How Credit Unions Can Capture the Opportunity in Auto Refinance

By Jeff Keltner, Senior Vice President of Business Development | Upstart

Recent trends in the auto lending market have unlocked a unique opportunity for credit unions to help both existing and new members save money on their car loans, especially during periods of financial uncertainty.

Due to rising rates, one might think there is little opportunity to grow in auto refinance. However, interest rate hikes have caused consumers to evaluate their debt for new opportunities to save. By capitalizing on this neglected asset class, credit unions can help both new and existing members lower their monthly payments with auto refinance.

Rising rates and car prices creating more mispriced loans

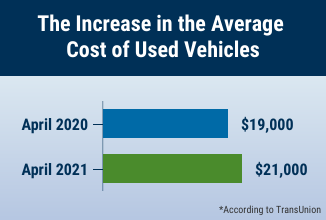

Rising rates coupled with increased car prices has created an environment for consumers who want to save money on their mispriced loans. The average cost of a used vehicle has increased from $19k to $22k from April 2020 to April 2021, according to Transunion.1 Total auto loan balances also rose a percent from Q1 2019 to Q1 2021.

A growing market opportunity

A growing market opportunity

While the percentage of auto loan originations used for refinance has historically been a small segment of the auto loan market, its share is growing. While only 4.5 percent of auto loans were used for refinances in 2019, this has scaled to 5.2 percent in 2021, indicating steady 16 percent growth.2 Still, auto refinance remains a neglected asset as only 5 percent of the auto lending market.

An information gap with today’s borrowers

Though the auto refinance market is growing, there remains an information gap with today’s borrowers. Many borrowers remain unaware or misinformed about the opportunity for them to save money on their car payments by refinancing.

- Only 50 percent of borrowers were aware of the opportunity to refinance their auto loans even when their financial institution advertised this opportunity to them, versus 71 percent of borrowers who were aware they could refinance their mortgage loans.3

- 20 percent of consumers cited that the top two reasons they did not refinance their auto loan was because they did not know how or that the process was too difficult.4

Transunion estimates that over 200,000 borrowers are currently in the market for auto refinance loans in the next two months, and as stewards of their community, credit unions can help consumers reduce their monthly payments especially during stressful economic periods. In 2021, the average monthly savings for a consumer who refinanced their auto loan was $62, and 29 percent of refinances resulted in savings of over $100 a month for consumers.5

The problem that most credit unions face is the large barrier to entry; the end-to-end auto refinance process involves multiple complexities when it comes to perfecting the lien – which can vary state by state – and many processes that can be time-consuming and costly in order to seamlessly transition the existing loan.

Leveraging AI to enable a better refinance experience

Leveraging AI to enable a better refinance experience

In order to build a successful auto refinance portfolio, credit unions need a combination of fast funding, a digital experience, and best-of-breed lending with all the intricacies of the auto refinance process. These include a seamless application, instant quote and verification, offers, quick loan closing, and automated lien perfection.

With a well-established referral network for auto refinance loans, lenders are empowered to diversify their portfolios with a securitized asset, deliver an exceptional digital experience for member and lend to more borrowers safely by maintaining full control over credit policy.

- Diversify their portfolios with a securitized asset

- Deliver an exceptional digital experience for members - Complete with fast application, automated approvals and stips and lien perfection processing, the right AI-powered digital experience has the potential to find hidden prime borrowers and more than double pull-through rates.

- Lend to more borrowers safely by maintaining full control over credit policy - Credit unions can increase approvals within their chosen risk tolerance, allowing them to stay in full control of their auto loan portfolios. Many partners will provide a large network of borrowers, gaining new members outside of their traditional branch footprint.

As institutions dedicated to helping their members thrive, it is unsurprising that many credit unions are already leaning into the auto refinance opportunity – in 2019, 66 percent of refinances were originated by credit unions, versus 72 percent in 2021.6 However, the market opportunity for auto refi is still untapped. As credit unions continue to seize the opportunity to serve their members’ needs during periods of financial stress, they will ultimately gain loyalty among their existing members as well as acquire new loans and members.

Credit unions don’t have to build these capabilities internally. Partnering with the right company can help your credit union kick-start your auto refinance portfolio. Click here if you’d like to hear more from NAFCU Preferred Partner, Upstart.

1 Transunion. "Auto Refinance Opportunities." April 2022.

2 Ibid.

3 Ibid.

4 Ibid.

5 Ibid.

6 Transunion. "Auto Refinance Opportunities." April 2022.