The 7 Most Expensive Vendor Management Mistakes

By: Patrick Goodwin, President of Strategic Resource Management, Inc. (SRM)

Financial institutions are full of smart professionalsâstraight shooters who know how to judge character and structure a deal. But even the wisest among them overlook savings opportunities when dealing with third-party vendors.

Pressed for time and facing salespeople determined to sell their services at a premium, these otherwise successful professionals can find themselves at a disadvantage and end up paying for it. From the insidious to the emotional to the downright dangerous, here are the most expensive mistakes credit unions make with their vendorsâand how to prevent them.

1. NOT BIDDING OUT EVERY CONTRACT.

Itâs a headache and a hassle to bid out every contractâbut it gives you the pricing, terms and market intelligence you need to negotiate a fair deal. Begin the bid process within 24 months of your current contractâs expiration to maximize leverage and never tell a vendor that you arenât entertaining other options. You will lose every bit of leverage you have.

2. REFUSING TO CONSIDER OTHER VENDORS.

Donât just collect RFPsâconsider the possibility that another vendor might be a better fit. Credit union executives have a fiduciary duty to the board and shareholders to run operations as efficiently as possible. While most of our clients stay with their existing vendor, they take the time to ask if a new vendor might help them achieve their goals in a changing marketplace.

3. RFP MISMANAGEMENT.

Are you asking the right questions of third- party vendors? My experience suggests you arenât. This is the biggest mistake I see financial institutions make, and they have no idea they are doing it. The vast majority of institutions wonât get what they need to accurately compare pricing and terms because they are asking the wrong questions.

For example, donât just ask vendors for pricing. Give them the pricing model nomenclature you want to use. Avoid surprises by making sure the RFP requires vendors to itemize what they will and wonât charge for.

4. NEGLECTING THE AUTO RENEW CYCLE.

4. NEGLECTING THE AUTO RENEW CYCLE.

Itâs the most common mistake I see. A financial institution doesnât have a contract management system in place or the person who first negotiated the contract loses track of deadlines and suddenly a contract is renewed for two or more years. Iâve even seen auto-renews for the full length of the original contractâas much as 7 yearsâif there isnât 180 daysâ notice. By the end of the renewed contract, the institution would have pricing that is 14 years old!

Avoid this problem by putting contract management policies and procedures in place, using software or by hiring a third party to stay on top of contract expiration dates. Contractually limit auto renews to 12 months and be sure to cap fee increases.

5.FAILING TO NEGOTIATE DECONVERSION COSTS.

Youâre focused on joining up with a new vendor, not thinking about the day the relationship ends. Yet some day you may want to leave your vendor. If the cost is left up in the air, the charges will be at the discretion of a potentially punitive vendor.

Address this head on by talking to your vendor about deconversion costs during contract discussions. Vendors are very open to negotiating this fee at the beginning of a relationship and are often willing to cap it at a fixed amount since it wonât cost them anything up front.

6. GROWING TOO EMOTIONALLY INVESTED IN A VENDOR.

Sales representatives do an incredible job building relationships. They take you and your staff to lunch or the golf course. They remember your birthday. Â When it comes time to renegotiate your contract, many financial institutions are uncomfortable putting the contract out to bid because they donât want to hurt the repâs feelings or worry that they wonât get the same level of service.

Thatâs exactly what your vendors want you to think. Vendors donât want you to go through the bidding process because they donât want you to have competitive market intelligenceâbut theyâll easily forgive you. Thatâs because vendors want to retain you as a client. They arenât going to dump you just because you considered other options.Avoid the drama and perceived hurt feelings by setting policies and procedures regarding what gifts employees can receive from vendors. Set policies requiring that major vendor contracts are put out to bid so staff can blame the policy for the RFPs. Let someone who can keep emotions out of the decision handle negotiations.

7. MISCALCULATING GROWTH.

Too often financial institutions negotiate long-term contracts without taking the time to forecast where the institution will be in three, five or seven yearsâor they misjudge how much the institution will grow. If a contract is designed around incorrect assumptions, it can blow the budget or prevent the institution from reaching its goals. I often see clients outgrow contracts in just three years.Contracts should be designed with growth parameters that give an institution the flexibility to accommodate growth. If youâre not sure how much flexibility you can push for, find someone with the experience to know.

Contracts should be designed with growth parameters that give an institution the flexibility to accommodate growth. If youâre not sure how much flexibility you can push for, find someone with the experience to know.

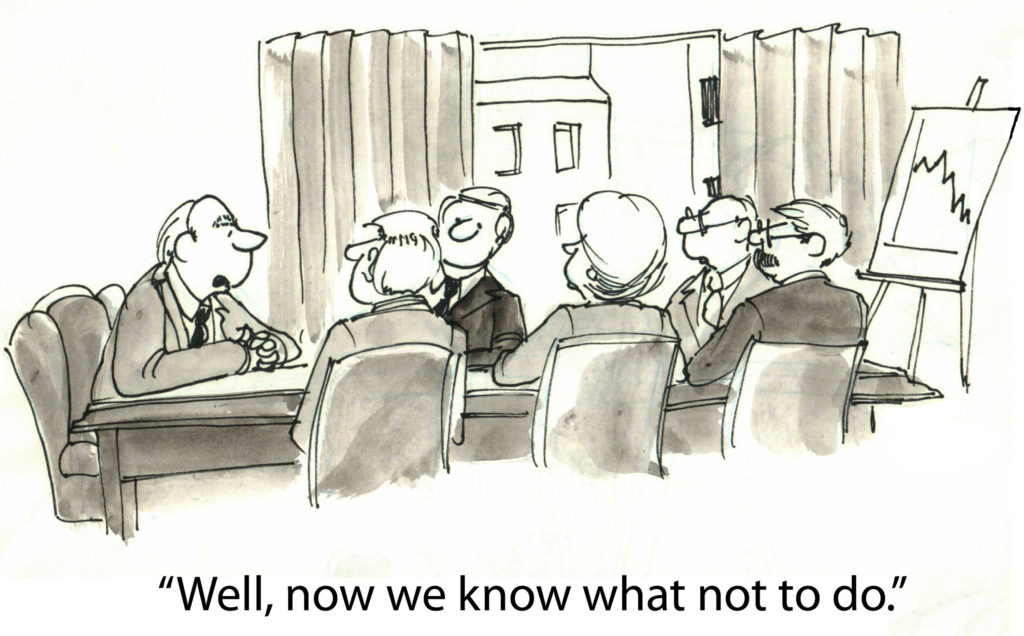

These are just seven of the most expensive third-party vendor management mistakes, but there are many other ways to get tripped up. Make sure you have the right policies, procedures and knowledge in place to ensure youâre getting the best value and terms for your institution.

Strategic Resource Management is the NAFCU Services Preferred Partner for Vendor Cost Benchmarking and Negotiation Services.

Strategic Resource Management is the NAFCU Services Preferred Partner for Vendor Cost Benchmarking and Negotiation Services.