The Science of Debt

Written by Anthony Demangone

Most of us within credit unions are financially literate. And even if we aren't financial experts, we're far ahead of those who don't work with financial products regularly.

It would make sense for many Americans to refinance high-interest debt with a credit union. Â But how do you catch their attention? How do you get their buy-in?

This article from Scientific America tackles the issue. This is a must-read for your marketing team.  Here's a snippet....

In one experiment, we asked people who had credit card debt to imagine that they had amassed so much credit card debt that they were not able to pay off their balance each month and would likely be making payments on their credit card for the next couple of years. We then presented them with several different advertisements for a refinance loan from a credit union. While the basic information and terms of the loan was the same across all advertisements, we randomly varied the way we described the interest rates. In one ad, we noted that the average credit card interest rate is around 19% and the new loanâÂÂs interest rate could be closer to 6%. In another ad, we stated the difference in interest paid over a 3-year term on a $10,000 loan at the different interest rates. And in a third ad, we provided a visual of the interest paid by graphing the difference.

We then asked everyone how useful they thought this loan was and how much effort they would be willing to invest in trying to refinance their debt. While almost everyone thought it would be useful, people who just saw a comparison of interest rates were only willing to invest an average of 4 hours in refinancing. People who were told the numerical difference in interest paid were willing to spend an average of 6 hours to refinance. And people who graphically saw the difference were willing to spend an average of 8 hours; thatâÂÂs twice as much effort as people who only saw the different interest rates.

Does your credit union use graphics to show how much money members could save? It sounds as if it should.

Here's another nugget..

In another field experiment with, we targeted people with high-interest personal loans to refinance with a credit union. One-third of the members received a pre-approval offers in a simple, generic letter, telling them about the pre-approval and basic information about the loan product. Another third of the members received the same information but with extra sentences emphasizing that the credit union has their best interest at heart and wants to help them save money. The final third of the members received the second letter but added that members should to call the credit union even if they did not want to refinance their loan. We found that three times as many members refinanced their high-interest personal loans when they received the third letter compared to the first. This is likely because members who received the third version felt that they could not procrastinate. They needed to make a decision, which helped push them toward refinancing to a better loan.

Again, small tweaks that seem to catch  the attention of members.

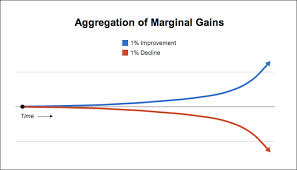

I don't think such changes will make a massive difference. But small differences can move mountains over time. Â This graph shows how..

Again, here's a link to the article.

Here's a link to the actual underlying research paper. (And this is a treasure trove, as it lists and references dozens of other studies on the subject.)

I haven't had time to dig into the research papers yet, but I wanted to highlight this issue for you. There are studies and hard research that can help us reach and help more Americans. And some of them are simple and easy to do.

Happy reading!

***

I'm fairly pumped about our Annual Conference. Sure, the content will be great. But we're planning to end things with a Taste of Nashville Festival and Concert with John Michael Montgomery.

The festival will have live music and food from roughly 20 of Nashville's best restaurants. Â And then the night finishes with a private concert at the Ryman. Montgomery really puts on a show!

Â

Â