5 Key Trends in Peer-To-Peer Payments

By Bill Hampton | Senior Vice President and Division Executive | FIS

In 2020, curiosity about peer-to-peer (P2P) payments escalated to necessity. As branches reduced services or closed doors and postal services were disrupted, the pandemic pushed even more consumers to digital solutions for sending and receiving money. The appetite for P2P, which has been growing steadily since smartphones hit the mainstream in the late 2000s, is only going to grow even more as branches and businesses return to normal operations.

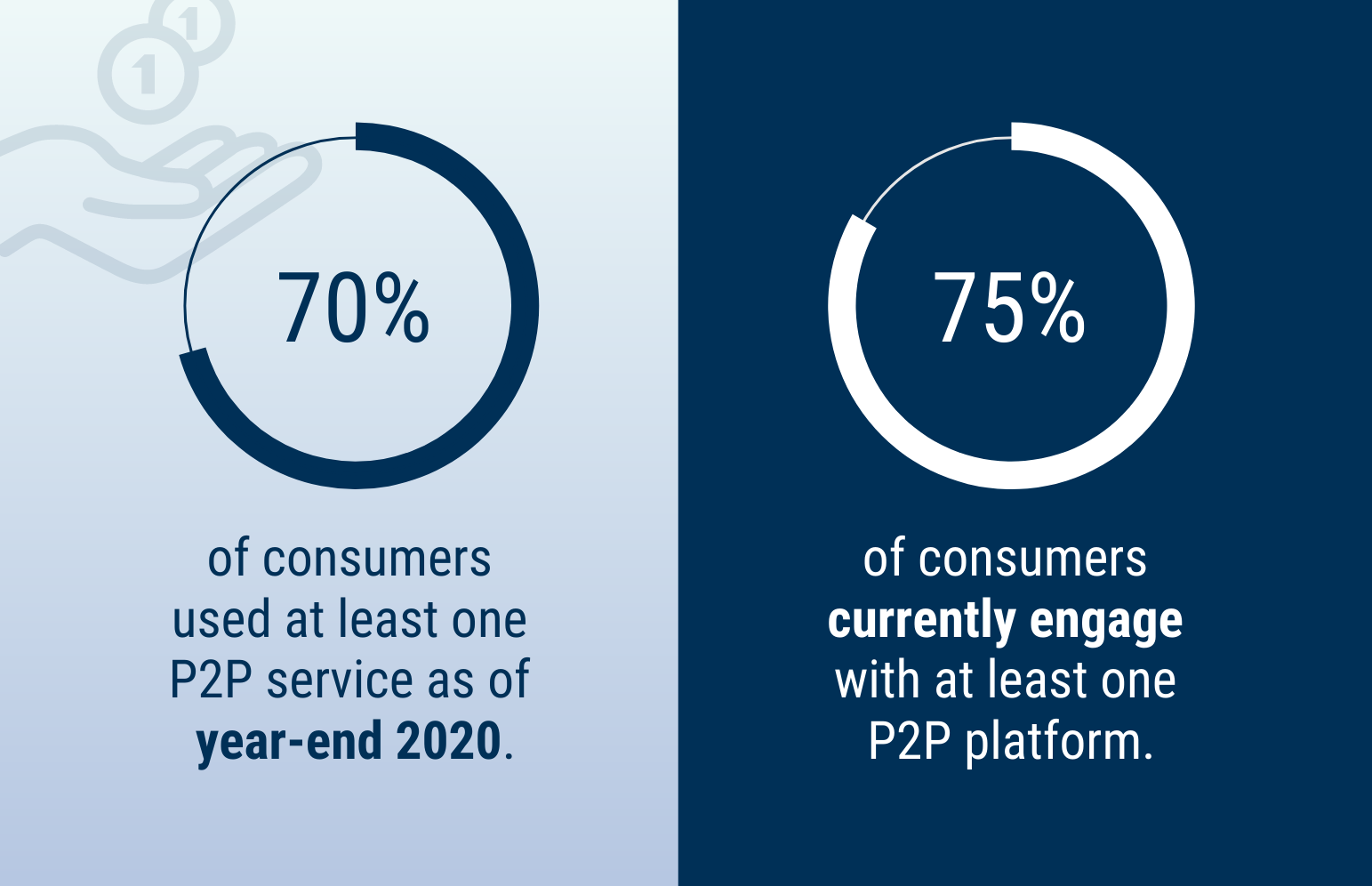

P2P gives individuals the control and immediacy of an in-person cash transaction, plus the convenience of anywhere/anytime access. They mirror the low-friction experience of digital wallets, bypassing the need to dig for an account number or physical card in order to complete a transaction. And with nearly three-quarters of American consumers engaged with at least one P2P platform, they’re inching closer and closer to the goal of universal acceptance.

Here’s my take on five significant trends credit union leadership should watch in the months to come:

70% of adults used at least one P2P service as of year-end 2020; a remarkable sign of growing adoption. Some of the pandemic-driven numbers tell a mixed story based on overall economic conditions and spending behaviors, so keep an eye on the long-term trends. A Mercator Advisory Group study found that overall P2P transaction frequency fell year-over-year in 2020, from 9.0 to 8.0 transactions per year. But several up-and-coming platforms have doubled their market share over a three-year period, which points to even more growth as these services increase their marketing and education outreach.

70% of adults used at least one P2P service as of year-end 2020; a remarkable sign of growing adoption. Some of the pandemic-driven numbers tell a mixed story based on overall economic conditions and spending behaviors, so keep an eye on the long-term trends. A Mercator Advisory Group study found that overall P2P transaction frequency fell year-over-year in 2020, from 9.0 to 8.0 transactions per year. But several up-and-coming platforms have doubled their market share over a three-year period, which points to even more growth as these services increase their marketing and education outreach.- It’s increasingly easy for credit unions to offer P2P services directly to members. P2P industry growth is driven both by uptake of independent (non-bank) apps and of co-branded P2P networks with hundreds of banks and CUs on the roster. CU leadership looking for increased digital engagement may want to consider whether adding P2P directly to their app will provide that boost. One way or another, members will find a way to meet their needs for fast digital payments. Joining a P2P network is a way to help promote more security around P2P transactions, since the member’s credentials are connected to the institutional security your CU already uses.

- P2P is also gaining in importance and interest to criminals. According to Javelin Strategy, P2P account fraud climbed significantly in 2020 as attackers went after crucial unemployment and stimulus funds. That’s even as traditional identity fraud losses fell 21% year-over-year. (See above about why security will be a growing concern to all P2P participants!)

- P2P isn’t just for check-splitting. Although small, casual payments are an obvious use case for P2P, on a recent podcast Al Ko, CEO of P2P provider Zelle’s parent company, disclosed that the average Zelle transaction is $250. A 2019 analysis by ARK Research pegged P2P rival Venmo’s average transaction value near $75.

- As P2P grows, businesses will enter the picture and take part as both senders and receivers on P2P payment networks. Whether or not the industry rebrands from the consumer-driven “peer-to-peer” roots remains to be seen, but the day is definitely coming when businesses will use P2P both for disbursements to individuals as well as to settle obligations with other businesses. This will help businesses settle those obligations more quickly than they could with a paper-based check, and without the potential complications and verification delays that come with ACH transactions.

For more information on P2P and other payment strategies and solutions, check out our other resources.