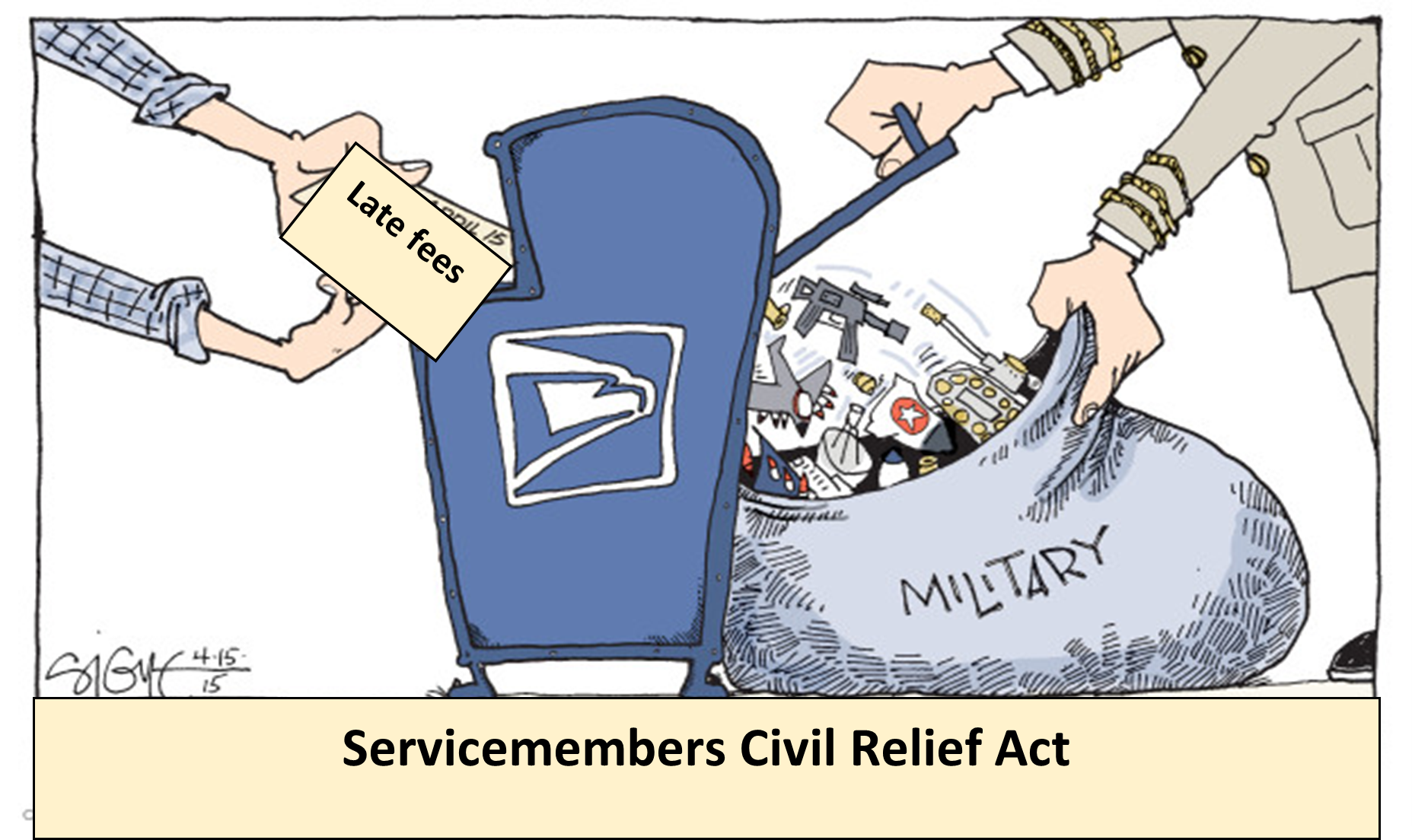

Misconceptions of the Servicemembers Civil Relief Act and Late Fees

We’ve all heard the rumors. My personal favorite rumor (or lie…) is “active-duty servicemembers don’t have to pay for anything once they join.” That’s right. Once you join the military everything is smooth sailing from there! EVERYTHING! Well… while one might argue our servicemembers are very deserving of free things, that isn’t always necessarily true. We in the financial world know that federal regulations provide protection for servicemembers from certain financial risks, including the Servicemembers Civil Relief Act (SCRA).

The SCRA was enacted to help alleviate financial burdens of active-duty military members entering the military and safeguarding their assets and legal interests. The Act provides interest rate reductions, protections against foreclosure and repossession, the ability to terminate leases, limitations on evictions, and specific safeguards during civil legal proceedings. If you want a more in-depth view on the parameters of the SCRA, check out this NAFCU Compliance Monitor article (member login required). For the purposes of this blog, we will discuss how late fees are affected under this context. More simply, does the SCRA shield military persons from paying late fees? The short answer is maybe.

The SCRA doesn’t directly address late fees. Instead, late fees are addressed in another way. The Act defines “interest” broadly. Interest consists of “service charges, renewal charges, fees or any other charge” other than bona fide insurance costs (emphasis added). Due to the broad nature of the definition, late fees, which are typically charges a credit union imposes when a member misses a payment, are considered interest. The SCRA limits the interest for past debts at 6%, found in § 3937 of the Act.

How does the interest limitation affect late fees? Since we have established that fees are considered interest, late fees must be factored into the interest cap. (And no! I will not do the math for you.) Any interest above six percent must be retroactively waived back to the date of the member’s entry into military service. All interest above the 6% cap must be surrendered by the credit union. Further, the credit union is prohibited from adding this amount back, after a member leaves military service. In application, if a credit union charges a late fee penalty that raises the interest rate above 6%, the creditor is required to pardon all interest greater than six percent. For example, if the interest rate is lowered from 8% to 6%, then any fee charged would bring the interest above that threshold. However, if the interest rate is lowered from 8% to 5%, then the late fee may not bring the interest about that threshold (again, you’ll need to do the math). Interest is not deferred. The credit union must also be sure to reduce the required payments by the amount of interest forgiven and maintain the same maturity date, unless a court determines a creditor qualifies for relief.

And if you are also bad at math, remember the credit union always has the option of waiving the late fee for the covered borrower. Please note, this is a completely separate creditor function, and you are not directly obligated to waive the late fee under SCRA, if your credit union has incorporated the late fee into the 6% interest cap.

This subject is very important for creditor credit unions to understand because your business could actually be forgiving too many late fees! If a credit union fails to collect late fees that are already factored in the interest cap, the entire membership could suffer the financial loss. On the other hand, credit unions could face steep punishment for overcharging a servicemember late fees that inflate the interest rate over six percent. Credit unions with questions on how to compute the 6% interest rate cap may want to discuss this with their local counsel or accountant, to ensure that compliance with the interest rate limitation is handled.

Regulatory Compliance School | March 13 – 17, 2023 | Arlington, VA

Join your peers and understand credit union compliance from A to Z when you attend NAFCU's Regulatory Compliance School. Plus, you can earn your NCCO. Right now, save $200.00 with code SCHOOLSAVINGS. View the agenda.

About the Author

JaMonika Williams, Regulatory Compliance Counsel, NAFCU

JaMonika Williams joined NAFCU as regulatory compliance counsel in July 2022. In this role, JaMonika assists credit unions with a variety of compliance issues.