Mortgage Periodic Statements & The E-SIGN Act; Key Takeaways from NAFCU's Webcast

Written by Steve Van Beek

One of the issues discussed last week at School and again on yesterday's webcast was the ability of credit unions to send mortgage periodic statements electronically without going through the full E-SIGN Act consent process.

Here is the language from new 12 CFR 1026.41(c):

"(c) Form of the periodic statement. The servicer must make the disclosures required by this section clearly and conspicuously in writing, or electronically if the consumer agrees, and in a form that the consumer may keep. Sample forms for periodic statements are provided in appendix H-30. Proper use of these forms complies with the requirements of this paragraph (c) and the layout requirements in paragraph (d) of this section." (Emphasis added).

The official staff commentary to 12 CFR 1026.41(c) has additional information:

"41(c) Form of the periodic statement.

1. Clear and conspicuous standard. The âÂÂclear and conspicuousâ standard generally requires that disclosures be in a reasonably understandable form. Except where otherwise provided, the standard does not prohibit adding to the required disclosures, as long as the additional information does not overwhelm or obscure the required disclosures. For example, while certain information about the escrow account (such as the account balance) is not required on the periodic statement, this information may be included.

2. Additional information; disclosures required by other laws. Nothing in ç 1026.41 prohibits a servicer from including additional information or combining disclosures required by other laws with the disclosures required by this subpart, unless such prohibition is expressly set forth in this subpart, or other applicable law.

3. Electronic distribution. The periodic statement may be provided electronically if the consumer agrees. The consumer must give affirmative consent to receive statements electronically. If statements are provided electronically, the creditor, assignee, or servicer may send a notification that a consumer's statement is available, with a link to where the statement can be accessed, in place of the statement itself.

4. Presumed consent. Any consumer who is currently receiving disclosures for any account (for example, a mortgage or checking account) electronically from their servicer shall be deemed to have consented to receiving e-statements in place of paper statements."  (Emphasis added).

As you can see, the commentary is extremely important. It clarifies that simple consent to electronic statements is sufficient (as opposed to the electronic consent required by the E-SIGN Act). It also clarifies that members who have consented to receive other disclosures electronically "shall be deemed to have consented" to receiving their mortgage periodic statement electronically.

Of course, the new periodic statement requirement only applies to credit unions that service 5000 or more mortgage loans (NAFCU log-in required). However, credit unions below the threshold - and, thus, not required to the new periodic statement - can still use the commentary as a guide to the delivery of any mortgage servicing information they currently send to members.

***

Two Important Notes. Â

- Limited Scope. This does not open the flood gates with regard to the E-SIGN Act. This flexibility applies solely to closed-end loans secured by a dwelling. It does not extend to HELOC statements which must follow 12 CFR 1026.7. The flexibility also does not extend to other products (checking accounts, credit cards, etc.).Â

- Training Staff. The E-SIGN Act has already caused numerous headaches for compliance officers. This flexibility for mortgage periodic statements (simple consent versus full E-SIGN Act consent) has the potential to amplify this confusion.

***

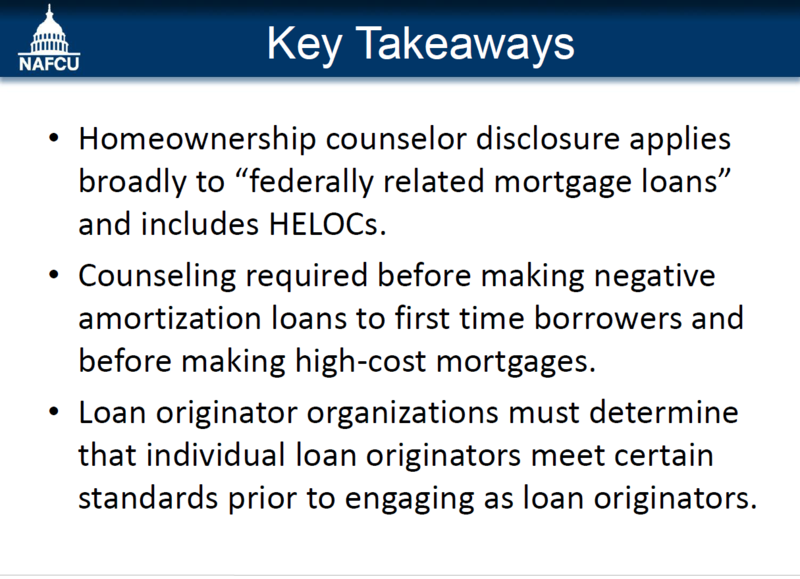

Yesterday's webcast included a detailed discussion of this issue as well as many of the other "under the radar" issues in the new mortgage regulations. Below you can find the Key Takeaways from the webcast (click on the photo of the slides):

Of course, the webcast is available for on-demand purchase. If you are following the Key Takeaways from School and putting together a mortgage implementation team at your credit union, this would be a good webcast to watch together to ensure everyone is on the same page.