Mind the Gap: Understanding UDAAP Guidelines (Part 2)

By Peter Krall, Vice President of National Group Markets | Allied Solutions

In part one of this blog series, we discuss how auto loans are increasingly being paid off early and how this is impacting GAP (Guaranteed Asset Protection) waivers.

Increasing voluntary protection product regulation places the responsibility on creditors to refund borrowers on unused portions of ancillary products. The CFPB's spring 2022 issue of Supervisory Highlights, indicates an increased burden on creditors to comply with UDAAP (unfair, deceptive, or abusive acts and practices). Supervisory Highlights notes how auditors are faulting lenders for “failing to request refunds from the third-party administrators for ‘unearned’ fees related to GAP products.” This is considered a UDAAP violation because “the product no longer offered any possible benefit to consumers.”

This amplified regulatory pressure is causing some specific pitfalls for credit unions.

Product Refund Pitfalls

UDAAP concerns: UDAAP was designed to provide financial institutions with best practices to protect consumers against unfair, deceptive, or abusive acts and practices related to financial products and services. Previously a more generalized concept,

UDAAP concerns: UDAAP was designed to provide financial institutions with best practices to protect consumers against unfair, deceptive, or abusive acts and practices related to financial products and services. Previously a more generalized concept,

UDAAP now resembles a laundry list of rules for financial institutions. Creditors need to ensure compliant policies and processes to mitigate UDAAP violations for ancillary product refunds.

- Speed and accuracy of refunds: In addition to UDAAP concerns, there are varying methods for calculating refund amounts which can cause a delay in the timing to get refunds into the hands of members. This not only creates a poor member experience but can also violate state guidelines. For example, in California, lenders are required to refund a borrower for the unearned portion of a GAP waiver within 60 days. The timeline and accuracy of these refund amounts are paramount but also highly complex.

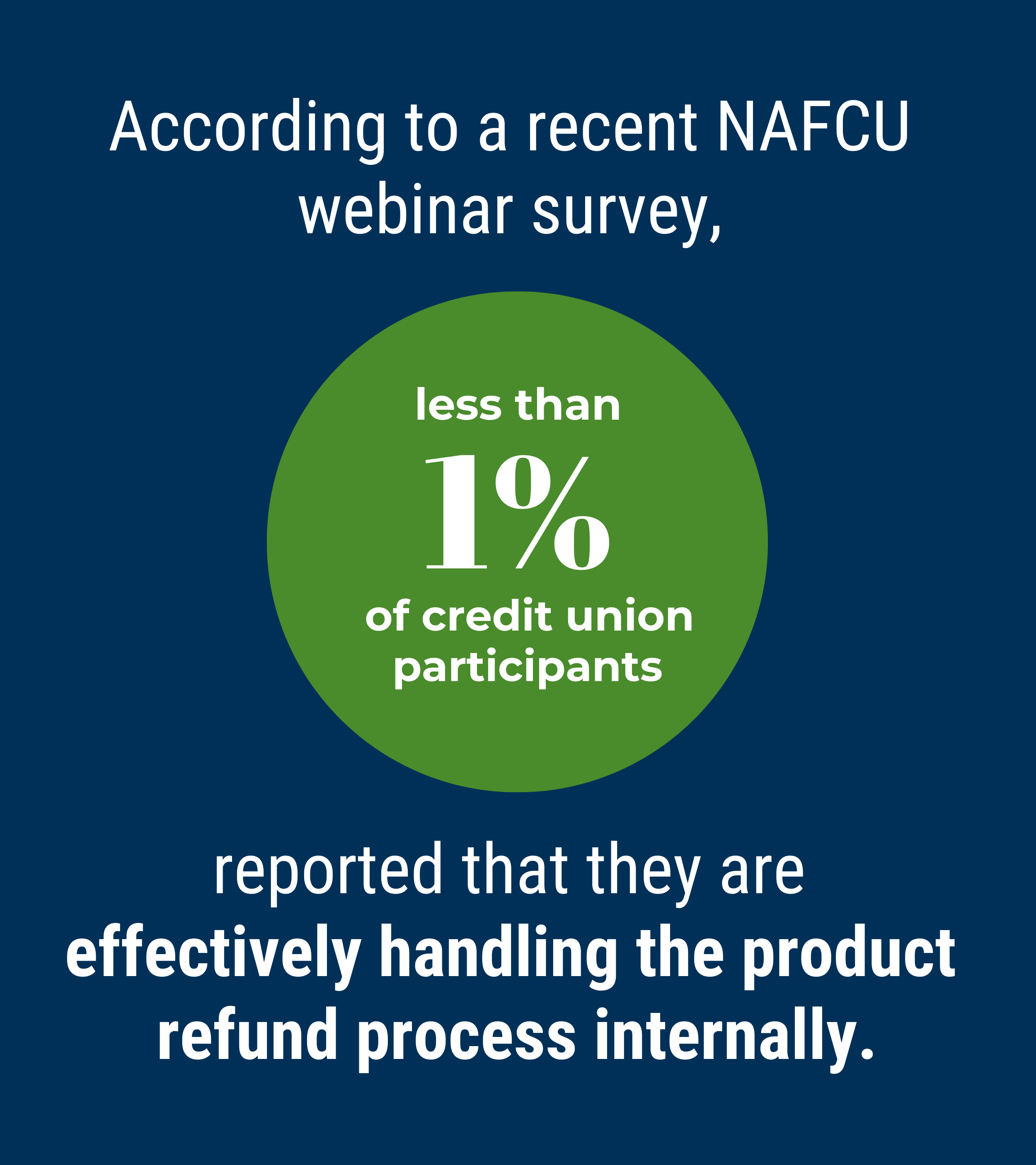

- Workforce shortages: According to a recent NAFCU webinar survey, less than 1% of credit union participants reported that they are effectively handling the product refund process internally. Creditors that are attempting this process internally are experiencing a significant strain on staff. This can cause employee burnout in an already tight labor market.

Here are some emerging best practices to help your credit union avoid these pitfalls.

8 Dos and Don’ts of Product Refunds:

- Don’t: Wait to take action till legislation requires it. As seen in Colorado, creditors that did not proactively refund members on canceled ancillary products are facing significant litigation and brand damage. The CFPB and state regulators will continue to scrutinize financial institutions for product refunds. Proactive action is less costly than remediation.

- Don’t: Treat all ancillary products the same. GAP is the common ancillary product under fire, but it’s important to remember that the CFPB and state regulators are paying attention to all ancillary products. Each ancillary product refund is calculated differently, and the amounts vary case-by-case. The amount of the refund is dependent on the term of the loan and the triggering event (i.e., repossession versus early loan payoff).

Don’t: Think that product refunds only apply to direct loans. Most auto loans will end early and trigger a product refund to the borrower. This is regardless of where the product was sold, so the ratio of indirect loans does not come into play here.

Don’t: Think that product refunds only apply to direct loans. Most auto loans will end early and trigger a product refund to the borrower. This is regardless of where the product was sold, so the ratio of indirect loans does not come into play here. - Don’t: Assume that regulation does not apply to smaller asset credit unions. The Consumer Financial Protection Act (CFPA) of 2010 originally included provisions for financial institutions over $10B in assets to be scrutinized, but with each CFPB and pending class action lawsuit revolving around product refunds it is evident that the standard is extending to all size financial institutions. This means that all financial institutions, regardless of asset and membership size, with all types of loan portfolios, can become subject to investigation and potential product refund requirements.

- Do: Know your responsibilities. In most cases, members are unaware that they qualify for a refund. Depending on state law, the creditor can be liable to refund the borrower even if the member doesn’t request a refund.

- Do: Be aware of the legislation. Work with your legal counsel to know the requirements of the state(s) you do business in and where members live. This is an emerging issue and regulations are shifting quickly.

- Do: Partner with a specialized provider. Pending litigation and legislation are making product refunds even more complex for creditors to manage on their own, and manual processes and systems increase the risk for non-compliance. Consider outsourcing product refunds to a specialized provider that can automate product refunds start to finish, manage dealer and product provider communications, and can pivot with legislative changes.

- Do: Recognize that these refunds benefit members. Product refunds put dollars back into the hands of your members. These refunds are significant: The average GAP refund is $500, and other Vehicle Service Contracts (VSC) can be up to $1,600.[1] In difficult economic times, product refunds can provide members with additional finances.

The risk exposure related to product refunds for creditors continues, and proves to be a remarkable gap for credit union operations. Now more than ever, creditors need to implement an end-to-end process for refunding members on canceled ancillary products.

Allied Solutions is proud to be NAFCU’s Preferred Partners for Product Refund Liability (RefundPlus).