Aligning CU Executive Incentives With CU Goals and Member Needs

By David Frankil, President, Burns-Fazzi, Brock and Associates

Dr. Jack Clark from Clark Research Associates presented the results of the 2014 NAFCU-BFB Executive Compensation and Benefits Survey at this summerâs NAFCU Annual Conference. Â There were many tidbits in the presentation, but one topic caught my eye â the wide variety of incentives that Boards have used to create bonus plans for top executives.

The topic of how incentives affect behavior is far from new â go back to freshman-year economics and Adam Smith â

âIt is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.â

Adam Smith, An Inquiry into the Nature & Causes of the Wealth of Nations, Vol 1, March 9, 1776

Just as water finds its own level, economic activity naturally seeks its highest and most efficient use. Â Thatâs not to say that the greater good is subverted to individual self-interest, rather that well-designed compensation models effectively align individual incentives with desired outcomes that benefit the credit union, its members and top executives.

On that we can probably all agree â but what are the metrics and desired outcomes that will create optimal goal alignment? Â To use a baseball analogy, home runs are great â but rewarding players just based on home runs would result in tons of shortstops and second basemen batting .075 as they swung from the heels every time up at the plate. Â Youâd have a hard time finding anyone who wanted to pitch too.

First off, what sorts of credit unions offer bonus plans tied to incentives? Â On average, only half (49%) offer bonus plans tied to incentives, with the tipping point being around $150M in assets. Â The survey clearly showed that mid-size and larger credit unions are more likely to offer them, with roughly 80% of the credit unions between $150M and $750M, and 90% over $750M, doing so.

Hard to know what is cause and what is effect here â have the larger credit unions figured out how effective bonus incentives can be in driving growth, or are they using these bonus models because they can better afford them?

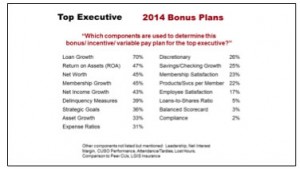

Second, what is the metric most often used as the incentive? Â Given how similar most of our financial services business models are, youâd naturally expect to see a high degree of commonality in the incentives used. Â And youâd be wrong â see the chart below.

While âLoan Growthâ topped nearly everyoneâs list at 70%, after that you see a cluster of metrics such as Return on Assets (ROA), Net Worth, Membership Growth, and Net Income Growth â and then a broad range of others from Delinquency to Employee Satisfaction and Asset Growth, with Compliance coming in dead last. Â We can only assume that is not an indicator that compliance is unimportant, just that it is expected to be done right regardless of incentives.

The other conclusion we draw from this chart is that many credit unions are apparently using more than one measure of success for incentives tied to bonus.

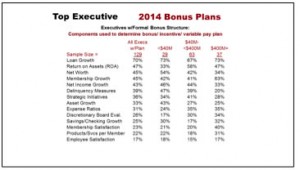

Now that we know there are a variety of measures, the next question is whether there are any patterns that emerge based on credit union size.

Once you get past Loan Growth as a common metric, larger credit unions tend to be more focused on ROA, Membership Growth, Member Satisfaction and Products/Services per Member - and smaller and mid-size credit unions tend to be focused on Net Worth, Net Income Growth, Delinquency Measures and Strategic Initiatives.

There may be some crossover here â Iâd be surprised if âStrategic Initiativesâ didnât include some of the other specifics cited, for example. Â But Net Worth, Net Income Growth, and Delinquency Measures must also be important to larger credit unions too.

Not sure there is any one explanation, but taken together it looks like the larger credit unions tend to be focused on âmaking the pie biggerâ â in particular, the focus on membership growth and products/services per member. Â Think of this in the context of indirect lending â just growing an indirect lending program can certainly help with net worth and net income growth, and youâd have to be concerned about delinquency rates too.

But transforming a single indirect lending transaction into a broader relationship with multiple solutions that positions your credit union as the primary financial institution can yield benefits across many of the metrics cited. Â And the long-term relationship will continue to yield in the future long after the indirect loan had been paid off, assuming that individual remains a satisfied member.

The survey contains many more interesting insights into credit union compensation and executive benefits. If youâre interested in learning more, a recording of Dr. Clarkâs recent webinar is available online, along with his presentation slides. You can find the recording, and the schedule of upcoming free webinars, at www.nafcu.org/BFBwebinars.

For a copy of the NAFCU-BFB Executive Compensation and Benefits Survey, contact Liz Santos at lsantos@BFBbenefit.com.

Â