Don’t Let Legacy Tech Hold Your Credit Union Back

By Mike Manahan, Senior Vice President of Banking and Credit Unions, Total Expert

Whether your credit union has been around for a few decades or a hundred years, it can be a challenge to modernize your organization’s marketing and the technology you use to reach prospects and better serve your members.

You’re not alone. When asked to identify the greatest barrier to their financial institution's ability to drive digital transformation, executives cited their complex legacy IT environment and the cost of modernizing as the most significant obstacle to adopting new technologies.

Everyone is feeling pressure to join the race toward a better member experience, and this means making better use of the data you already have on hand.

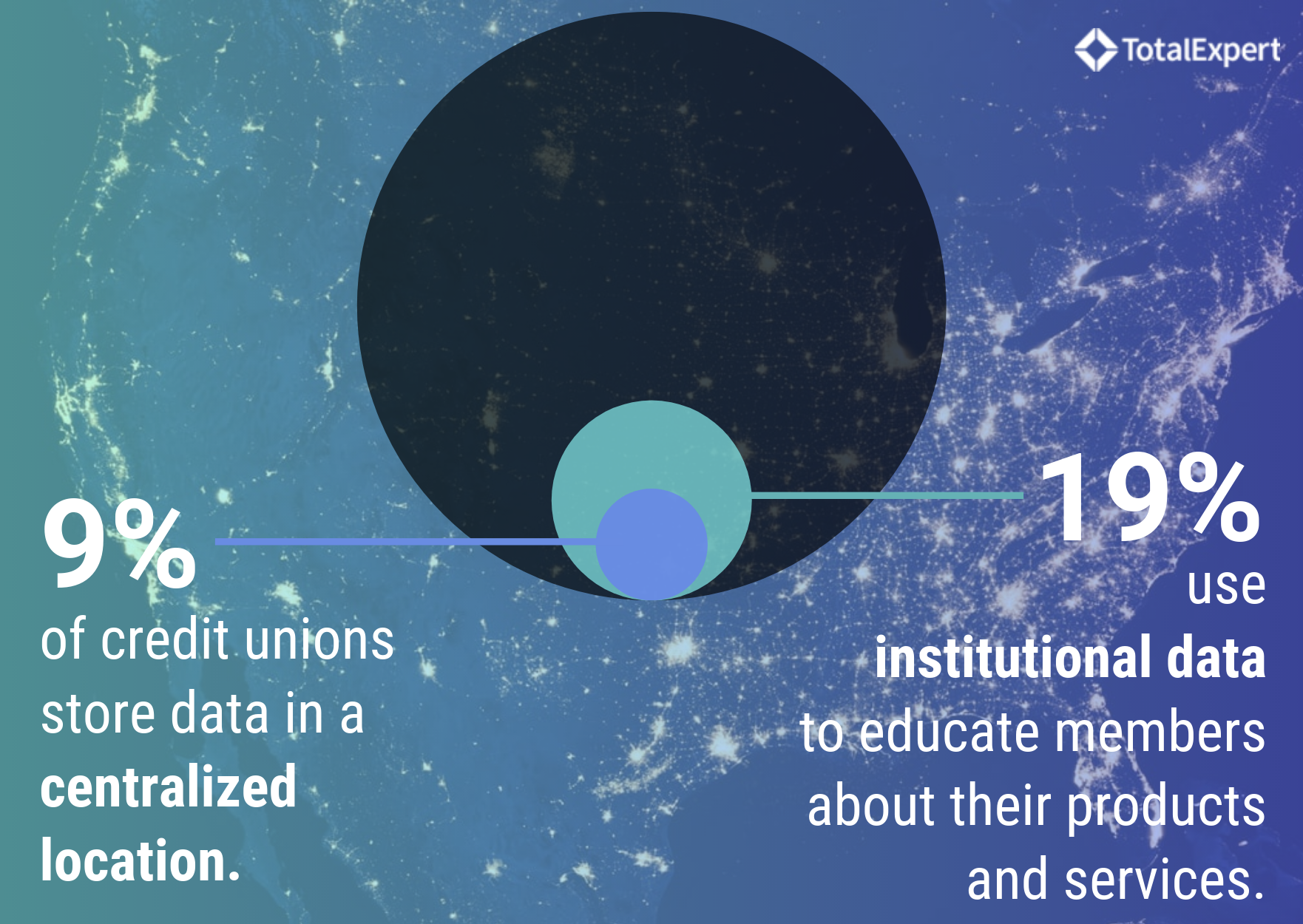

We recently surveyed financial marketers and found that only 9 percent of credit unions store data in a centralized location and a mere 19 percent regularly use institutional data to educate members about their products and services. If your data is stuck in silos or hard to access, it’s easy to imagine why you’re not leveraging actionable insights more often, but that doesn’t mean you can’t take steps toward a more efficient, data-driven future.

Here’s why it’s worth your time to advocate for investment in better technology to keep your credit union focused on the future.

The Opportunity Cost of Not Keeping Up

While it can be hard to calculate exactly how much revenue you’re missing out on because you lack the right tech, there are four areas where credit unions may struggle without the right tools to enable their staff and members:

- Bring new members in the door- Thanks to the marketing savvy of fintech-powered financial institutions, the competition for member acquisition is hot. To bring new members in the door, you’ll need to have the right tools to send humanized communications to prospective members through the right channel at the right time. And you can’t do this at scale without the right marketing operating system (MOS).

- Establish your value during the onboarding process- Once your member has opened a share account, the next touchpoints are critical. This is your chance to consistently demonstrate to every new member that you know who they are, what they need to know, and how your credit union can help them grow with you in the long-term and become a member for life.

- Retain members and grow their financial life within your organization- If you want to best serve your members and become their primary financial institution, you’ll need to provide an experience that keeps their attention, proves you understand their needs, and helps them access the most useful financial products and services.

- Know the importance of having the right tech stack- Today, 67 percent of consumers use multiple channels to complete a single transaction, and this can make tracking customer activity a challenge – unless you have the right tools to work with member data. You’ve got to have modern technology to bring top talent in the door and to empower your teams to deliver timely and personalized member services that leverage data without adding stress.

So, what is the cost of not delivering the right messages through the right channels at the right member life stage? If you deliver a fractured member experience, you’re not just missing out on adding valuable products or services, you’re losing out on gaining that member’s loyalty for life at a time when becoming your members’ primary financial institution is critical.

But it doesn’t have to be this way, and here’s how…

Start by Assessing Your Data

If you’re not sure you have enough data on hand to reap the full benefits of a marketing operating system, audit the state of your current database by asking a few simple questions:

- Do you have member account information and personal information stored in separate silos?

- If a member were to visit a branch location, would the member services team know how that member had last interacted with your credit union?

- Does your online member services experience line up with your in-person services?

Chances are, you have plenty of data available to help you improve your members’ experiences. The challenge is you don’t have the technology to easily access the data and use it in a way that resonates with your members.

At this stage in the audit, there’s only one question more to ask: What do you want your members’ experience to look like in an omnichannel world? From here, you can begin the discovery process that will lead your credit union to procure and adopt the right tools to establish your credit union as your members’ primary financial institution.

New Technology Can Help Build Relationships that Scale

It’s long been understood that people join credit unions because they want to feel connected to the institution that’s helping them manage their financial life. Members want a personal connection with their member service representative – a real person – who will get to know them, advocate for their needs, and guide them through a lifetime of financial questions.

From their first touchpoint to their second car loan, a credit union with the right operational technology is capable of scaling up the one-on-one relationship that members expect from their credit union. In order to get to this end-state, you need to have a member-centric culture from the top down. When leadership invests in technology that supports a humanized member experience at every level, they're also investing in the cornerstone of their financial institution: current and future members for life.

With the right technology, your team can easily harness member data to seamlessly command the messages going out to your members at every stage in their lifecycle with your credit union. This will help you deliver on the humanized member experience you’ve promised and maintain your place as the trusted financial partner of each of your members…for life.