Do Your Female Members Have the Life Insurance They Need?

To increase their ownership, focus on their multi-faceted identities

By Sarah Randle, TruStage Specialist

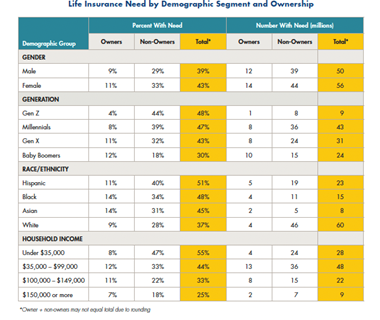

Women in the US are much less likely to have life insurance than men. According to 2022 research from LIMRA, 47% of US women aged 18-75 own life insurance compared to 58% of men.[1] Information from the U.S. Census suggests that roughly 57 million women need life insurance vs. approximately 51 million men, with need being defined as either having no or not enough life insurance.[2]

Life Insurance Awareness Month in September is a perfect time for credit unions to address this gap. However, don’t view your female members as a single homogenous group or you’ll miss key opportunities to understand and serve them.

Why You Need to Dig Deeper

While it might seem logical to focus on gender-centric issues to convince women to investigate and purchase life insurance, your credit union may need to go deeper. Your members are complex, multi-faceted individuals with needs and decisions influenced by a variety of factors. This point was strongly reinforced by CUNA Mutual Group’s[3] research on multicultural, multigenerational consumers. As one survey participant eloquently stated, “I’m not just a woman. I’m not just Black. I’m not just one thing. All parts of my life intersect to make me who I am, and all those parts are important to how and why I do things.”

What Stops Women from Buying Life Insurance?

Before learning how to connect with female members, it’s useful to consider why many may not own life insurance. According to LIMRA4, the following reasons top the list for all consumers, with women being more likely to cite each reason:

- The belief that it’s too expensive

- Other financial priorities

- Not knowing how much or what type to get

LIMRA data has shown for years that consumers vastly overestimate the cost of life insurance. More than half the population believes term life insurance is three times more expensive than it actually is.[4] Given the misperception, competing financial priorities—especially in these inflationary times—and high levels of product confusion, it’s not surprising women don’t buy the coverage they need.

Why Should a Lack of Life Insurance be Such a Concern for Women?

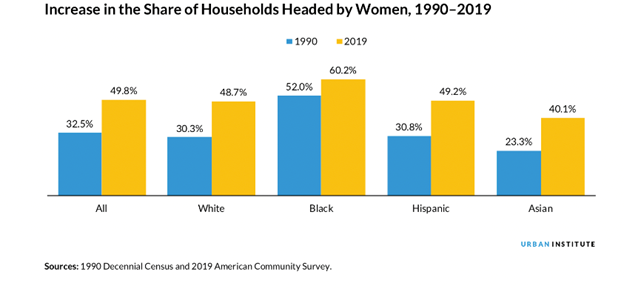

Since 1990, there’s been a surge in the share of households headed by women of all races and ethnicities—with head of household defined as being the household’s main breadwinner.[5] That means it’s increasingly important for women to protect their income.

Three Things Your Credit Union Should Know to Better Connect with Female Members

To meet the life insurance needs of your multi-faceted female members, your credit union should understand these three things:

1. Beliefs around life insurance

To develop effective marketing tools and communication campaigns, it’s critical to understand key perceptions about life insurance.

Here are a few interesting insights from the LIMRA research, many of which will reflect the needs of some portion of your female membership:

- Why they are/are not interested in life insurance. Understanding the “why” behind a life insurance purchase will play a critical role in the types of life insurance you make available and your key marketing messages. For instance, while covering burial and other final expenses was the top reason Black, White, and Hispanic consumers buy life insurance, replacing lost wages was the top reason for the Asian community4. Black and Hispanic consumers are most likely to see life insurance as a way to leave an inheritance. As was true in general, when looking across races/ethnicities, the same top two reasons for not buying held up: expenses (though this percentage was lowest for Black consumers) and other financial priorities4.

- End-of-life discussions. While only a quarter of Americans are comfortable talking about end-of-life planning, younger consumers and Hispanic and Asian consumers are the least comfortable with these discussions4. Consider how this might impact the ways in which you present life insurance options to your female members.

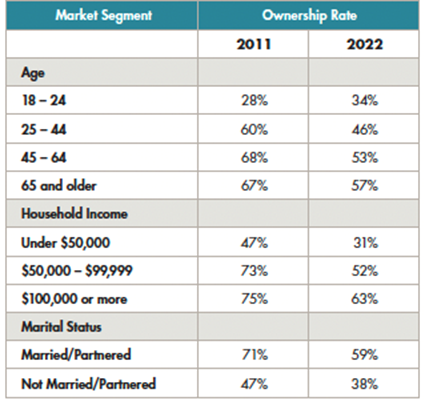

- Ownership rates for life insurance. LIMRA research shows that from 2011 to 2022, there’s been a drop in life insurance ownership in every age category, except those aged 18-24. Ownership has also dropped at every income level and marital/partnered status4.

When examining this question by race/ethnicity, research from the WMN survey found that Black and Multiracial consumers showed a consistent need for life insurance—both by their actual and anticipated purchases. Six in 10 Black (58%) and Multiracial (61%) consumers purchased life insurance in the last five years. Four in 10 Black (42%) and Multiracial (43%) consumers plan to purchase life insurance in the next five years. WMN also found Millennials and LGBTQ+ consumers represent strong market segments for life insurance products in the upcoming five years.4

2. Where the biggest life insurance gaps exist

We’ve already established that women are less likely than men to have the life insurance they need; however, beyond gender, you can better target your message to women if you understand the gaps across three other demographics: age, race/ethnicity, and household income.4

- Age. According to the LIMRA data, the groups most in need of life insurance by percentage are Gen Z and Millennials. Nearly half of Gen Z and Millennial consumers—roughly 52 million people—need more life insurance than they currently have. Given that these two segments are critical to the future success of your credit union, it’s vital to understand the life insurance needs and preferences of Gen Z and Millennial women.4

Race/Ethnicity. The LIMRA research also shows that life insurance need is highest among consumers who identify as Hispanic or Black — 51% of Hispanic consumers and 48% of Black consumers believe they need more life insurance. Women of color will have unique needs which can be better met by understanding this difference. 4

Race/Ethnicity. The LIMRA research also shows that life insurance need is highest among consumers who identify as Hispanic or Black — 51% of Hispanic consumers and 48% of Black consumers believe they need more life insurance. Women of color will have unique needs which can be better met by understanding this difference. 4 - Household Income. Low-income consumers are the most likely to need life insurance. Of those with household incomes less than $35,000, 55% either have no or little life insurance; and of those with household incomes between $35,000 - $99,000, 44% have no or little life insurance. Given the LIMRA data about misconceptions around the cost of life insurance, it seems logical to assume some percentage of these households mistakenly believe they can’t afford the coverage. With more women-led households, those in lower income brackets can be better assisted through targeted messaging that reflects their unique needs and conveys the true cost of insurance. 4

3. Which tools and resources members are likely to use to research, purchase, and use financial products.

Both LIMRA and WMN research support an increasing use of digital channels. According to the WMN research, nearly half of all respondents (43%), especially Multiracial (49%), Black (46%), Hispanic (44%), and Native American (44%) consumers say they check their accounts daily, regardless of income level — which indicates a heavy reliance on digital channels. Generationally, Millennials (53%) are the most likely to agree with the statement, “I am the type who checks my financial accounts daily,” followed by Gen X (45%) and Gen Z (42%).3

LIMRA research shows that consumers in all age groups use social media to research financial topics, with Facebook and YouTube being the top two categories for each group4. And since 2016, there’s been a nearly 20% drop in in-person life insurance shopping and a 7% increase in the use of online channels4.

Next Steps for Your Credit Union

Armed with these high-level insights, it’s time to do the following:

- Dig into your data. This will help you gain a complete understanding of your membership that includes not just gender but income, race/ethnicity, and age.

- Choose partners whose coverage reflects member needs. Keep the needs and preferences of your members in mind when choosing best-fit insurance partners.

- Create communication tools that leverage these insights. Once you have a better understanding of your multi-faceted female members and their goals, perceptions, and fears, use this information to develop communication tools that better address them and utilize the channels they prefer. The right partner will be key here too.

Your female members need and deserve the coverage that life insurance can deliver. Develop a deeper, more nuanced relationship that allows you to understand, connect with, and serve them better. You can access more data and insights from the CUNA Mutual What Matters Now study here.

[1] LIMRA Insurance Brief: U.S. Women 2022

[2] U.S. Census Bureau, Population Division, Demographic Analysis Total U.S. Resident Population by Age, Sex, and Series, December 2020 as cited by LIMRA 2022 Barometer Study

[3] CUNA Mutual Group, 2022 What Matters Now Research Report, conducted in partnership with Ipsos and The Collage Group.

[4] LIMRA 2022 Insurance Barometer Study

[5] Goodman, Laurie et al, “More Women Have Become Homeowners and Heads of Household. Could the Pandemic Undo That Progress?” March 16, 2021, Urban Institute

|

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of TruStage or CUNA Mutual Group. TruStage® Life Insurance is made available through TruStage Insurance Agency, LLC and issued by CMFG Life Insurance Company. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. Product and features may vary and not be available in all states. Corporate Headquarters 5910 Mineral Point Road, Madison, WI 53705. GEN-4903928.1-0822-0924 © CUNA Mutual Group |