What Your Credit Union Needs to Know About Synthetic ID Fraud

By Chris Danese, Principle Fraud Consultant, Mastercard, North America

While credit union leaders are ever vigilant of the latest in fraud activity to keep their institutions safe, synthetic identity fraud is an area that’s tricky for many to detect. It helps fraudsters navigate through most credit unions’ initial identification checks. Not only can credit unions get caught up in the scam by issuing credit cards, for example, but so can many other businesses that end up accepting those credit cards.

Synthetic identity theft involves the use of real documents, like utility bills, but some or all the documents are based on false information. A true synthetic identity is created with completely fictitious elements, but it appears real and will pass the first line of traditional identity checks. For example, a fraudster may order utility services to a vacant lot. They can use the invoice for this service as proof of residence, thus passing an initial check performed by many credit unions.

Synthetic ID fraud typically falls into one of three categories: employment, credit repair, and nefarious.

- Work or employment synthetic identity fraud is used to avoid being disqualified from jobs that require citizenship, residency, or no criminal record, and jobs that require good credit ratings in order to access consumers’ personal data or information. These typically are not conducted by a single individual, but more likely an organized group that establishes and sells the identity credentials.

- The other reason people might commit synthetic identification fraud is for simple credit repair, also known as credit sales. A multi-billion-dollar industry exists for the buying and selling of tradelines online. The result: fraudsters create a ‘scorable’ credit file within 30 days, which can also hit a credit union when the criminal applies for a loan. These platforms have accelerated the ability to create synthetic profiles, allowing the creation of false identification documents and fraudulent loans to make money selling newly established tradelines.

- Lastly, nefarious identification fraud results in the theft of services, from utility companies and others, which are never paid and result in financial loss. Synthetic ID fraud can be witnessed across multiple industries, like wireless services, insurance, and, of course, financial institutions. Sometimes these fraudsters can gain access to utilities for extended periods of time, and companies are unable to pursue them for payment of services because they don’t really know who they are. The wireless industry has been hit hard with fraudsters activating accounts under false IDs, purchasing expensive devices to be paid as part of their monthly service bills, and then selling these devices on the black market. In the insurance industry, fraudsters are creating shell companies with many false employees and collecting insurance payments on falsified injury claims.

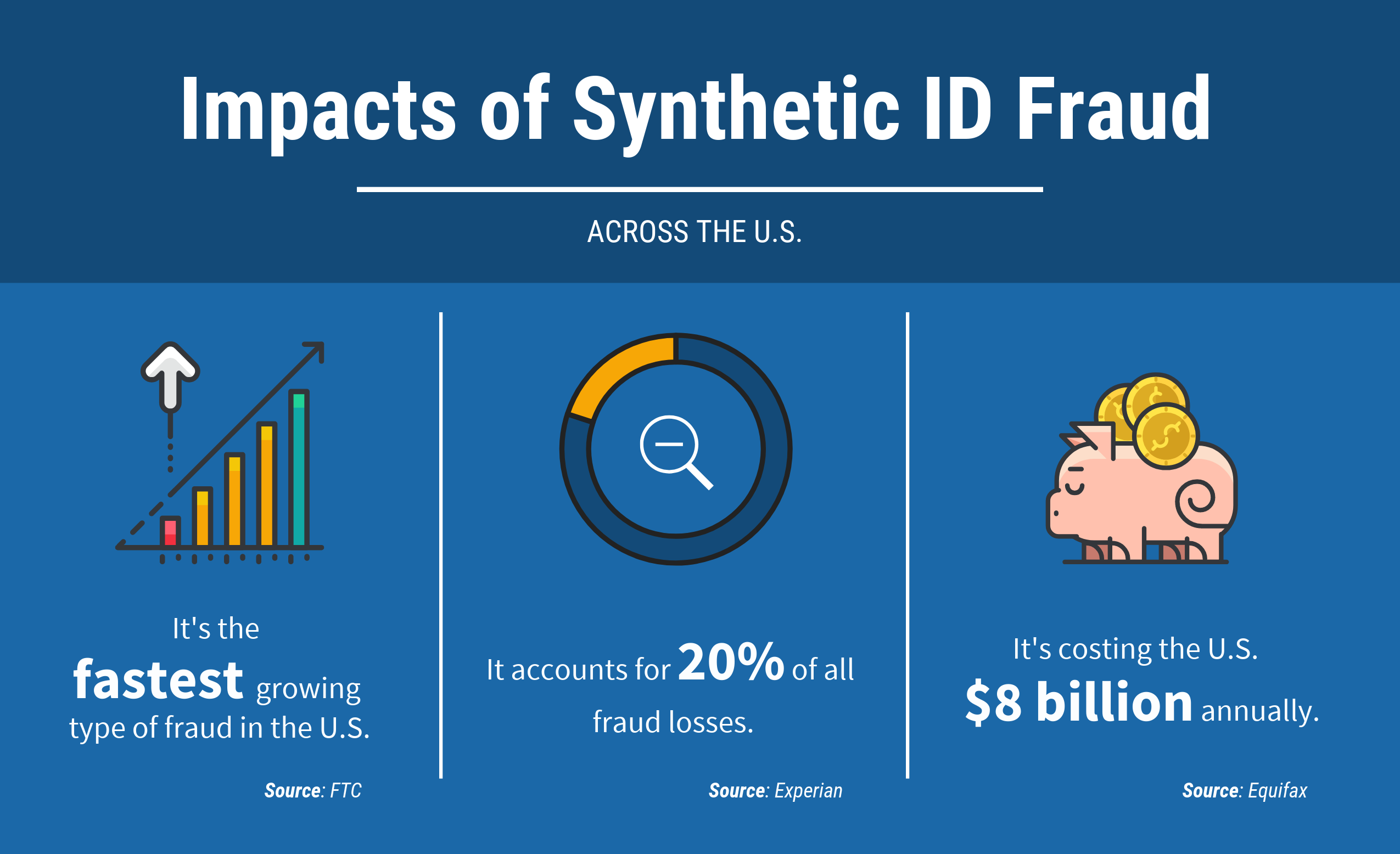

So, how large a problem is synthetic ID fraud? According to the FTC, it is the fastest growing type of fraud in the U.S. Experian reported that synthetic ID fraud accounts for 20% of all fraud losses, and statistics from Equifax show that it costs the U.S. $8 billion annually. With numbers like that, they’re certain to hit your credit union, too.

Synthetic fraud may be difficult to detect, but with some simple risk-management techniques, thorough employee training, and digital enhancements, you can rest assured your credit union will be well-protected.