NCUA Board Meeting; Shameless Plug

Posted by Anthony Demangone

Yesterday, NCUA held its monthly board meeting.  The meeting addressed the following issues:

RegFlex. NCUA approved a final rule that ends four RegFlex "exemptions" in the areas of 1) fixed assets, MBLs, stress testing of investments, and discretionary control of investments. The rules go into effect 30 days after the rule is published in the Federal Register. Â For a detailed discussion of the rules, please read our NAFCU Today article on the RegFlex changes.

Merger Registry. The NCUA board heard a briefing on its efforts to create a merger partner registry that will help create transparency in the merger process.  Here's a link to the briefing materials.  (PowerPoint presentation.)

PCA. Â The board approved an interim final rule that applies a 0% risk weighting to debt instruments that are unconditionally guaranteed by NCUA. This will benefit credit unions that purchase NCUA Guaranteed Notes (NGNs) that NCUA is selling as part of its corporate stabilization efforts.Â

Keep in mind that the board discussed other items as well, so please review NCUA's "board actions" website, where you can download all available materials reviewed by the NCUA board at the meeting.Â

***

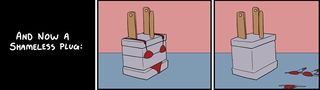

Shameless plug alert.

At our Compliance Seminar, Steve Van Beek and I did three "Shotgun Compliance" sessions where we covered a ton of ground in roughly 3 hours. Â We had quite a few attendees tell us that they wished their coworkers could have seen the presentation, because the sessions highlighted numerous compliance issues and red flags that affected nearly every area of credit union operations. Â In addition, they said the sessions would be a nice way to show the credit union's senior management how many regulatory changes were coming down the pike.

With that in mind, NAFCU will offer a webcast on November 3 that tries to boil down our three shotgun sessions into one fast-moving, 90 minute webcast. Â And NAFCU's Director of Regulatory Affairs, Carrie Hunt, will moderate! This will be a great opportunity to get the gang together so that everyone will catch a glimpse of major changes that place, and those that will soon be upon us. Â In addition, if you couldn't attend our seminar, you'll get a good taste of what we addressed. Â Here's what we'll cover in the webcast:

- NCUA Roundup

- Guidance documents of note

- Final rules and proposals

- NCUA's new enforcement stance

- Material loss reviews

- Changes within NCUA and the outlook for 2011

- Fed Roundup

- Final and proposed rules

- Fed resources

- Dodd-Frank

- Interchange

- Mortgage reform

- CFPA

- Miscellaneous

- Miscellaneous

- ADA and ATMs

- Risk Based Pricing Notices

- 2010 BSA Manual Update

- OFAC

- NCUA National Merger Registry

- How the "Hoo-hoo" are we supposed to keep up with all of this?

The early registration deadline is next Wednesday.  If you are interesting in signing up, go here.  Â

In any event - have a great weekend! Even you Gopher fans...