The Auto Lending Paradox

By Rick Vanko, Product Manager for iLien Motor Vehicle, Wolters Kluwer

In spite of a strong economy, lenders need to be ready to recoup their investments.

The good news? Strong growth in the U.S. economy has the auto industry reaping the rewards. Higher average loan amounts and increased sales in the luxury sector have made auto lending the fastest-growing asset class, with 28 million vehicles sold and $1.2 trillion in total balances at the end of 2018.

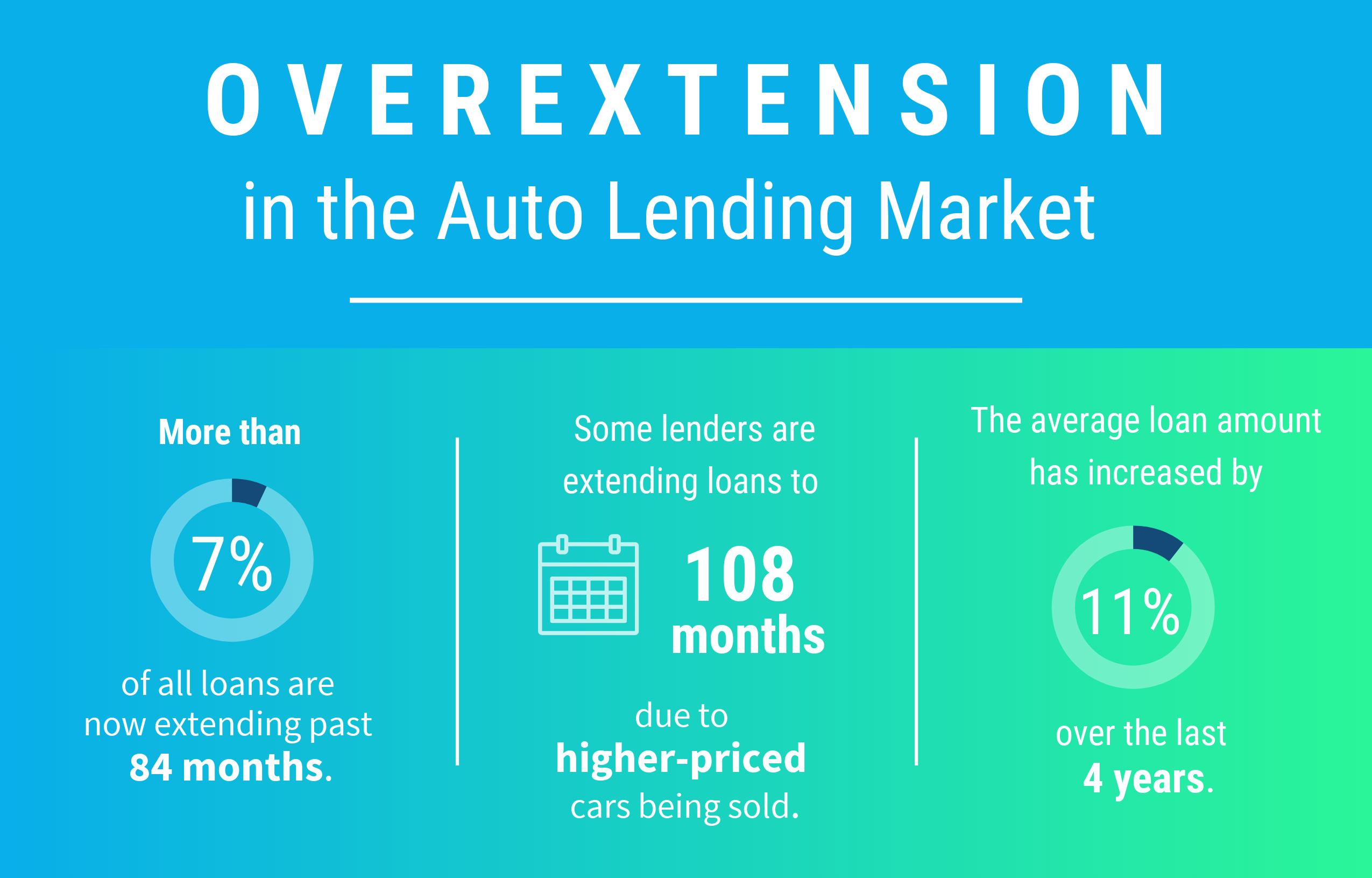

The bad news? Auto sales aren’t the only thing that’s growing. Loan terms are becoming longer (some as high as 10 years!) and over 20 percent of total lending is now being extended to subprime borrowers. This means many people are buying vehicles they can’t really afford, which helps explain why delinquency rates are on the rise with over 2.7 million averaging between 30- and 60-days delinquent. In 2017, over 1.8 million units were repossessed, which was the highest volume since 2009.

What’s behind this dichotomy and what does it mean for lenders?

The auto lending market can be contrarian and there’s overextension on both sides.

The average monthly car payment is also increasing. Not only are borrowers buying more expensive cars, but non-prime interest rates are driving monthly payments higher—from $478 in 2009 to $551 in 2019.

Auto lenders are also issuing credit more freely, not only accepting lower credit scores but also taking borrowers at their word regarding their income rather than following the proper procedures to verify it. As a result, delinquencies are projected to grow even further in 2019.

Whether lenders want to accept it or not, there is a true risk in the auto lending marketplace right now with the increase in delinquencies and repossessions. When repossessions increase, there is a very tangible and measurable impact on lenders’ infrastructure and their bottom line. Repossessions also mean more work because unperfected loans increase the administrative burden exponentially.

What can a lender do to lessen the impact to their businesses?

STAY EDUCATED

Lenders and financers need to stay educated on the changing jurisdictional requirements by:

- Staying on top of legislative changes and updates.

- Understanding jurisdictional differences.

- Educating themselves on Department of Motor Vehicle (DMV) rules and requirements.

REDUCE COSTS AND TIME FOR THE TITLING PROCESS THROUGH AUTOMATION

Lenders can drive cost reductions and create efficiencies through automation and integration.

- Consider the value of Application Program Interfaces (APIs) and solution integrations.

- Eliminate manual in-house processes for repossession title request management.

- Optimize workflows.

PARTNER WITH INDUSTRY EXPERTS

Lenders can leverage the opportunities in the refinance and repossession markets by partnering with industry experts to help them:

- Stay compliant with jurisdictional requirements.

- Take advantage of predictable fees.

- Improve turn-around times with automation.

- Track status of repossession titles from start to finish.

- Handle volume increases.

The strong economy and increased auto sales have lulled lenders into a false sense of security. It’s important for lenders to pay attention to the warning signs on the horizon to ensure they are adequately preparing their businesses to ride the highs and lows of ever-evolving market conditions.

To learn more about the auto lending paradox, listen to our podcast episode.