Back-of-Card Branding Webinar Q&A

And the questions kept on coming! One of our last webinars of 2015, âPreserving Credit Union Income: Â The Impact of Back-of-Card Branding to Your Bottom Line,â sparked so many questions that Caroline Heller, industry expert and webinar speaker, decided to follow up to those we didnât have time to address during the webinar.

And the questions kept on coming! One of our last webinars of 2015, âPreserving Credit Union Income: Â The Impact of Back-of-Card Branding to Your Bottom Line,â sparked so many questions that Caroline Heller, industry expert and webinar speaker, decided to follow up to those we didnât have time to address during the webinar.

To Catch You Upâ¦

On average, approximately 20% of a credit unionâs non-interest income is derived from payments. In recent months, many institutions have seen some erosion of their payments-based income, but have not been able to specifically identify the source of the erosion.

This webinar helps your institution focus on one area of potential revenue erosion â back of card branding. In addition to the brand mark found on the front of your debit card, there are usually one or more brand marks present on the reverse side of the card. It is important to understand the implications of the back-of-card brand marks to your transaction routing and subsequent revenue stream.

Watch the full webinar here:

Click here to watch the presentation in a new window

Webinar Q&A

Caroline Heller, Vice President of Core Payments Solution Sales with MasterCard, responds to your questions:

1. What are a few of the key questions we ought to be asking our current back-of-card brand to ensure our revenue is not eroding?

- You may request these reports from your PIN Networks and/or your processor. Â First, request reporting that separates PIN transactions from PINless. Ensure you have transaction count, amount, and interchange earned. These may come from various reports vs. one report. Second, request historical reports to look for trends of the above. Â Look at a year ago (or two.) Is PINless increasing?

- Ask if your PIN Network supports dual message (aka âsignatureâ) transactions or if they have plans to support in the future.

- Request current and historical Top Merchant Reports to look for trends. Â Is their significant growth (above your overall growth)? This could be a shift from your other PIN network or from signature debit transactions now routing as PIN. Â Compare the Top Merchants across all of your networks.

2. How do we know the optimal number of PIN POS Networks on the back of the card?

You may want to consider pairing down the number of PIN POS Networks on the back-of-card. For instance, if you have 3, I would consider reviewing the economics and need for each network. If it makes sense, I would limit to 2 networks.

3. Right now we have a rewards program that only gives points for signature debit transactions. Is that still okay, or what do you recommend?

I recommend doing a thorough profitability analysis on your portfolio including the cost of rewards and the estimated increase in usage before changing anything. However, there are a few things to consider:

- When cardholders are encouraged to use their card for all purchases, regardless of signature/PIN, both transaction types tend to increase.

- The signature vs. PIN methodology will become more complex with EMV. For instance, a cardholder could enter their PIN, and the transaction is still routed dual message to MasterCard or Visa (what would have been a âsignatureâ transaction prior to EMV).

- PINless transactions as they work today definitely are confusing to cardholders when they are motivated to sign for the purchase. The cardholder is not given a choice at the point-of-sale for these transactions when the PIN network is participating in PINless transactions.

4. Can you explain the term 'exempt issuerâ?

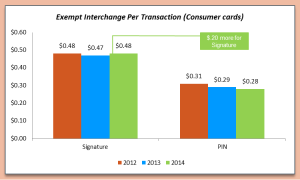

I am referring to Section 1075 of the Dodd-Frank Act (aka âDurbin Amendmentâ). One portion of the Durbin Amendment caps debit interchange with specific exemptions. One exemption is for small issuers defined as an issuer with assets less than $10B. These issuers are often referred to as âExempt Issuersâ when talking about debit interchange and profitability.

I am referring to Section 1075 of the Dodd-Frank Act (aka âDurbin Amendmentâ). One portion of the Durbin Amendment caps debit interchange with specific exemptions. One exemption is for small issuers defined as an issuer with assets less than $10B. These issuers are often referred to as âExempt Issuersâ when talking about debit interchange and profitability.

This ABA article details the competitive advantage of âexempt issuersâ over âregulated issuersâ relative to Durbin.

5. Are there any negatives to the issuers that opt out of PINless? Loss of small transaction volume, customer satisfaction, anything else? Â

Generally speaking, we donât believe there would be any negative repercussions were you to opt out of PINless, neither relative to volume or revenue, nor to customer satisfaction.

6. In the event that we were to manage opting out of PINless with our PIN networks, would those transactions which might route as PINless fallback on signature rails?

Yes. Â These transactions would likely fall back on signature rails with no signature required.

7. I am an FI. To whom do I opt out of PINless with? MasterCard or my network?

You would opt out with PINless on your PIN Networks.

8. How is EMV going to affect routing?Â

The Card Verification Method (CVM) on an EMV card authenticates the Cardholder, but does not dictate routing. Â A cardholder could enter their EMV Card PIN, and the merchant can route the transaction to any of the applicable networks on the card including MasterCard or Visa.

MasterCard is the NAFCU Services Preferred Partner for Credit, Debit, and Prepaid Branded Products. For more information, please visit www.nafcu.org/mastercard

©2015 MasterCard Worldwide Proprietary and Confidential

The information provided herein is strictly confidential. It is intended to be used internally within your organization and cannot be distributed nor shared with any other third-party, without MasterCardâs written prior approval.

Information in this response relating to the projected impact on your financial performance, as well as the results that you may expect are estimates only. No assurances are given that any of these projections, estimates or expectations will be achieved, or that the analysis provided is error-free. No reliance can be made on this response and MasterCard will not be responsible for any action you take as a result of this response, or any inaccuracies, inconsistencies, formatting errors, or omissions in this response.  This response constitutes willingness, in good faith, by MasterCard to explore the possibility of a business arrangement between the parties and does not contain all matters upon which agreement must be reached in order for the proposed transaction to be established.