May I Please Be Recused?: Avoiding Conflicts of Interest

Welcome to 2019!

Before the holidays, we blogged on some of the recent questions our compliance team has received on the bylaws, board of directors and other federal credit union governance issues. Today’s blog takes a look at another related question: What exactly is a conflict of interest?

Article XVI, Section 4 of the model federal credit union bylaws prohibits a director from participating in a decision that affects his or her interests. Directors are required to recuse themselves from all phases of the decision, including discussions, deliberations and voting. This requirement is rather clear when the board is selecting a new accounting firm and a director owns a local accounting firm being considered for the contract. The director has a clear interest in the company and would profit from his company being selected. As a result, the director would not be permitted to be involved in the selection process.

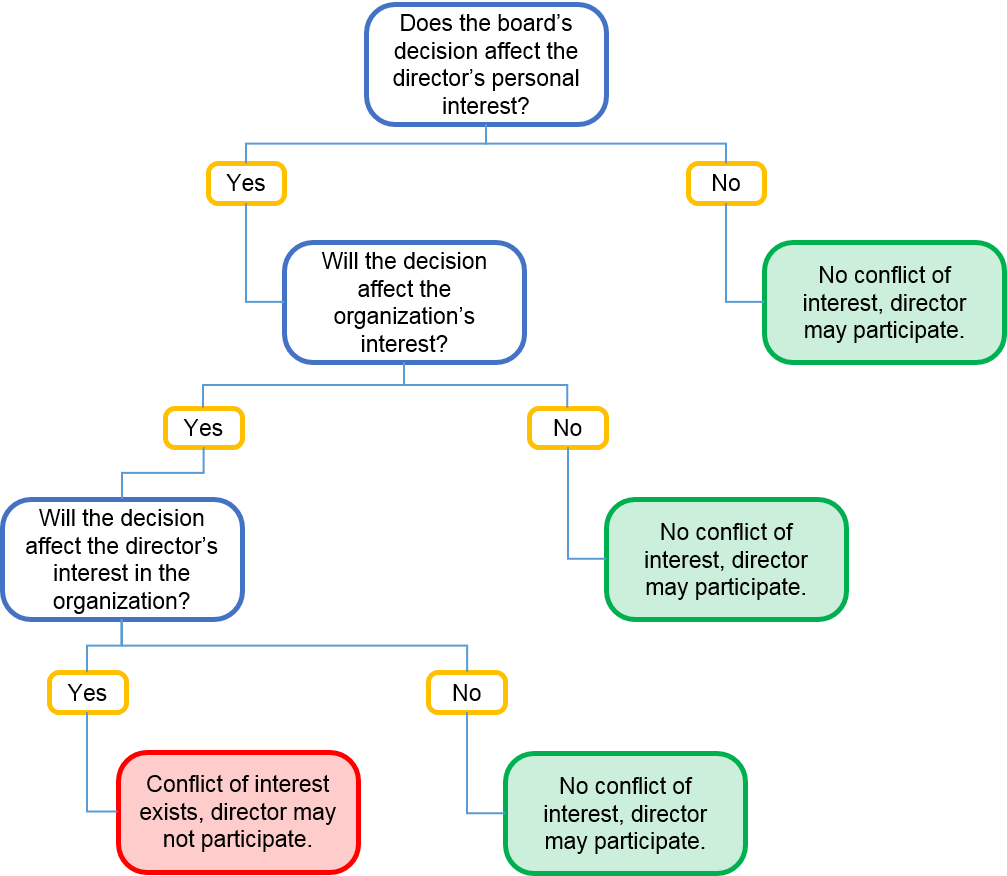

Where the conflicts of interest rule gets murky is when the director’s interest is not so direct. In a 2010 legal opinion letter, NCUA provided a multi-part test for analyzing conflicts of interest issues when the director has an interest in an organization interested in working with the credit union. For ease of reference, here a chart demonstrating how the test works:

For a conflict of interest to exist, there must be a real or actual effect on the director’s interest in the organization; a speculative or hypothetical effect is not sufficient. For example, suppose Joe serves on a credit union’s board of directors. As part of his personal stock portfolio, Joe owns some stock in Intel. If the credit union is considering purchasing new computers from Intel, Joe would not be required to recuse himself from that decision. NCUA explained this is because Joe’s interest in Intel is likely so attenuated that his interest will not actually be affected by the credit union’s decision to purchase computers from Intel. As a result, the answer to the question “Will the decision affect the director’s interest in the organization?” in the chart above is “no,” resulting in no conflict of interest.

Similarly, directors can make decisions about issuing dividends and setting dividend rates even though they are members of the credit union. NCUA believes these broad decisions that affect an entire group rather than just the director’s personal interest do not create a conflict of interest.

Here are some of NCUA’s legal opinion letters addressing general conflicts of interest issues:

|

Director associated with organization may not participate in decision to establish relationship with organization. |

|

|

Director only employed by organization doing business with the credit union does not create a conflict of interest. |

|

|

Director employed by select group may participate in decision to add competing select groups to field of membership. |

|

|

General discussion of conflicts of interest (discussed above) and various examples of arrangements that do or do not create a conflict. |

While NCUA has taken a somewhat narrow view of the types of decisions that affect a director’s interest, there are other reasons why a director may elect to recuse himself even if recusal is not necessarily required. One such reason can be reputation risk. Depending on the facts and circumstances involved, a credit union may want to consider whether there are any potential public perception issues with the director’s involvement in the decision. Sometimes, reputation risks can be offset by how the transaction is announced or presented to the public, but this is not always the case.

Also, keep in mind that section 701.21(c)(8) of NCUA’s lending regulation may actually prohibit certain relationships with organizations a director has an interest in as directors may not receive any compensation in connection with loans made by the credit union. For example, NCUA determined where a director had an ownership interest in an organization providing indirect lending services to the credit union, the relationship with the credit union violated section 701.21(c)(8). In these cases, it is the relationship itself that is impermissible so the director’s recusal from the decision whether to establish the relationship is not sufficient to avoid violating the rule.

Ultimately, whether a particular situation is a conflict of interest will be highly fact specific. NCUA’s two-part test and legal opinion letters should be sufficient to answer many questions, but sometimes an attorney’s opinion may also be appropriate.