Here's Your Sign...

Posted by Steve Van Beek

Last month, NCUA issued a final rule on the shared branch insurance sign with a April 3, 2009 effective date. NAFCU will be issuing its Final Regulation on the shared branch insurance sign later today. If your credit union does not participate in a shared branch or if your

shared branching relationship consists of only federally insured credit

unions, the second sign would not be required.Â

NAFCU was able to obtain copies of NCUAâÂÂs shared branch second sign. The signs below are for your information but credit unions should wait until NCUA releases the official version of the signs before updating its own signs.

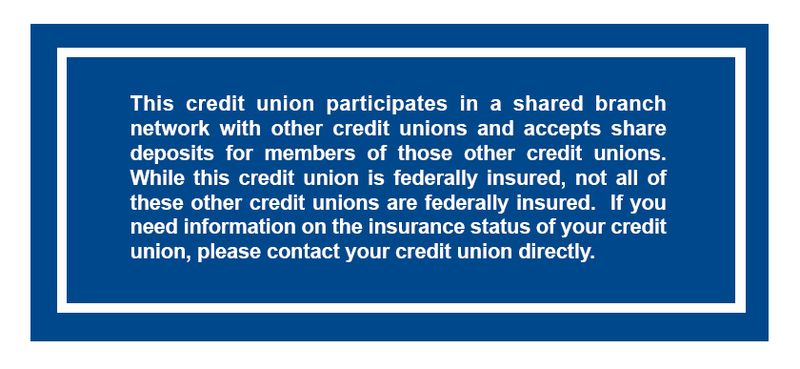

Here is the language for the second sign for teller windows at federally insured credit unions:

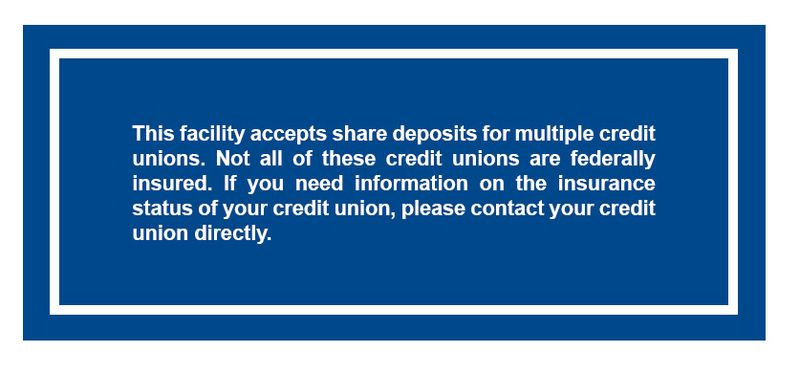

The second sign for teller windows at shared branches operated by non-credit union entities looks like this:

Here is a brief summary of the new changes that the Compliance Guy penned:

NCUA approved a final rule to amend regulations (ç 740.4) that requires federally insured credit unions to display the official NCUA sign at every teller station or window where insured funds or deposits are normally received. The regulation requires tellers accepting share deposits for both federally insured credit unions and non-federally insured credit unions to post a second sign adjacent to the official NCUA insurance sign. The old rule required this second sign to list each federally insured credit union served by the teller along with a statement that only those credit unions listed were federally insured. NCUA revised the rule to replace the currently required listing of credit unions. Instead, credit unions must merely post a statement that not all of the credit unions served by the teller are federally insured and that members should contact their credit union if they need additional information. The effective date is April 3, 2009.

Enjoy the weekend!