PMI/MIP Refresher

I used to work in the servicing department of a large mortgage company, and one of the most frequent inquiries we’d get from borrowers is whether or not they could remove the private mortgage insurance (PMI) or mortgage insurance premium (MIP) from their loans. So, I figured a PMI/MIP refresher may be helpful.

Under section 4902(a) of the Homeowners Protection Act of 1998 (HOPA) a borrower has the right to request PMI cancellation in writing when, based either on the amortization schedule or actual payments, the principal balance reaches 80% of the original value or the property. Before cancelling the PMI, due to a borrower’s request, a credit union can require that the borrower:

- Be current on the payments;

- Have a “good payment history”; The term good payment history is defined to mean the borrower has not been late by 30 days or more on a payment within a year of the cancellation date or the date the mortgagor submits the cancellation request, whichever occurs later, and has not been late by 60 days or more within the first 12 months of the last two years prior to the cancellation date or the date the mortgagor submits the cancellation request, whichever occurs later;

- Provide the credit union with evidence that the value of the property has not declined below its original value; and

- Certify that the property does not have a subordinate lien.

Additionally, section 4902(b) of the HOPA requires the credit union to automatically terminate PMI when, based on the amortization schedule, the principal balance reaches 78 percent of the original value of the property (“the termination date”). If the borrower is not current on the payments on the termination date, the credit union is not required to terminate PMI at that time, but HOPA requires the credit union to do so once the loan becomes current. Here is a CFPB Q&A on PMI cancellation that may be helpful.

So, what happens if a borrower pays down their principal balance in order to reach a 78% LTV? In that case, the credit union may still require the same information as if the LTV reached an 80% LTV. The PMI is only automatically removed if the loan reaches a 78% LTV based off the original amortization schedule.

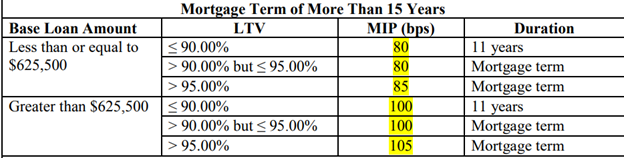

It is important to remember that FHA loans with MIP are not treated the same way as conventional loans with PMI. Per this HUD chart, if the loan was originated on or after June 3, 2013, then the MIP either stays for the life of the loan or drops off after 11 years (depending on how much the borrower put down at the time of purchase). If the LTV was greater than 90% at closing, then the MIP stays for the life of the loan and can only be removed through a refinance of the loan. Here is a screenshot of the chart for reference:

If the loan originated before June 3, 2013, then the MIP can be removed if the borrower made all their payments on time, has an LTV of 78% or lower, and has made at least 5 years of mortgage payments. You can also find more information at FHA.com and HUD.gov . Specifically, Mortgagee letter 2000-46, which can be found via the HUD.gov link, states:

“All other mortgages with terms greater than 15 years, regardless of the initial loan-to-value ratio will have annual premiums for the greater of five years or until the amortized loan-to-value reaches 78 percent.”

I hope this refresher will help guide you in your future PMI/MIP inquiries!

--------------------------------------------------------------------------------------------------------------------------------

Compliance Roadmap

The latest edition of NAFCU’s Credit Union Compliance Roadmap breaks down regulations into easy-to-understand language and includes updates to sensitivity to market risk, Regulations E & F, NCUA guidance on service and much more! One purchase provides access for your entire team.

About the Author

Tara Simpson, NCCO, NCBSO, Regulatory Compliance Counsel, NAFCU

Tara Simpson joined NAFCU as a regulatory compliance counsel in July 2022. In this role, Tara assists credit unions with a variety of compliance issues.