Money Talks: Gift Giving to Officials

Modesty is dull. Everyone loves to be showered with blinged out gifts. Especially the people who make recommendations to the board that management has dropped the ball with safeguarding member information. Just because they may be super strict, it doesn’t take away the fact that officials work extremely hard to determine credit union financial health.

Playing devil’s advocate here, the members of the supervisory committee are likely right that member files shouldn’t be kept under the magazines in the lobby. No one wants to review paperwork with coffee stains. So how does a credit union reward an official who seemingly has it all? I’d suggest a tie or a grill, but those are “boring gift ideas,” says my dad.

For starters, the federal credit union should determine if gift giving to an official is even allowed under the rules. At this point, it may be helpful to remind ourselves of some key terms. "Officials" under the NCUA regulations is defined as “a person who is or was a member of the board of directors, credit committee or supervisory committee, or other volunteer committee established by the board of directors.” The “compensation” definition found in the NCUA regulations excludes reimbursement of reasonable costs incurred and reasonable health insurance.

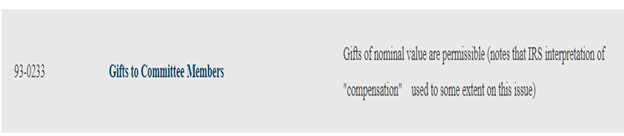

In application, we know there are compensation restrictions imposed on FCU officials. While it is clear the rules prohibit FCU officials from receiving compensation for performance (this link has member-only access), it appears that nominal gift giving to supervisory committee members is permissible. See this relevant excerpt from this NAFCU blog which explains board compensation:

This NCUA opinion letter which analyzes the difference between gift giving and compensation is somewhat based upon federal tax agency definitions. It appears to confirm that small gift amounts don’t equate to compensation:

“Section 701.33(b) of the NCUA Rules and Regulations, 12 C.F.R. ~701.33(b), provides that, with the exception of one board officer specified in the federal credit union's ("FCU") bylaws, no FCU official may receive compensation for performing duties or responsibilities of the board or committee position to which he has been elected or appointed. "Official" is defined in Section 701.33(a) to include a member of the supervisory committee or the credit committee. Section 701.33(c) sets forth several exceptions to the definition of compensation, none of which is applicable here. Clearly, under the Act and the Regulations, a supervisory committee or credit committee member may not receive compensation from the FCU. The IRS has generally held that Christmas gifts of nominal value given to employees are not considered compensation. Although NCUA is not bound by IRS rulings, we have previously followed that IRS interpretation when construing the word "compensation" for purposes of Section 111 and Section 701.33. Therefore, it is our opinion that gifts of nominal value to supervisory and credit committee members do not constitute compensation in violation of the Act or the Regulations.”

Ultimately, the value of the gift appears to be the litmus test of whether the gift would be permissible under NCUA compensation rules. While NCUA doesn’t provide examples of what a nominal gift looks like, a two-week trip to the Cayman Islands may be pushing it. However, NCUA states the board of directors must “set the amount of the gifts, and to ensure that they actually are of nominal value. If necessary, the board should consult its own attorney on this issue.” (Emphasis added).

Compliance Blog Mentions:

📣 Sessions are open now! Join NAFCU's BSA School On-Demand and/or Risk Management Seminar On-Demand to unlock comprehensive training from anywhere.

About the Author

JaMonika Williams, Regulatory Compliance Counsel, NAFCU

JaMonika Williams joined NAFCU as regulatory compliance counsel in July 2022. In this role, JaMonika assists credit unions with a variety of compliance issues.