Researching the Federal Register

We write a lot about various regulations impacting credit union operations, but compliance officers and related staff often have to be research gurus. While I did learn to do internet research before there was Google, I’m glad I never had to dig through paper to find answers to complex compliance questions. Instead of diving into a specific compliance question today, here’s something a little different – a quick guide to using the Federal Register when you may be faced with an unclear rule or want a little more detail.

People have varied research approaches and styles that work for them. Most start researching a question by going to one of the many core resources out there to research compliance questions, including but not limited to:

- The Electronic Code of Federal Regulations or eCFRs;

- NCUA’s recently redesigned website including Letters to Credit Unions, legal opinion letters, the Examiner’s Guide and soon-to-be-retired AIRES exam questionnaires; and

- The CFPB’s website including the agency’s interactive eRegulations, compliance resources organized by topic including various small entity compliance guides; and Supervision and Examination Manual.

Sometimes a rule is relatively straightforward, or there is staff commentary, a legal opinion letter or other guidance document from the regulator that helps explain a particular regulatory requirement. But what about rules where there is no commentary or little guidance provided? Where can you go if you find yourself still unclear about what is required of your credit union even after consulting multiple resources?

This is where the Federal Register can come in handy. The preamble to a rule or proposed rule often provides more context for a particular requirement. Let’s walk through an example.

NAFCU’s members sometimes ask our compliance team at what point is a credit union required to provide a loan originator’s National Mortgage Licensing System (NMLS) identification number. Does it have to appear on business cards? Stationary? The credit union’s website? Section 1007.105 (part of Regulation G/the S.A.F.E. Act) requires a credit union to provide a loan originator’s NMLS id “through the originator’s initial written communication with a consumer, if any, whether on paper or electronically.”

This regulation does not have any staff commentary to help clarify specific operational questions. Final rules usually include an explanation of the rulemaking’s goals that may shed some light on what the regulator’s expectation is for a particular provision. So let’s see what we can do using this example from Regulation G.

The Federal Register has an advanced search function. Putting a specific phrase from the rule in quotations can help identify where regulators may have further explained a particular rule in a preamble. Placing a quote from section 1007.105 (“through the originator’s initial written communication”) into the search function gave six results. The ones labeled rules or proposed rules are most likely to be helpful.

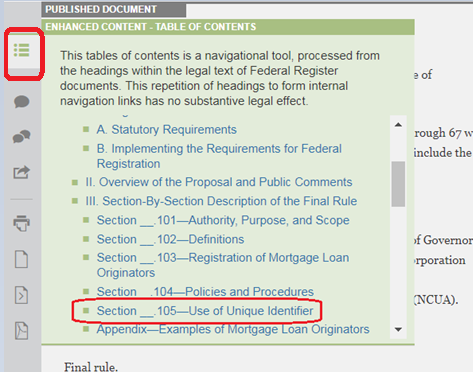

This original rule was a joint rulemaking finalized in 2010 before authority for the S.A.F.E. Act rules transferred to the CFPB. After clicking on this entry, there is a table of contents, circled in red in the top left which will generate an interactive table of contents:

Click the hyperlink for the citation being researched, in red at the bottom, to be taken straight to the relevant discussion. A few paragraphs in, there is some helpful information:

“…an Agency-regulated institution may comply with the § __.105(a) requirement in a number of ways. For example, the institution may choose to direct consumers to a listing of registered mortgage loan originators and their unique identifiers on its Web site; post this information prominently in a publicly accessible place, such as a branch office lobby or lending office reception area; and/or establish a process to ensure that institution personnel provide the unique identifier of a registered mortgage loan originator to consumers who request it from employees other than the mortgage loan originator. Furthermore, the Agencies intend § __.105(b)(3) of the rule to cover written communication from the originator specifically for his or her customers, such as a commitment letter, good faith estimate or disclosure statement [now the Loan Estimate for most consumer real estate loans], and not written materials or promotional items distributed by the Agency-regulated institution for general use by its customers. While, this provision does not require institutions to include the unique identifier on loan program descriptions, advertisements, business cards, stationary, notepads, and other similar materials, institutions are not prohibited from doing so. We also clarify that the requirement to provide the unique identifier to the consumer through the originator's initial written communication, if any, applies whether that communication is provided in writing on paper or through electronic means… (Emphasis added.)

Not all preamble searches are this helpful, so it can still be worth searching the webpage for different key terms to find additional information. Sometimes though, even the preamble doesn’t provide much information or a particular problem did not appear to be contemplated by the regulator. In these cases, judgment calls may need to be made, perhaps in consultation with local counsel.

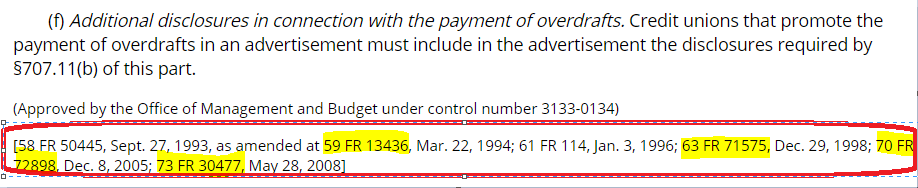

Besides just doing searches in the Federal Register, some may prefer to search by using the citations to the Federal Register found in the eCFR. If you are already in a particular rule in the eCFRs, sometimes a citation is at the bottom of a specific piece of text.

As an example, this is at the bottom of the Truth in Savings advertising rule with multiple citations (highlighted) to times where NCUA amended the regulation:

Placing one of these cites into the Federal Register’s search function without quotes should give a link to the specific document.

Of course, NAFCU members can always reach out to our compliance team for direct assistance at compliance@nafcu.org. We also have our new member-only NAFCU Compliance, Risk & BSA Network where members can share insights and information on how to handle operational issues, check it out if you haven’t had a chance to as yet.

***

CFPB Updates Small Entity Compliance Guide for Payday Lending Rule. Speaking of regulatory guidance, the CFPB just announced it has amended its guide for the payday lending rule. NAFCU members can find a Final Regulation here.

***

Programming Note. NAFCU will close at noon today and be closed all day tomorrow in observance of Independence Day. Have a safe and enjoyable holiday and we’ll be back to blogging on Friday.

About the Author

Brandy Bruyere, NCCO, Vice President of Regulatory Compliance/Senior Counsel, NAFCU

Brandy Bruyere, NCCO was named vice president of regulatory compliance in February 2017. In her role, Bruyere oversees NAFCU's regulatory compliance team who help credit unions with a variety of compliance issues.

Brandy Bruyere, NCCO was named vice president of regulatory compliance in February 2017. In her role, Bruyere oversees NAFCU's regulatory compliance team who help credit unions with a variety of compliance issues.