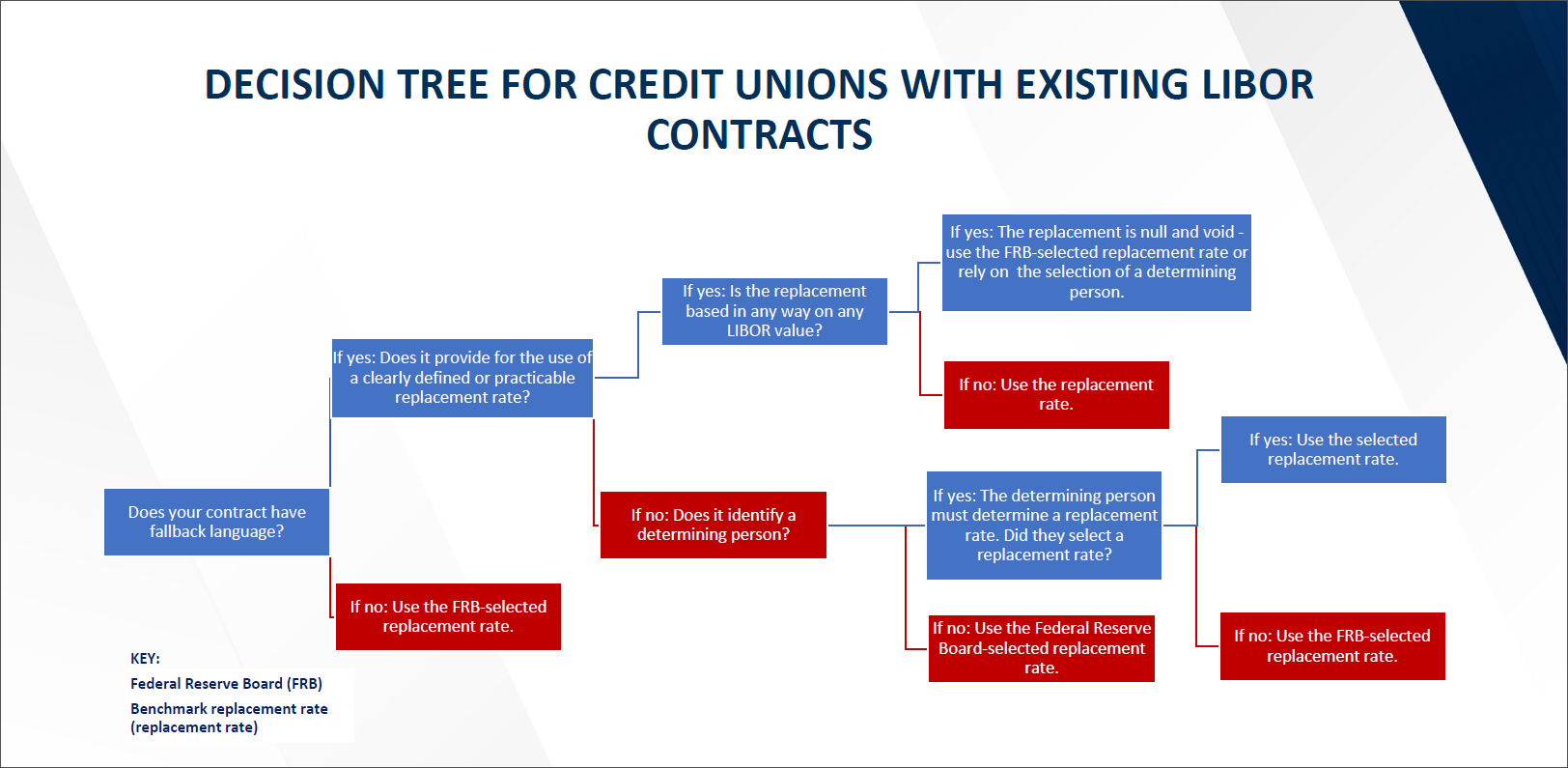

Any LIBOR contract provisions that include these types of references “shall be deemed null and void and without any force or effect.” In a scenario where a credit union’s contract includes a replacement that is based on any LIBOR value, the replacement would be null and void, and the credit union could either rely on the selection of a determining person (if one is so named), or utilize the Board selected benchmark replacement. This can be a little confusing to untangle, so this decision tree graphic may be helpful to illustrate how this all will work:

The Act further provides a safe harbor against liability for damages for credit unions who select or use a Board selected benchmark replacement. On the other hand, the Act stipulates that it does not create any negative inference or presumption around the use of a non-Board selected benchmark replacement. In addition, the Act specifies that the selection or use of a Board selected benchmark replacement will not constitute an amendment or modification to any LIBOR contract, nor will it “prejudice, impair, or affect the rights, interests, or obligations of any person under or with respect to any LIBOR contract.”

While the Adjustable Interest Rate (LIBOR) Act is now in effect, NAFCU will continue to inform our readers on the FRB’s implementing regulations once they are issued, within the next six months.