Two Utes Walk Into a Credit Union to Open Accounts…

Written by Elizabeth M. Young LaBerge, Regulatory Compliance Counsel

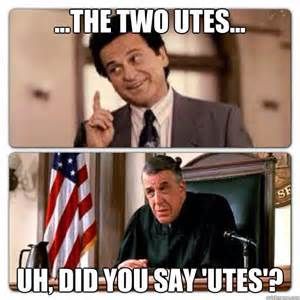

Laywers love To Kill a Mockingbird. I need both hands to count the number of lawyers I know who have dogs or children named Atticus. Personally, I have always advocated for My Cousin Vinny as the better movie about trial work. So when a wave of questions about ute accounts youth accounts came in to the Regulatory Compliance team recently, I could not resist.

The Federal Credit Union Act expressly provides that a federal credit union (FCU) may issue shares in a minor's name, subject to conditions prescribed by the bylaws. See, 12 U.S.C. 1765. NCUA's Federal Credit Union Standard Bylaws permit minors to own shares, but points to state law with regards to their rights to transact business with the federal credit union:

“Article XV. Minors

Section 1. Minors permitted to own shares. Shares may be issued in the name of a minor. State law governs the rights of minors to transact business with this credit union.” See, 12 C.F.R. Part 701, Appendix A, Article XV, Section 1.

The standard bylaws direct an FCU to the state law in their jurisdiction regarding the rights of a minor because whether or not a minor has legal ability to enter into a binding agreement, i.e. the legal capacity to contract, is determined by law in each state. If an FCU were to enter into a contract, for example - an account agreement, with someone who did not have capacity to do so at the time the agreement was made, the agreement could become void, possibly even years later. For this reason, most credit unions require a parent or adult to also be on the account, to ensure that an enforceable agreement is in place. An FCU considering youth accounts or writing a policy regarding youth accounts should speak with local counsel who can advise it on the law regarding minority and capacity to contract in the credit union's jurisdiction.

NAFCU members have also asked about performing Customer Identification Program (CIP) procedures on youth accounts. When a parent opens the account for the minor because the minor does not have the legal capacity to make an agreement under state law, the customer for an account is usually the parent. Below is from the CIP Overview section of the FFIEC's Bank Secrecy Act/Anti-Money Laundering Examination Manual:

“The CIP rule applies to a customer. A customer is a person (an individual, a corporation, partnership, a trust, an estate, or any other entity recognized as a legal person) who opens a new account, an individual who opens a new account for another individual who lacks legal capacity, and an individual who opens a new account for an entity that is not a legal person (e.g., a civic club).” (Emphasis added.)

Even if not needed for CIP reasons, many credit unions request the minor's SSN and/or birth certificate to document the account and to ensure the minor is actually a minor.

If a state's laws and the credit union's policies permit the minor to open the account on his or her own behalf, then the minor is the customer. In this case, the FCU should perform CIP regarding the minor as it would on any other customer.

One final consideration with regard to youth accounts is the Children's Online Privacy Protection Act (COPPA). COPPA imposes certain requirements on operators of websites or online services directed to children. Credit unions are subject to COPPA if they operate a website or online service directed to children, or have actual knowledge that they are collecting or maintaining personal information from a child online. COPPA could apply to a credit union's internet-based services, such as online banking. A credit union could be unintentionally accessing a minor's personal information through cookies or similar devices which may collect nonpublic personal information. Making COPPA determinations generally requires an analysis of the specific facts and circumstances surrounding a credit union's online activities against the requirements of COPPA. Thus, a credit union may want to work with local counsel to see if COPPA applies. The FTC's website has an excellent overview of COPPA.

Vinny Gambini may have been great at cross-examination, but he was terrible at managing his reputation. Don't make the same mistake! Check out NAFCU's new webcast:

How to Manage Reputation Risk: A Deep Dive into Murky Waters

Live Webcast: Wednesday, March 30 | 2:00 p.m. - 3:30 p.m. EST

Part of the Risk Webcast Series

Enterprise Risk Management (ERM) is becoming a more prominent management strategy in the credit union industry. This webcast focuses on the importance of reputation management and NCUA's requirements and expectations. You'll work through real examples of risk scenarios that could significantly impact your reputation, such as data breaches and social media attacks. Learn how to properly implement a reputation risk plan and how to defend your credit union.