CFPB Sharing Complaint Data; Unverified Complaints; Feedback on NCUA Process

Written by Steve Van Beek

Back in mid-December, the CFPB announced it would be sharing consumer complaint data with state regulatory agencies. They also note that this is just the beginning:

"In the future, we're planning on building ways to accept complaints and information from the agencies as well, and to make the data available to other federal agencies, state attorneys general, local agencies, congressional offices as appropriate, and other governmental organizations like the California Monitor (a program of the California Attorney General) and the Office of Mortgage Settlement Oversight."

The announcement then goes on to provide a summary of the CFPB's complaint process:

"What happens when I file a complaint?

When a consumer files a complaint, we screen it to make sure that it's complete and not a duplicate of another complaint we're already working on for that consumer. Next, we send it to the company in question and ask them to reply to the complaint within 15 days and expect them to close all but the most complicated complaints within 60 days. After the company responds, we publish a selection of the data (with information identifying the consumer removed) in our public Complaint Database."

You'll easily notice that there is no verification process. And, the Complaint Database's disclaimer doesn't exactly jump off the page. Of course, this is an issue we've discussed over and over on the blog - so much so that we have a Member Complaints category.

***

Initially, it is important to remember that credit unions under $10 billion are not included in the Consumer Complaint Database. The CFPB will forward any complaints from these credit unions to NCUA and credit unions will need to follow NCUA's procedures for responding to member complaints (more on this at the end of the blog post).

Unverified Complaints. So, what is the big deal with unverified complaints? The reputation risk issue is one that cannot be ignored. In this age of viral media - where a simple complaint or issue can fly through blogs, Facebook, Twitter - it is much harder to correct inaccurate information. Sometimes, once the story is out there, it is....well, out there.

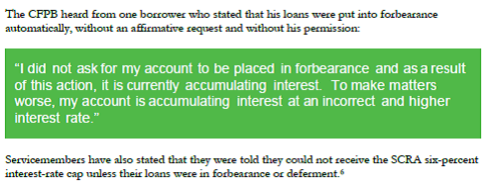

But, there is another angle that could be even more dangerous. The CFPB's Annual Report on Student Loans and the companion report - The Next Front? Student Loan Servicing and the Cost to Our Men and Women in Uniform - both use consumer complaints as a focal point to help show the current regulations or enforcement is insufficient.

The latter quotes directly from consumer complaints, for example:

That comes from page 5 of the Report. An earlier quote includes this footnote: "This report cites information from specific complaints submitted to the CFPB. In these cases, the consumers have provided consent to include the details of their complaints."

Again, there is no mention of verification of the complaints. I'm interested, was the rate incorrect? We don't know. But, the CFPB is implying it was by including one side of the story. Remember: The institution - whichever institution this was from - is prohibited by privacy laws from providing any information about the member's account. So, we have the one side of the story.

Of course, I'm not saying these complaints are not true. I'm just saying they are unverified (if they were verified, the CFPB should include that information).

And, I'm not saying that institutions always do everything correctly. For example, if this complaint is accurate - the institution has a lot of work to do:

"According to a complaint received by the CFPB, one borrower had six loans with a servicer, two of which had interest rates above six percent and four of which had interest rates below six percent. Instead of reducing the interest rate on the two higher-rate loans to six percent and leaving the four lower-rate loans untouched, the servicer simultaneously increased the interest rate on the lower-rate loans up to six percent."

Or, it could have been a mistake that was quickly corrected by the institution. We just don't know.

***

The New Cycle? The reason I bring this up is that this seems to be the start of a new type of regulating that credit unions need to be aware of. Or, at the least it is a new type of justifying the need for new regulation.

Think about it. The CFPB is soliciting consumer complaints (remember the flashing red "complaint button" on their first website?) Then, they write a report (usually to Congress) using the complaints to argue there are issues that need to be corrected. There might also be testimony to explain the report and what they've found. After that? Well, it might just be that the reports help build the case for a new regulation (or a new law from Congress). All with unverified consumer complaints.

At this point, we don't know. But, the CFPB seems to be falling short of their data-driven analysis goal:

"The CFPB is a data-driven agency. We take in data, manage it, store it, share it appropriately, and protect it from unauthorized access. Our aim is to use data purposefully, to analyze and distill data to enable informed decision-making in all internal and external functions."

And, remember - the new requirements that come from these new regulations or laws will not be limited to credit unions with more than $10 billion in assets. The new requirements will apply to everyone.

***

NCUA Complaint Process. Taking a little different angle here. We've detailed the NCUA Complaint process a couple of times on the blog. Most recently here and here. What we are interested in from blog readers is if there are areas NCUA could improve? If so, please let us know. We'll be sure to raise the issues with NCUA and see if some of the issues can be smoothed out.