Speed Matters in the Battle for Digital

By Adam Malka, Program Specialist, TruStage

We all got better at digital in 2020. COVID-19 accentuated trends that were already in motion. Closed branches and stay-at-home orders meant every credit union had to accelerate their level of digital functionality and sophistication and provide members with a more seamless and engaging experience.

Today, there are strong indications your members will increasingly use digital tools, either because they like their convenience and features or because ongoing pandemic-related flareups make it impractical to access services in-branch.

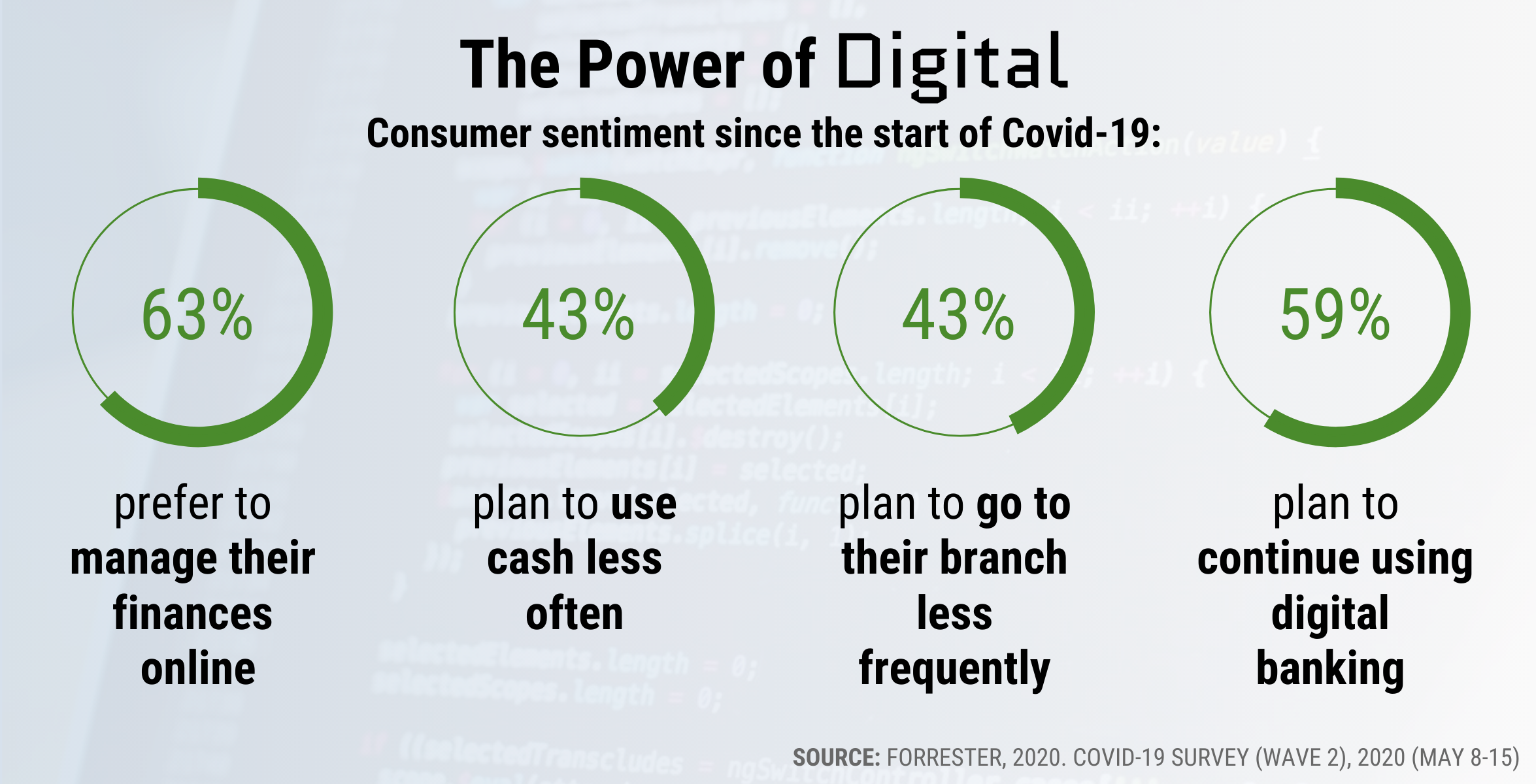

A recent survey from Forrester found that since the start of COVID, 63% of consumers agreed/strongly agreed they preferred to manage their finances online, 43% planned to use cash less often going forward and 43% thought they’d go to their branch less frequently in the future. Another proof point of the power of digital: this same study found 59% of survey respondents planned to continue using digital banking going forward.1

As branch lobbies begin to re-open, it might seem like your credit union has a bit of leeway before you need to continue your digital transformation. But it’s likely you don’t.

Keep the following in mind as you revisit your current digital strategy:

Don’t assume your tools are meeting members’ needs.

Don’t assume your tools are meeting members’ needs.

Audit and assess your member’s digital experience and consider your tools from their perspective—not yours.

Table stakes in the digital world means:

- Clear, consistent navigation

- Easy-to-follow instructions

- Simple language—minimize the use of jargon and acronyms

- A searchable library of educational tools and resources

- Ready access to appropriate staff

Are you offering at least the basics? And how does your credit union’s digital experience compare to the competition’s—especially deeper pocketed banks and fintechs?

Your credit union has significant advantages

Your credit union has a few secret weapons to wield in its efforts to compete with other financial offerings: member relationships, integrated solutions, and the member data you’ve accumulated because of them. Use all three to continue to build the momentum of your digital offerings.

Don’t just invest in more digital—invest in better digital

It can be tempting to mimic the service offerings of a media darling fintech that’s homed in on one segment of the financial services marketplace and gotten a lot of attention—and a slice of the marketplace. But that approach is expensive, nearly impossible to maintain, and might not prioritize what your members need and want.

Tap into the power of your data

Credit unions have a lot of member data. But quantity isn’t the important thing. Your data’s true value lies in how quickly you can turn:

- Data into insights

- Insights into hypotheses

- Hypotheses into tests

- And tests into features and products

Digital service offerings are well suited to simple, online experiments to test member interest and acceptance. You don’t need to build out a full offering to run promotions and gauge interest: Run tests that are small, fast, and agile. The time you spend setting up, running, and reacting to tests has an opportunity cost associated with it, so use it wisely.

Consider complementing your internal data with third-party data—working with an external partner is an affordable way to gain insights into your members that would be difficult and expensive to uncover on your own.

Be diligent and disciplined

As you refine your digital offerings, it’s vital to know what you’re trying to accomplish, how you’ll know if your idea is working and how you’ll know what to change. If you can’t answer those questions, you might be on the wrong track.

Use data to create digital solutions that enhance traditional income streams—and uncover new ones

Data analysis might uncover that members want you to offer your entire loan application online—a step that could be a great way to boost your auto loan portfolio. Or it could show that members wish you’d offer digital tools to help them tap into less common credit union products such as insurance or wealth management.

Recognize not every problem has a digital solution

One thing you might learn from the data: digital isn’t the fix for every member problem. Here are two interesting data points from the Forrester survey that highlight this:

- Accessing customer support online garnered only a 29% net satisfaction score from survey respondents.1

- During COVID only 4% of survey respondents reported filing an insurance claim online. This is the smallest percentage for any of the tasks discussed in the survey.1

These two stats may indicate not every task can or should be handled through digital channels. There will always be situations where members will continue to prefer one-on-one assistance.

One final thought: Remind members why you’re unique

No successful credit union can survive without offering some level of digital functionality. That said, keep in mind digital probably isn’t the reason your members chose your credit union instead of a bank. Credit unions continue to grow and thrive because consumers continue to value a financial partner they can trust that understands and prioritizes meeting their needs.

As you strive to deliver the digital services members want, don’t eliminate the channels that keep a credit union tied to its community. Yes, virtual tellers and chatbots are more cost-effective and efficient than face-to-face tellers and a call center. But you risk losing part of your identity—and, perhaps, some of the members who prefer traditional channels—if you eliminate them. Digital doesn’t necessarily replace traditional channels and strengths, it’s meant to enhance them.

1Forrester, 2020. COVID-19 Survey (Wave 2), 2020 (May 8-15)

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Corporate Headquarters: 5910 Mineral Point Road, Madison WI 53705. © CUNA Mutual Group, 2021. CORP-3632308.1-0621-0723