How to Resonate with Today’s Up-and-Comers

By: Stacy Styles, Vice President and Senior Business Leader at Mastercard.

Marketing to Millennials

The myth of the millennial as the perpetual adolescent has finally been put to rest. Adult millennials, meaning those in the 28 to 37-year-old age bracket, are todayâs adults with families, homes, careers, and most importantly to credit unions, money. In fact, older millennials are really the sweet spot for credit unions. They are growing in affluence, accounting for a third of adults earning more than half a million a year and more than 6 million of them earning six figures.

Play to their Passions

In a recent webinar, Key IngredientsâResonating with Millennials and a Sneak Peek at Centennials, we discussed how to capture millennials' business. The key is to understand what drives them. This group is making money and they are not afraid to spend it on things they care about such as travel, golf, and cuisine. These three areas differentiate affluent millennials from other generations.

Travel: Â Nearly three-quarters value travel for entertainment. More than half have traveled outside the country in the last year which sets them apart from other adults.

Golf: 22 percent played in the last year. Thatâs more than double the rest of the adult population. Nearly three-quarters are willing to travel just for golf and use it for business.

Cuisine: Millennials are the true foodie generation with two-thirds saying cooking and food are a big part of their identity. They are really ready to put their money where their mouths are. A whopping 87 percent said they would splurge on a nice meal even when money is tight. They are willing to spend $282 per person for an extraordinary culinary experience, compared to the next highest spending group, which came in at $170.

Building the Bridge with Boomers: Community and Future Planning

A question on the minds of many is how to market to millennials while still appealing to the largest current base: the boomer generation. The answer is community.

Getting involved and making a difference locally is very important to millennials. More than three-quarters of millennials say they feel like they should be doing more to help their local communities. The same number report that when a company donates to or does something for their school or community, they try to buy things from that company as often as possible. This is a value shared by the boomer generation. Itâs also a great spot for credit unions which are smaller and more personal to the communities they serve.

Both of these groups are also in stages of planning. Boomers are still planning retirement while older millennials are planning for their childrenâs educations. A good area to focus on that resonates with both generations is providing easy tools to create life plans.

Whatâs Next? The Centennial Generation

The next generation, weâll call them centennials, would refer to those currently 19 years old and under. They are expected to be quite different from millennials as they grew up under the recession and are more cautious, are savers not spenders and are very concerned about the future. This generation wants advice and is debt adverse, so offer them educational materials including the benefits associated with accumulating debt so they can get to where they want to be in the future.

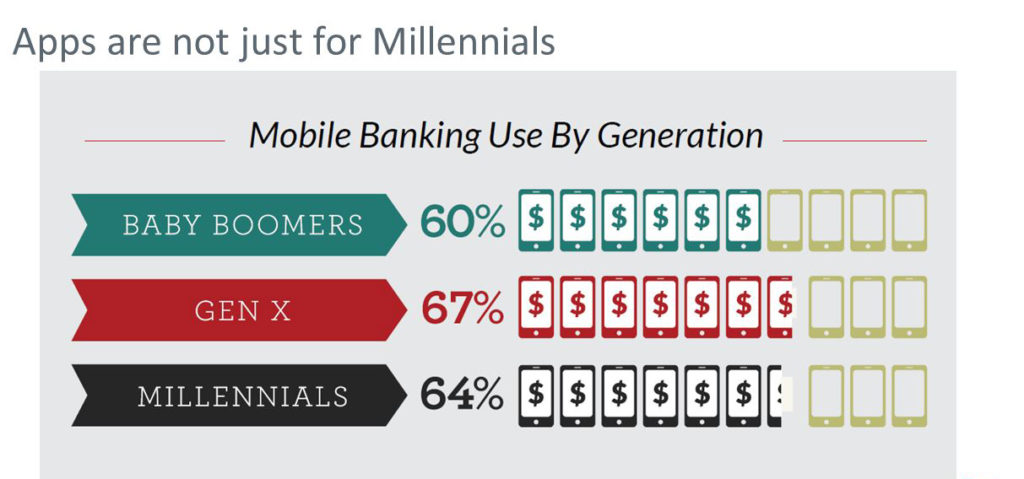

One area that bridges these generations is the digital landscape. There is no doubt this is important to millennials: 92 percent say they would make a banking choice based on digital services. Three-quarters of millennials would like to make payments by scanning with their phone, and 60 percent have already done this in a store. Mastercard did a study which indicated the only thing holding this group back from using their cell phones to make payments was availability. Not all places accommodate this, and they are waiting for it to happen.

So while it is obvious credit unions need to be offering the best possible digital services to millennials, this will be a foregone conclusion for centennials. The next generation doesnât know anything but the digital age and they will expect everything in place, so getting up to speed now will pay off in the future.

Watch the webinar in its entirety here.

![]() Mastercard is the NAFCU Services Preferred Partner for Credit, Debit, and Prepaid Branded Products. More educational resources and contact information are available at www.nafcu.org/Mastercard.

Mastercard is the NAFCU Services Preferred Partner for Credit, Debit, and Prepaid Branded Products. More educational resources and contact information are available at www.nafcu.org/Mastercard.