Social Media: An Effective Banking Conversion Tool

Originally posted on forwardbanker.com.

Guest post written by Trevor Rasmussen, Content Marketing Manager, Deluxe Corporation.

Guest post written by Trevor Rasmussen, Content Marketing Manager, Deluxe Corporation.

The 2014 Deluxe Exchange Conference offers crucial advice on the most pressing topics in financial services. Use code NASC14 to receive 20% off registration before December 20 »

A recent blog from Gallop, Inc. talked about the influences that lead people to open a new account at a financial institution. According to their research, 59 percent of new accounts come without any prompting from the bank or credit union.  This is rather prominent, but 41 percent of people need more effort to reach and convert.

This is rather prominent, but 41 percent of people need more effort to reach and convert.

Converting prospects who arenât thinking about opening an account is not easy to do. The challenge with doing this is finding ways to reach and communicate with people who are not actively looking. Traditionally financial institutions use advertising to stay top of mind, but many have struggled to see social media as an option to truly convert new customers.

Social Media as a Conversion Tool

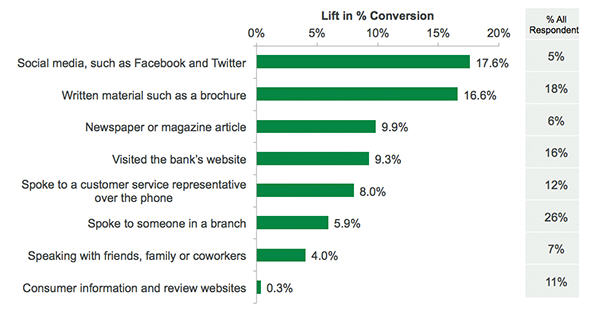

Social media has been a mixed bag in the financial services industry. Some financial institutions have embraced it while others have shunned it. Most in the industry realize itâs a part of life that is not going away anytime soon but they donât understand how to use it in an impactful way. According to Gallupâs Retail Banking Industry survey, more than half of those who are considering buying a new product seek out information prior to purchase. The act of seeking out information, from any source, prior to purchase leads to a significant lift in conversion rates. So what methods did Gallop find to be the most successful?

Gallup found that social media provided the most lift to sales conversion of all the channels in their survey. Surprised? Even more surprising is that the two highest cost sales channelsâpeaking to someone at a branch and speaking to a representative on the phoneâare among the lowest lift to conversion. Brochures and other written materials were a close second. Banks and credit unions that are ignoring social media or using it without a real strategy are missing out on the most effective conversions tool in the industry.

Not all channels are created equal

While social media did provide the most lift, it also had the lowest number of respondents. On the flip side speaking to someone in the branch had one of the lowest conversion lifts, but easily the largest number of respondents. There are a variety of reasons why this might be the case.

Availability: Is your bank or credit union making yourself available to consumers? Financial institutions arenât really engaging with their customers on social media. Iâve noticed most use it as a form of free advertising which really is in contrast to how the world uses social media.

Channels: Are you using the right social channels to connect with your specific customers? While teens might use Tumblr and Instagram right now, working adults are easier to reach on Facebook, Twitter, and LinkedIn. Are you targeting the channels that your customers are using and want to use to communicate with you?

Interest: Is this really how people want to communicate and learn? The answer for some is no, and it will always be no. But for a large and growing audience, social media is a primary form of communication. Just like email was once a niche form of communication, social media is emerging as something you just canât ignore.

Source: Who do people want to talk to at your financial institution? Do they want to reach out to you at your corporate account or would they rather have the availability of contacting a rep that has built a relationship with them? This is something that few banks and credit unions are doing right now.

After reading a report like this, itâs hard to argue that social media doesnât have a place at your credit unionâunless your credit union is strictly targeting retired people. You could argue that the economy just isnât there to invest, but the flip side is that until you invest the economy of scale may never be there. If you donât write the brochure, people wonât be able to be converted by that channel. There isnât one correct method or tactic to make social media work, but you have to get out there and experience what works with your customers. Clearly they are looking to learn and convert from this channel⦠donât miss out on a golden opportunity to capture and retain new customers.

More educational resources and contact information are available at www.nafcu.org/Deluxe/.

Also available: Use Member Retention to Improve Your Bottom Line (Podcast) »