Return to Sender: Time to Comment on Remittance Transfer Disclosures

My parents and younger sister live in the south of Spain, so this past Christmas Devon and I learned the hard way that sending gifts abroad is not only difficult but incredibly expensive. To sum it up, we had to pay hefty shipping and insurance costs at the U.S. Postal Office and once the package arrived in Spain we were surprised with an additional imposition of import duties and taxes as well as a local delivery fee. Needless to say, when the package made its way to a sorting hub in Barcelona and triggered a bill that was sent to my parents for about half the cost of the presents, pragmatic me told them to just let the package return to the United States. In the end we received the package back about 4 months later, soaked in water, and mangled (picture below). After this experience we no longer send gifts abroad; rather we now use our local credit union to send international remittance transfers and kindly request that my parents take my little sister shopping.

The reason sending money abroad can be better than mailing items internationally is because of the disclosure requirements of the remittance transfer rule which helps the sender avoid unpleasant surprises similar to the one the Spanish government handed me.

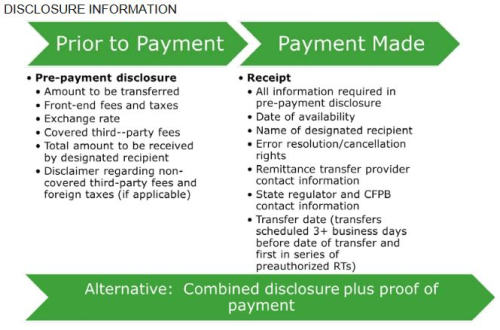

Basically, the remittance transfer rule requires that credit unions provide the sender with a written prepayment disclosure full of helpful information such as the exchange rate, fees and taxes that may be imposed, and the amount of money expected to be delivered prior to the payment of the transfer. See, 12 C.F.R. § 1005.31(b)(1), (e)(1). The rule also requires that the credit union give the sender a receipt once the transfer is made. See, 12 C.F.R. § 1005.31(b)(2). As an alternative to providing two separate disclosures, the rule permits credit unions to provide a combined written disclosure prior to payment, so long as the provider also provides proof of payment once the remittance transfer is made. See, 12 CFR § 1005.31(b)(3). Examples of these three disclosures can be found in Appendix A to Regulation E and the CFPB's website.

Understanding the timing and content of these disclosures is key to comply with the rule. To help with that, here is a nifty chart from the CFPB's small entity compliance guide:

NAFCU's compliance team has been contacted before regarding how to practicably provide the required written disclosures, especially as more members bank remotely. I wanted to highlight that in cases when the member requests a remittance transfer through online-baking, the rule does permit the credit union to provide the pre-payment disclosure electronically without regard to E-SIGN consent; however the receipt must comply with E-SIGN requirements. See, 12 C.F.R. § 1005.31, Supp. I, comment (a)(2) – 1. This leaves credit unions in a bit of a compliance dilemma.

For example, remote members that have not yet consented and cannot properly consent to E-SIGN delivery at the moment but need to make a funds transfer can be highly inconvenienced. For those instances, the rule has a narrow exception for remittance transfers completed by phone. The exception allows a credit union to treat an impractical written or electronic request as an inquiry as long as the credit union then calls the member to facilitate the remittance transfer entirely by phone. See, 12 C.F.R. § 1005.31, Supp. I, comment (a)(3) – 2. By completing the remittance transfer entirely by phone, the credit union may provide the required disclosures orally instead of going through the impracticality of sending written disclosures to a member who may not be near a computer.

There are other variations of the same issue for providing required disclosures and other parts of the international remittance transfers rule. So the CFPB is requesting comments on its plan to assess the effectiveness of this rule. If your credit union struggles with the requirements of the remittance transfer rule or can otherwise think of a better system for providing these required disclosures, feel free to contact NAFCU's Regulatory Affairs team or let the CFPB know directly. The important thing is to have a channel to further improve this system for your members and to lift some of the operational burden off credit unions.