The Lowdown on Non-member Loan Participations and the MBL Cap; New Resource: NAFCU FFIEC Cybersecurity Assessment Tool Workbook

Written by Elizabeth M. Young LaBerge, Regulatory Compliance Counsel

Since NCUA's Final Rule on MBLs was released, the Regulatory Compliance Team has gotten a few versions of the same question: Is it true that nonmember loan participations will no longer count towards a federal credit union's MBL cap?

In the immortal words of Neil Patrick Harris's Barney Stinson:

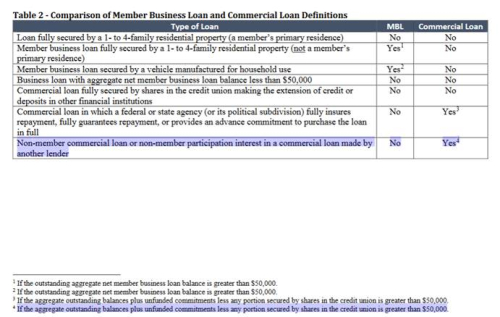

Yes, it's true. Under the revised MBL Final Rule, the definition of a member business loan specifically does not include non-member participation interests in commercial loans made by other lenders.

Below is the text of the new rule:

723.8 Aggregate member business loan limit; exclusions and exceptions.

This section incorporates the statutory limits on the aggregate amount of member business loans that may be held by a federally insured credit union and establishes the method for calculating a federally insured credit union's net member business loan balance for purposes of the statutory limits and NCUA form 5300 reporting.

(a) Statutory limits. The aggregate limit on a federally insured credit union's net member business loan balances is the lesser of 1.75 times the actual net worth of the credit union, or 1.75 times the minimum net worth required under section 1790d(c)(1)(A) of the Federal Credit Union Act.

(b) Definition. For the purposes of this section, member business loan means any commercial loan as defined in 723.2 of this part, except that the following commercial loans are not member business loans and are not counted toward the aggregate limit on a federally insured credit union's member business loans:

(1) Any loan in which a federal or state agency (or its political subdivision) fully insures repayment, fully guarantees repayment, or provides an advance commitment to purchase the loan in full; and

(2) Any non-member commercial loan or non-member participation interest in a commercial loan made by another lender, provided the federally insured credit union acquired the non-member loans and participation interests in compliance with all relevant laws and regulations and it is not, in conjunction with one or more other credit unions, trading member business loans to circumvent the aggregate limit.

See, revised 12 C.F.R. 723.8. (Emphasis added.) As you can see, non-member participation interests are generally not included in the definition of member business loans for the purposes of the cap. For more information on the new definition of member business loans in the revised MBL rules, check out this previous blog post on the topic. This change will be effective January 1, 2017.

NCUA reserved the option to re-include non-member participation interests in member business loans if it identified that credit unions were essentially trading MBL interests to circumvent the aggregate limit. It discussed this caveat in the Preamble to the Final Rule:

To preserve the existing safeguard against evasion, the final rule retains in substance the current rule's stipulation that, for the exclusion to apply, a credit union must acquire the non-member loan or non-member participation interest in compliance with applicable laws and regulations and it must not be swapping or trading MBLs with other credit unions to circumvent the statutory aggregate limit. Attempts to circumvent the statutory aggregate limit will not be tolerated and will be treated as a violation of this final rule. A credit union that demonstrates a pattern or practice of evading the MBL cap, as with any other regulatory violation, will be subject to commensurate supervisory action.

That perception could be an important consideration when purchasing and selling participations, but that caution is not new.

Still don't believe us? Have a look at NCUA's Summary of Key Changes to NCUA's Final Member Business Loan Rule document, as screenshot of which is below:

If NAFCU member credit unions have other questions regarding the changes to the MBL rule, please let your NAFCU Regulatory Compliance Team know. We are here to help.

New Resource Now Available: NAFCU FFIEC Cybersecurity Assessment Tool Workbook

NAFCU's Regulatory Compliance Team has created a new, user-friendly version of the FFIEC's Cybersecurity Assessment Tool. The NAFCU FFIEC Cybersecurity Assessment Tool Workbook is a members-only, editable, fillable, self-tallying Excel workbook that allows credit unions to self-test the cyber risk and readiness. Once all items are completed, the workbook presents the credit union's Risk Profile and Cybersecurity Maturity results in a visual, sharable format. We've also put together some available-to-all resources for cybersecurity compliance, including insightful blog posts, articles and webcasts, to help credit unions stay on top of this cybersecurity issues.

Not a NAFCU member yet? Learn how NAFCU can help your credit union with compliance and more.