Expanding Credit Access Compliantly with AI

By Jeff Keltner, Senior Vice President of Business Development | Upstart

In the latest episode of Leaders in Lending, Upstart’s Chief Compliance Officer, Annie Delgado, had some unconventional advice: “Don’t cut off both ends of the roast.”

The saying relates to a child asking their mother why she always cuts the ends off her roasts. The mother replies, “Well, my mom taught me to do it this way.” The child asks the same question to the grandmother and the grandmother replies, “I don’t know why you do it. I did it because my pan was too small!”

Delgado explained that a lot of the time, the same phenomenon is present in financial services. People tend to do things simply because that is how they’ve been done for a long time, even if those processes can and should evolve for the better. This is what Delgado calls “status quo bias,” and nowhere is this more apparent than in access to credit.

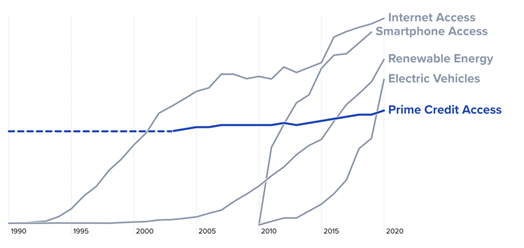

A few years ago, Upstart performed a study that found that 48 percent of Americans have access to prime credit, yet 80 percent have never defaulted on a loan.1 This mismatch means many Americans are shut out from life’s necessities, including education, homeownership, healthcare, and more. Many are charged higher interest rates than they should be, and despite innovations in internet access, smartphones, electric vehicles, and renewable energy, access to credit has remained stagnant since the 90s.

Prime credit access hasn’t changed in over 30 years

Prime Credit Access vs. Other Technologies Among Americans, 1994–20202

Given that access to capital is access to opportunity and upward mobility, and nearly half of Americans are unable to access fair credit, there is a huge social cost that must be addressed. In an economic environment that causes lenders to tighten or pause lending altogether, improving credit access is even more crucial for borrowers who need these funds to sustain their livelihoods.3 The American lending system is broken, and lenders, regulators, and fintechs alike have the opportunity to employ alternative approaches that can solve the problem of credit access by expanding access to more creditworthy borrowers — if we can help clarify and manage the related compliance issues, especially around fairness.

Why there is fairness risk in lending

Annie explained that there are three basic components of a fair lending assessment: the inputs, the decisioning, and the output. In terms of the inputs, most lenders have a suite of variables they use, such as credit score and debt-to-income ratios. These variables, however, are not ‘pristine’ when it comes to preventing bias. For example, women are paid less for the same job as men, and the lower end of the credit spectrum tends to be minority groups; thus, introducing the potential for bias.

Then, once the decisioning and assessment happens, human underwriters are riddled with unconscious biases. For example, a compensating factor— which is a characteristic that is used as a positive to offset a negative in the borrower’s credit qualifications— is fraught with the potential for bias and fair lending risk.

- The person who asked the underwriter to look for a compensating factor may differ depending on the protected class of the applicant.

- Who did the underwriter actually grant the compensation to versus not?

- What does the underwriter think counts as a compensating factor?

These biases can unfortunately result in outputs that leave many borrowers unfairly out of the equation, but AI can change that.

How AI can enable fairer decision-making

While lenders can test these outputs for consistent outcomes after human intervention, an AI system offers one ‘computerized brain’ that makes decisions based on logic versus human brains, which are subject to unconscious biases. An AI system allows lenders to pull back the curtain and assess the outcomes, and they can also be trained not to use hard cutoffs like credit scores. “If you have it done by an AI model making a statistical assessment based on actual real data and mathematical approaches, then what you get is a consistently applied compensating factor,” Delgado said.

Delgado argued that the risk of bias in lending has persisted due to societal as well as human brain power issues. Since AI models can understand more nuance, she believes AI is the solution rather than the risk. In order to ensure fairness, lenders should constantly be assessing approvals and declines to understand and improve credit access.

A meeting of the minds between fintechs and regulators

Fair lending laws, as written, have stood the test of time, but Delgado explained that more clarity is needed about how the laws apply to technology that wasn’t available when the laws were written. Though the laws are good, Delgado argued that more “meeting of the minds” and collaboration between the lending industry and regulators need to take place.

Upstart recently joined MoreThanFair, a new coalition designed to bring together industry, regulators, and special interest groups to provide a better framework for solving the problem of fairness in lending.

MoreThanFair alludes to the fact that ‘fairness’ or parity does not imply inclusion or access. This is a big problem with the ecosystem. Lenders can achieve parity by only lending on the prime end of the spectrum, leaving out the subprime end, which more heavily includes immigrants and people of color. On the surface, this looks fair but isn’t inclusive. It certainly isn’t solving the greater societal need of expanding credit access.

Along the same lines, Upstart joined the White House-led Economic Opportunity Coalition as a founding member to provide access to its AI technology with no implementation fees for all Community Development Financial Institutions (CDFIs) nationwide.

The path forward with fair lending and AI

As the lending laws are written now, Delgado is not very concerned with changing the language. Their intention is to achieve exactly what we want, to avoid discrimination and unfair credit decisions. Where improvements can be made, however, is clarification on how those laws can apply to existing and newer technologies like AI in lending.

“Regulators and policymakers have to be looking at it from all different angles, striking a balance and having all those conversations simultaneously,” Delgado explained. AI can help solve complex problems in the lending space when it comes to bias, but regulators need to be brought into the conversations to understand the difference AI truly makes.

To work toward better serving historically underserved communities, closer collaboration between regulators, fintechs, and special interest groups is the first step. Working toward a common goal of enabling better access to opportunity for more Americans, Delgado believes the industry can get to a place where AI can simply be a tool that banks and credit unions employ to prevent bias and expand opportunity.

1. According to an Upstart retrospective study completed in December 2019.

3. CNBC. “Banks say they are tightening lending standards even as demand for money falls.” August 3, 2022.