When it Comes to Life Insurance, Simple Matters

By Chuck Sutton, Director, Life & Health Product Management, CUNA Mutual Group

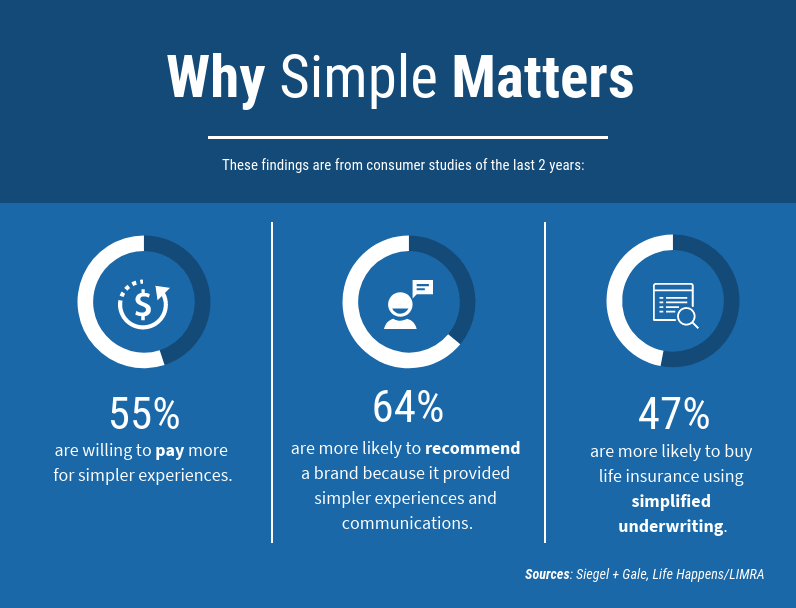

Think about the last product or service you bought. What drove your decision? If a combination of price, speed, and simplicity was the key—with a heavy emphasis on the simple—you’re in good company. A 2018 study found that 55% of consumers surveyed were willing to pay more for simpler experiences and 64% said they’re more likely to recommend a brand because it provided simpler experiences and communications.1 Unfortunately, “simple” can be hard to find. A 2019 report found consumers ranked simplicity as one of their most important needs and that “brands are under-delivering on simplicity, with about half of consumers saying brands are not meeting their needs.”2

Simple doesn’t mean less valuable.

When LIMRA released the annual Insurance Barometer in April 2019, one of its top findings confirmed simplicity matters in the world of insurance too. Almost half of those surveyed (47%), said they’re more likely to buy life insurance using simplified underwriting—which tends to be shorthand for get it faster and without a medical exam.3 The average credit union member needs the security life insurance can deliver for the people they care about most. But finding the product can feel anything but simple—and overwhelmed members are all too likely to opt out of the process and the product.

Ready to make life insurance simpler? Start here:

1. Demonstrate how life insurance protection can simplify members’ lives. One in three families admit they could face a financial disaster within one month should their household’s breadwinner die.4 Show members how life insurance protection can address those worries and remove a time-consuming burden.

2. Show them it’s cheaper than they think. In the 2019 LIMRA study, respondents—across a variety of ages—thought life insurance (in this case, a $250,000, 20-year level term policy for a healthy 30-year-old) would be three times more expensive than it actually was. Considering that LIMRA reports expense as the top reason consumers don’t buy life insurance, it’s imperative to clear up this misconception.

3. Deliver a simple, end-to-end online life insurance experience. The “Amazonization” of life has affected every consumer purchase, and life insurance is no exception. About half of consumers searched for life insurance online in 2018 and about a third tried to buy it there.5 Is your credit union delivering life insurance through member-preferred channels?

4. Find the “simple” sweet spot for your members. Research shows consumers are willing to pay more for simpler.6 Find and deliver the products your members demand.

Learn how to integrate the power of simple into your life insurance program.

1Siegel + Gale, “The World’s Simplest Brands,” November 2018

2The Great Divide,” Alliance Data, March 2019

32019 Insurance Barometer Study, Life Happens and LIMRA

42018 Life Insurance Statistics And Facts, BestLifeRates.org, Feb. 2019

52018 Life Insurance Statistics And Facts, BestLifeRates.org, Feb. 2019

62018 Life Insurance Statistics And Facts, BestLifeRates.org, Feb. 2019