What Keeps Credit Union Executives Up at Night?

Originally posted on CUInsight.

By Randy Salser, President, NAFCU Services

Download a complimentary copy of the "Grow 2020: Driving Effective Member Engagement" paper here.

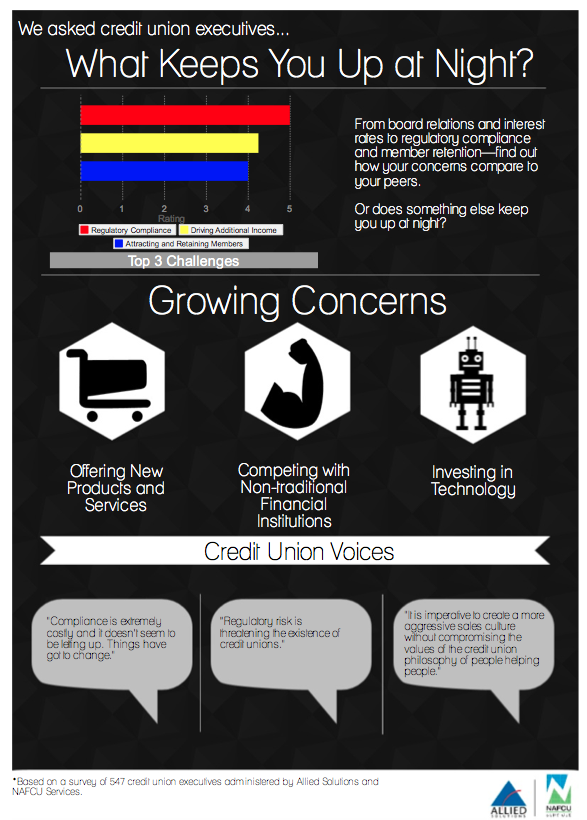

Credit union executives are facing more challenges than ever. Â In November 2013, Sundeep Kapur of Allied Solutions conducted a study on the challenges facing credit unions. Â The purpose of the resulting report is to:

- Release survey results highlighting the top concerns of 547 credit union executives

- Introduce prescriptive ideas for addressing these concerns

- Explore where we are headed over the next seven years

The study results have been to some degree surprising, affirming, and enlightening all at once. And the comments from credit union executives are especially insightful.

âWe have to increase lending. We have to keep growing. We have to maximize member share of wallet. Regulatory compliance is a great concern because of the time and investment necessary to comply, but also because more and more the CFPB and NCUA are issuing rules on how the credit union should be operated. These new rules just increase costs and reduce flexibility with no benefit to the members. We have spent hundreds of hours on complying with the rules, with no increased protection for the members.â

-Â Â Â Â Â Â CEO of a $3 Billion Credit Union

The material in the paper reinforces the need to stick to the simple mantra for success: reducing costs, increasing member engagement, and driving incremental revenue. The branch, the self-service channels, and the digital network are key pillars of every financial institution. When integrated, these pillars offer incredible consumer interaction opportunities. Members expect their credit unions to recognize them, remember their past activity, and serve them with relevance. What are the practical ways you can improve your engagement with your members?

Summarizing over 500 responses from credit union executives, the following report highlights several powerful insights and strategies for success.

Download the Industry Insights paper here.

For additional insight in to the credit union industry, attend the NAFCU Annual Conference for a concentrated program of best practices and case studies from around the worldâpractical, proven, and innovative ideas that are applicable to all financial institutions.

Credit union executives are facing more challenges than ever. Â In November 2013, Sundeep Kapur of Allied Solutions conducted a study on the challenges facing credit unions. Â The purpose of the resulting report is to:

- Release survey results highlighting the top concerns of 547 credit union executives

- Introduce prescriptive ideas for addressing these concerns

- Explore where we are headed over the next seven years

The study results have been to some degree surprising, affirming, and enlightening all at once. And the comments from credit union executives are especially insightful.

âWe have to increase lending. We have to keep growing. We have to maximize member share of wallet. Regulatory compliance is a great concern because of the time and investment necessary to comply, but also because more and more the CFPB and NCUA are issuing rules on how the credit union should be operated. These new rules just increase costs and reduce flexibility with no benefit to the members. We have spent hundreds of hours on complying with the rules, with no increased protection for the members.â

-Â Â Â Â Â Â CEO of a $3 Billion Credit Union

The material in the paper reinforces the need to stick to the simple mantra for success: reducing costs, increasing member engagement, and driving incremental revenue. The branch, the self-service channels, and the digital network are key pillars of every financial institution. When integrated, these pillars offer incredible consumer interaction opportunities. Members expect their credit unions to recognize them, remember their past activity, and serve them with relevance. What are the practical ways you can improve your engagement with your members?

Summarizing over 500 responses from credit union executives, the following report highlights several powerful insights and strategies for success.

Download the Industry Insights paper here.

For additional insight in to the credit union industry, attend the NAFCU Annual Conference for a concentrated program of best practices and case studies from around the worldâpractical, proven, and innovative ideas that are applicable to all financial institutions.

- See more at: http://www.cuinsight.com/what-keeps-credit-union-executives-up-at-night…