Who Are “The Unscoreables”? Hint: It’s Not Who You Think

Shortly before the NAFCU annual conference, David Frankil (who needs no introduction to readers of this blog), wrote a post titled, âIs Your Credit Unionâs Lending Universe Expanding?â

Davidâs post was a terrific explanation of how important it is for credit unions to expand their borrower pools in order to keep ahead in an increasingly competitive consumer credit market.

A basic requirement for that expansion is a credit score, which needs a history of credit usage. Some credit score models require very recent credit usage, such as activity on at least one account at some point within the last six months, in order to generate a score. In other words, whether a member has one credit account (e.g., a credit card) or many credit accounts, if there isnât any activity on at least one account during the most recent six months, that member may be invisible to you when they seek new credit; the credit score model may not recognize their credit history over the past six months and thus may be unscoreable.

Members who are new to the credit market such as recent high school or college graduates, divorced or widowed members or newly arriving immigrants have similar challenges obtaining a credit score for a different reason. Consumers cannot receive a credit score under some traditional models until after six months of reported payment history.

Having been an executive at large lending institutions for most of my career, I witnessed this scenario first-hand. A great many borrowers, whom I knew were good credit risks, were either manually underwritten, which costs lenders far more than using an automated system, or deemed higher credit risks than they actually were simply because they did not have a credit score.

This is one reason I joined VantageScore Solutions as President & CEO. Our credit scoring model inclusively scores people one month after their credit history has been reported to any or all of the three national credit reporting companies (CRCs): Equifax, Experian and TransUnion. And members can be inactive with their credit for 24 months and still be scoreable using the VantageScore® credit score model, versus others where inactivity after six months results in becoming scoreless.

Scoring more people is all fine and well, but ultimately, a credit union must make the decision to grant these individuals credit or decline them. So who are these people that make up what those of us in the industry commonly refer to as âthe unscoreables?â

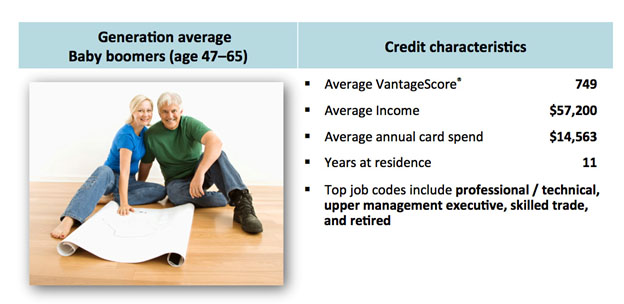

As the graphic below suggests, the average unscoreable consumer has a good job and a better-than-adequate credit profile. In other words, the typical unscoreable consumer is, wellâ¦typical.

Credit Characteristics of the UnscorableÂ

[caption id="attachment_1156" align="alignnone" width="624"] Source: Experian[/caption]

Source: Experian[/caption]

Â

One of the unfortunate outcomes of the unscoreable conundrum has been that consumers may be deemed high-risk, or âsubprime,â by traditional credit scoring criteria and/or lenders simply because the credit scoring model in use doesnât look back in credit histories far enough. However, by employing new methodologies in the VantageScore® credit score model, we found many people who are deemed unscoreable by traditional models are actually quite creditworthy and can be identified as prime or near-prime consumers.

A VantageScore Solutions study found that 15.5 percent of infrequent credit users have either prime or super-prime risk profiles. And 26.5 percent of new entrants to the credit scene, including recently graduated students, immigrants and recently divorced consumers, were found to have either prime or super-prime risk profiles.

When these consumers are denied credit scores or mislabeled as high-risk, they have little alternative but to seek credit from lenders outside the mainstream credit industry who may charge exorbitant interest rates.

Though the VantageScore® model is indeed able to provide scores for the traditionally unscoreable, beyond our model, there are a number of other new solutions in the credit scoring market that tackle the unscoreable issue. One great equalizer is rental payment history, which is now beginning to be reported by some landlords.

Rent payment information is one of the predictive factors used in the VantageScore® credit score model. Unlike mortgage payment information, it isnât widely reported to the credit reporting companies (CRCs).

It should be.

According to Experian, 32 percent of all renters are unscoreable without using their rental payment history. When rent payment history is present in the credit file and used to calculate a credit score, 87 percent of renters can be provided a score.

Think about this in terms of first time credit applicants who could have had earlier access to responsible credit so that they have the opportunity improve their lives and their familiesâ lives.

Reporting rental payment history is unnecessarily controversial. Critics suggest that since lower income consumers traditionally rent, they are more likely to miss payments and have their credit history harmed than those with higher incomes. In fact, 45 percent of high-risk consumers increased their VantageScore® credit score to 600 (the VantageScore model's scale is 501-990) and above when rent data was used in calculating their credit scores.

Another important fact that is missed is that when ongoing rent payments are not reported, renters are not provided the positive impact of those payments. But when a renter becomes seriously delinquent on payments and their landlord hires a collection agent, the negative impact of a collection account being reported to the CRCs comes into play. Itâs only fair that renters receive both the positive and negatives of their rent payment behavior.

If one of your members finds themselves among the unscoreable population, there are some tips you can provide. First, be sure to check to see if other credit scoring models provide the member a score. Second, help them open a secured credit card and be sure the payment history gets reported to the three major CRCs.

Of course, many credit unions are able to manually underwrite loans without requiring a credit score. If your credit union is able to handle this type of a loan, here again, itâs important that loan payments are reported to the CRCs, so the memberâs payment history can be reflected in the form of a credit score.

Extending credit to the large population of borrowers who cannot obtain traditional credit scores is a terrific opportunity for growth in the credit union sector. For a deeper dive into this issue, I encourage you to read a white paper we produced titled, âIdentifying Credit-Worthy Consumers in Underserved Populations.â

You can also learn more about VantageScore® , including how to contact us, on our NAFCU Services landing page.

Post written by Barrett Burns, President & CEO, VantageScore Solutions