Same-Day ACH Phase 2 Deadline Fast Approaching; Programming Note

Almost 2 years ago, NACHA adopted a Same-Day ACH system meant to move payments faster by using existing next-day capabilities and establishing a new option for same-day clearing and settlement of ACH transfers. We wrote a blog regarding this change, but now that Phase 1 of NACHA's Same Day ACH payments has come and gone, it is a good time to discuss progress, review what Phase 2 is all about and provide some NACHA resources.

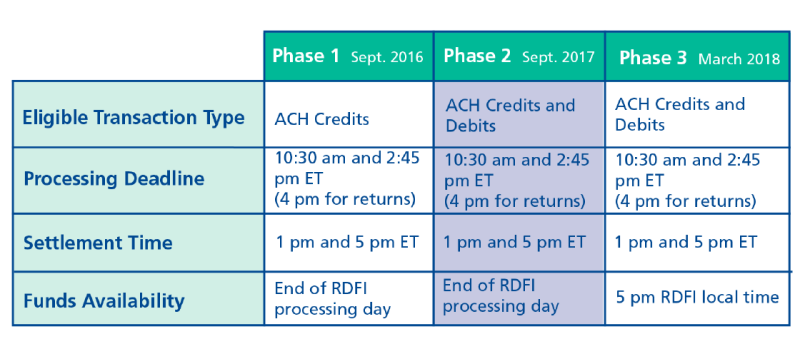

As a refresher, Phase 1 affected the crediting of ACH payments, meaning those payments that are originated in the credit union and sent elsewhere. While the rule allowed credit unions the choice of becoming a same-day originator, all financial institutions had to receive and process same-day ACH transactions upon implementation of Phase 1. On the flip side, Phase 2 affects the debiting of funds from a member's account. Credit unions will be required to provide Same-Day debiting capabilities staring September 15, 2017. Here is a NACHA chart that summarizes these changes and implementation dates for Phases 1 through 3:

A couple of weeks ago NAFCU staff met with NACHA representatives and discussed progress with Phase 1. There were a couple of takeaways from the meeting that I wanted to share. First NACHA reported that no financial institution saw an increase in fraud since the implementation of Phase 1. This may be in part because Phase I was only debits.

Second, some of the issues financial institutions encountered when implementing Phase 1 could have been smoothed out if more testing had been performed. As Phase 2 has more moving parts, testing is essential. Here are some testing tips from NACHA to get ready for Phase 2:

- Contact your ACH Operator to sign up for a testing window and review testing options

- Plan for testing across multiple, consecutive settlement days

- Test with all your vendors and processors. Don't assume you are done just because you tested Phase 1 or your software vendor has tested Phase 2

- Test posting all the way through the Demand Deposit Account and other transaction platforms

- Test with downstream applications for Same Day ACH reporting and origination

- Test origination and receipt of debit returns through same-day windows

- Test for balancing and reconciliation with your ACH Operator statements and advices

- Provide your corporate members with the opportunity to test Same Day ACH origination and receipt

- Include your Internal Compliance/Audit teams in your test plan

- Consider the impact on your Federal Reserve Bank settlement account

And here are some additional resources pertaining to Same Day ACH Phase 2 that may be helpful while preparing to comply with this new process:

- Checklists for ODFIs, RDFIs and Processors

- Call to Action for ODFIs, RDFIs and Processors

- Testing Tips for FIs and Processors

- Effective Entry Dates: Considerations for ODFIs

- ACH Operations Bulletin – Same Day ACH and Debit Processing

- "Check and Correct" Effective Entry Dates for Same Day ACH Debits

Finally, we also received an answer to a somewhat common compliance question regarding the interplay between Regulation E's error resolution for ACHs and NACHA's timely return requirement as they are not the same. Under Regulation E, members have 60 days from the date the credit union sends a periodic statement to timely notify the credit union of an unauthorized ACH transaction while NACHA rules give the Returning Depository Financial Institution (RDFI) 60 days from the date of settlement to submit a return through the automated return system. See, 12 C.F.R. 1005.11(b)(1)(i) and NACHA Rules 3.2.1. So what are credit unions to do if they find themselves past NACHA's timely return deadline but still having to credit a member's account under Reg E? According to NACHA Bulletin # 1-2014, the RDFI may go outside the automated return system and contact the ODFI directly to remind them about the contractual warranties the ODFI made in regards to the ACH. This should be sufficient in most cases to get the ODFI to reverse the unauthorized transaction so that the RDFI does not have to eat the loss. If it is not, then credit unions can also go through state contract enforcement channels as the warranty does not expire just because NACHA's automated return system rejects anything after 60 days.

Did you know... NACHA has a hotline that answers questions about NACHA rules and processes? Credit unions may want to directly contact NACHA if stuck on an ACH question especially as Phase 2 deadline approaches. Credit unions may e-mail their questions or call NACHA offices that will route the credit union's inquiry to the correct department.

Programming Note. NAFCU will close at noon today and remain closed on Monday in observance of Memorial Day. At the nearby Arlington National Cemetery, yesterday the 3rd U.S. Infantry performed the "flags in" tradition, placing a small U.S flag a foot in front of each headstone at the cemetery. These flags will be removed after Memorial Day, but are present for the weekend's events taking place at the cemetery in honor of fallen service members.

We will be back to blogging on Wednesday. Everyone have a safe weekend!