Aligning Your Leadership on Your Data Analytics Strategy

Every credit union leader is different. Yet, similar attributes make them all great digital transformation champions.

By Shazia Manus, SVP, Chief Strategy & Business Development Officer, AdvantEdge Analytics

Of all the credit unions on a digital transformation journey, the ones led by a team that is excited about the possibilities of analytics have a huge leg up. You can feel the difference. There’s a buzz in the air, and the positivity is felt at every milestone reached along the journey, as the leadership celebrates even the small wins right alongside the rest of the institution.

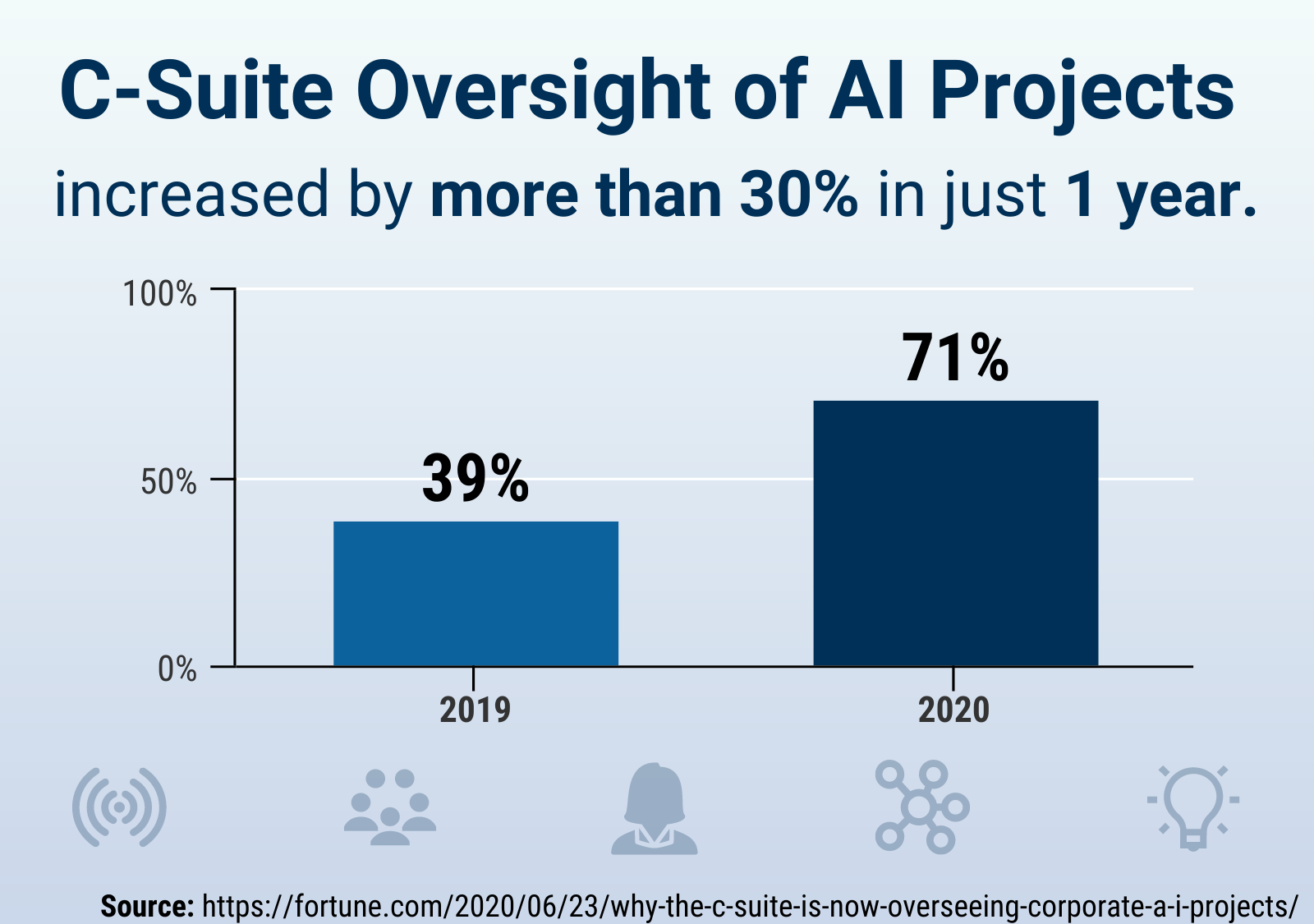

There are some indications that data and digital transformations led by the C-suite are becoming more commonplace. Whereas it was once normal practice for a CEO or other executives to be involved only at the outset of an analytics initiative, more often leaders are remaining engaged throughout a project. Take artificial intelligence, for instance, a technology heavily reliant on sound data strategy. The percent of C-suite-owned AI projects jumped more than 30 percentage points in just one year, from 39% in 2019 to 71% in 2020. Talk about exponential change!

Just as every credit union is different, every leadership team is different. That said, almost every credit union executive I’ve encountered over the last two decades has carried a unique set of attributes that make for reliable captains of an analytics ship.

Just as every credit union is different, every leadership team is different. That said, almost every credit union executive I’ve encountered over the last two decades has carried a unique set of attributes that make for reliable captains of an analytics ship.

First, they have a wealth of industry experience. Most credit union execs have a tenured understanding of the credit union movement, attuned to the winds of change and acutely aware of modern members’ needs. This is especially pertinent now, as the impacts of COVID-19 vary wildly from member to member. Delivering a highly customized, data-driven experience is how credit unions will claim their position as the modern member’s most trusted financial partner (and keep the financial wolves at bay).

Second, these teams are purpose-driven. Sure, they must care about cost control and risk mitigation. But their driving KPI is the member’s financial wellness. Coaching and guiding members, through everything from student loan debt to retirement planning, requires more business intelligence today than it ever has. Members expect personalized services, and the leadership team wants to give it.

Third, they are great believers in culture. They know that the motivation to move financial mountains for the people a credit union serves comes from the very top. Establishing and nurturing a culture of ethical analytics is how credit unions will best big banks, big tech, and fintech startups at proving they truly know their members. Credit union leaders are instrumental to getting cultural renewal off the ground.

Fourth, they have the ear of vendor partners. Analytics strategy requires strong collaboration and open communication among many different parties, not only internally, but externally, as well. Getting enthusiastic participation from a core processor or mobile banking provider is much easier when a respected and galvanizing CEO or exec makes that call.

Winning Over the Reluctant Executive or Other Stakeholders. For someone who’s a bit more “ho-hum” than “hooray” about analytics and digital transformation, there is plenty of hope. The key, says Deloitte advisers, is to tie data analytics and the actionable insights it can deliver to the credit union’s most pressing business initiatives.

“Linking data and analytics to issues the CEO already holds dear, such as customer focus or employee empowerment, can prove persuasive,” Deloitte’s Thomas H. Davenport and Nitin Mittal wrote in their recent Harvard Business Review article. “As can pointing to outside factors that depend on having data-based decision making, such as regulatory requirements or the threat of more data-driven competitors.”

As a former credit union CEO, I can attest that saying ‘yes’ to a proposed initiative is much more palatable when the initiative’s sponsor articulates how it connects to the organization’s mission, purpose, or goals.

Through my work with the AdvantEdge Analytics team of data champions, I’ve seen that when the leadership is fired up, data transformation is set ablaze. Discussions are more lively, people are more engaged, vendors are more collaborative. With several such partnerships in place for 2021, I know I speak for our entire AdvantEdge Analytics crew when I say this is going to be a great year of data and digital evolution for the credit union movement, led by some bold, progressive, and purpose-driven leaders.