Prepaid Accounts FAQ: Are Gift Cards Covered?

Written by Jennifer Aguilar, Regulatory Compliance Counsel, NAFCU

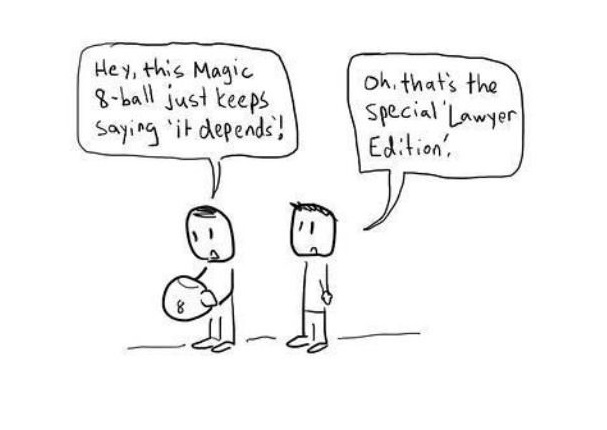

We are getting to the final weeks before the CFPB’s prepaid account rule goes into effect. To help credit unions navigate the complexities of this rule, this month’s NAFCU Compliance Monitor article provides a deep dive into some of the key parts of the rule. As credit unions are implementing this rule, one question that the compliance team has been getting recently is whether gift cards are considered prepaid accounts. And the attorney says…

Yes, that’s right. It depends. If a credit union’s gift card program is considered a “gift card,” “gift certificate” or “general use prepaid card” under section 1005.20, then it may not be a prepaid account and not subject to the new rule. Revised section 1005.2(b)(3)(ii) provides a list of products that are not prepaid accounts. The list includes gift cards and certain general use prepaid cards that are subject to section 1005.20:

“The term ‘prepaid account’ does not include:

[…]

(D)(1) A gift certificate as defined in §1005.20(a)(1) and (b);

(2) A store gift card as defined in §1005.20(a)(2) and (b);

(3) A loyalty, award, or promotional gift card as defined in §1005.20(a)(4) and (b); or

(4) A general-use prepaid card as defined in §1005.20(a)(3) and (b) that is both marketed and labeled as a gift card or gift certificate;” (Emphasis added.)

Under section 1005.20, a “gift certificate” and a “gift card” are those cards that can be used only at a single merchant or an affiliated group of merchants. For example, a gift card that can be used at any Macys store or a gift certificate that can be redeemed at any AMC Theatre. Gift certificates cannot be reloadable but a gift card can be either reloadable or non-reloadable.

A “general-use prepaid card” is one that can be used at multiple unaffiliated merchants or at ATMs. The commentary to section 1005.20(a)(3) explains a card is redeemable at multiple merchants “if, for example, such merchants agree to honor the card… if it bears the mark, logo or brand of a payment network.” For example, a gift card bearing the Visa logo that can be used at any merchant who accepts Visa. General use prepaid cards can be reloadable or non-reloadable.

In order for a gift certificate, gift card or general use prepaid card to be excluded from the definition of a prepaid account, the rule requires it to be marketed and labeled as a gift card. The commentary to section 1005.20(b)(2) provides an explanation and various examples of what it means for a card to be marketed and labeled as a gift card:

- Examples of being marketed and labeled as a gift card:

- Using the word “gift” on a card or accompanying material, including documentation, packaging and promotional displays.

- Representing or suggesting that a card can be given to another person, for example, as a “token of appreciation” or a “stocking stuffer,” or displaying a congratulatory message on the card.

- Incorporating gift-giving or celebratory imagery or motifs, such as a bow, ribbon, wrapped present, candle or congratulatory message on a card, certificate, accompanying documentation or promotional material.

- Examples that do not constitute being marketed and labeled as a gift card:

- Representing that a card or certificate can be used as a substitute for a checking, savings or deposit account.

- Representing that a card or certificate can be used as a substitute for cash.

- Representing that a card or certificate can be used as a budgetary tool, for example, by teenagers or to cover emergency expenses.

These definitions and requirement to label and market as a gift card are in the current rule, as it exists today. This provides a simple test to determine whether a credit union’s gift cards will be considered prepaid accounts. If a gift card program is currently covered under section 1005.20 and the gift card disclosures are required, then the account is not a prepaid account. If a gift card program is not currently covered under section 1005.20 and the gift card disclosures are not required, then the account may be prepaid account. Credit unions may need to review their gift card programs and related marketing activities to determine whether the program will be considered a prepaid account. Even if a credit union determines its program is not a prepaid account, it will still be subject to the requirements in section 1005.20, as these will remain unchanged.

Upcoming Webinars

Need more information on credit card optimization or controlling fair lending risk? Make sure you tune in to our upcoming compliance webinars!

March 14: Credit Card Growth and Optimization

March 28: Red Flags for Fair Lending